A version of this article originally appeared in ROAR Forward as part of a collaboration with their quarterly ROAR Report. This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

The COVID-19 pandemic reshaped the work landscape for older Americans, altering career paths and pushing some to reconsider their end-of-career timelines. Now that economic pressures persist, are those 55 and older adapting their expectations for retirement?

The Pandemic’s Impact on Older Americans in the Workforce

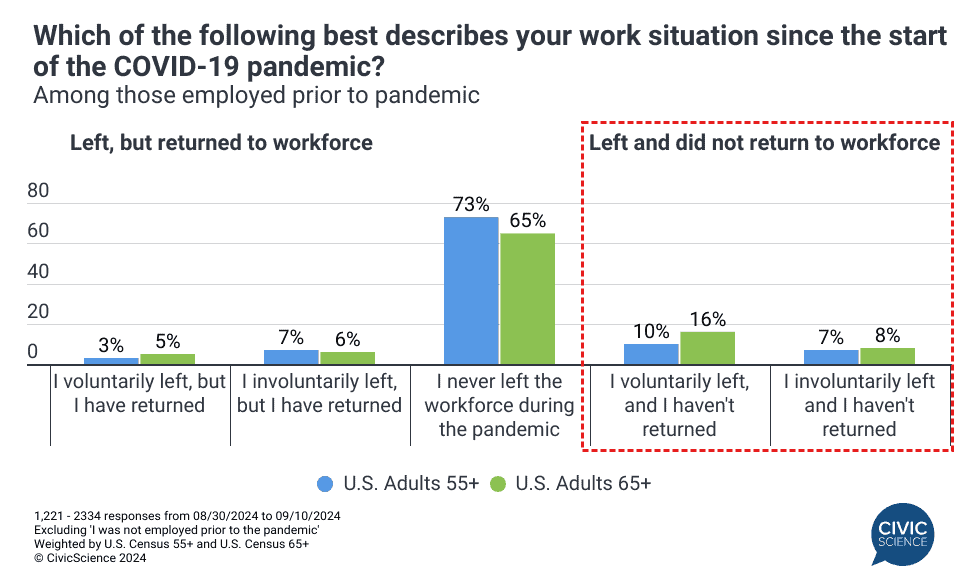

Before diving into retirement expectations, it’s important to first examine how the work situation of Americans who are 55 and older has evolved since the onset of the COVID-19 pandemic. CivicScience data indicate that a majority of U.S. adults aged 55+ (73%) and 65+ (65%) who were already employed at the beginning of the pandemic never left the workforce throughout. However, among those who did leave, a larger percentage of adults 65+ (24%) did not return compared to those 55+ overall (17%).

Cast Your Vote: Is retiring at 65 realistic today?

