CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

As December ramps up, retailers are competing for the attention of holiday shoppers who are still weighing their gift budgets and priorities. One trend that has remained consistent across CivicScience data is the rise of “shopping as self-care” and self-gifting during the holidays, which has persisted even amid economic uncertainty. Shoppers at Saks Fifth Avenue and Bloomingdale’s are particularly likely to adopt this shopping mindset. And while these audiences appear similar at a high level, CivicScience’s always-on consumer-reported data reveals the subtle nuances that matter to advertisers aiming to influence these customers during the holiday season and beyond.

Holiday Shopping Intentions

Right now is a critical window for both Saks and Bloomingdale’s. CivicScience data show that 34% of Saks and 36% of Bloomingdale’s shoppers have not yet begun their holiday gift buying. Conversely, 23% of Saks shoppers and 19% of Bloomingdale’s shoppers say they’re almost finished or are already done – highlighting that these shoppers are largely still in the decision-making process.

Even with similar progress, the two groups diverge in their expectations for spending this year. Saks customers are four points more likely than Bloomingdale’s customers to say they plan to spend ‘more’ on gifts than they did last year, and they also express slightly greater intent to purchase more gifts overall. When it comes to the types of gifts on their lists, both segments – similar to the Gen Pop – lead with clothing, shoes, and accessories as their top gift choices. However, Bloomingdale’s shoppers are slightly more likely to buy art and food/cooking gifts, while Saks shoppers have a slight edge in experience-related gifts.

For many shoppers, AI is becoming part of that decision-making process. Forty-six percent of Saks customers and 51% of Bloomingdale’s customers say they’ve already used GenAI or are ‘very’ likely to use it for holiday gift inspiration this year, with Bloomingdale’s shoppers five points more likely to do so.

What Matters Most

Further differences emerge when examining shopping priorities. Both groups say ‘free shipping’ is the most important factor in deciding where to shop, though Bloomingdale’s shoppers show a slightly stronger preference for free and expedited shipping. Saks shoppers, on the other hand, place somewhat more emphasis on product availability and buy now, pay later options.

For the in-store holiday shopping experience specifically, deals and being able to see products in person top the list for both groups. Yet Saks customers stand out for placing slightly more importance on the busy atmosphere, crowds, and holiday music or decorations that come with the season.

How to Reach Them

These holiday priorities reveal what guides shoppers’ decisions