Americans Over 65 Are Increasingly Staying on the Job

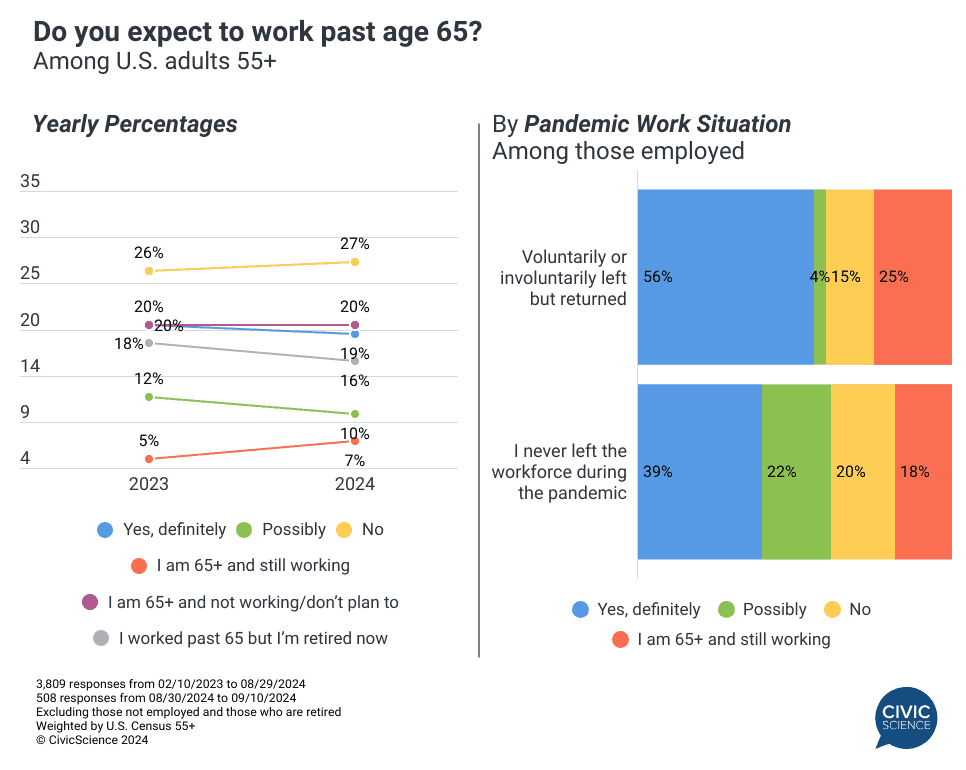

How have retirement expectations evolved with these pandemic-related work-life shifts in mind? The latest polling data offer a mixed picture compared to last year’s expectations – while slightly fewer Americans 55+ ‘definitely’ or ‘possibly’ expect to continue to work past 65, the percentage of those who are 65+ and still working increased by two percentage points to 7%.

Pandemic-related workforce exits are a contributing factor in reshaping retirements. Fifty-six percent of Americans 55+ who stopped working but returned to work following the pandemic ‘definitely’ expect to work past 65, outpacing those who never stopped working by 17 percentage points. Additionally, one-quarter of those who returned to work say they’re already working past 65, seven points higher than those who never left.

A Steady Income, Growing Need for Benefits Stand Out as Motivators for Working Past 65

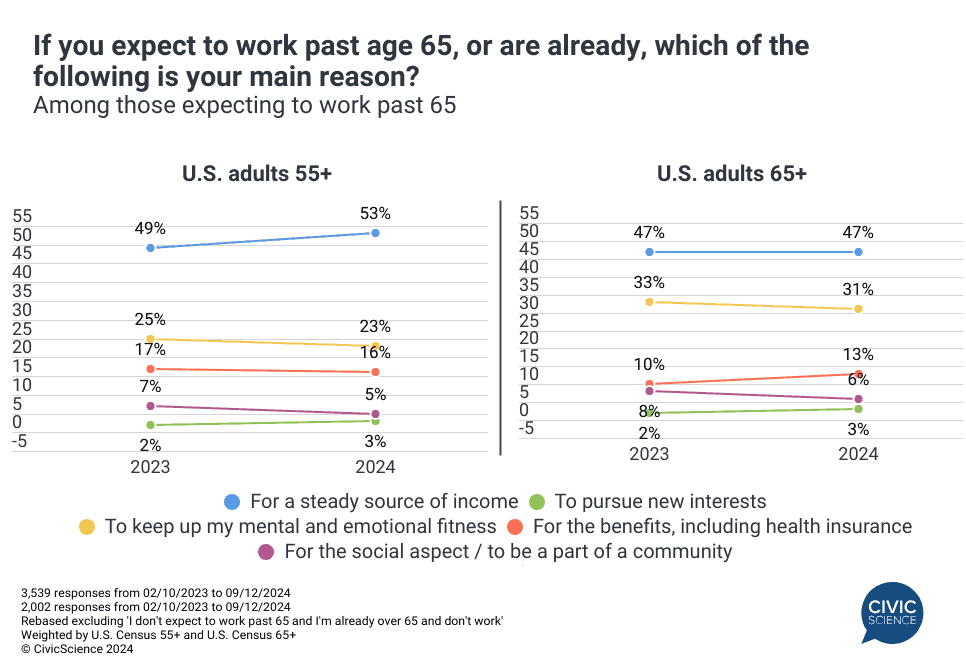

The picture is pretty clear as to why Americans in the 55+ crowd expect to work or are already working past 65. The need for a steady source of income was the only motivation studied that increased over the past year, with that percentage jumping by four points to 53%. Keeping up their mental and emotional fitness was also a leading priority, though this percentage fell slightly.

While income is also a leading driver among the 65+ demographic (47%), the only reasoning for continuing to work that increased over 2023 among them was ‘for benefits including health insurance.’ Additional data show 36% of those who cited benefits as their primary reason for continuing to work say they do not have Medicare, suggesting that people may be holding onto jobs to keep their employer benefits that might be better than what Medicare has to offer.

Take Our Poll: Do you intend to work past age 65?

The worst of the pandemic is in the rearview, but American retirement plans are one of the many areas caught in its ripple effects. While Americans over 55 tend to be better off financially than their younger counterparts, they are not immune to the impacts of higher prices, and the need for income to keep up will prevent some from an on-time retirement. The rising emphasis on health insurance benefits underscores the need for robust support systems, ensuring that older workers can navigate their extended careers with financial stability and adequate healthcare coverage.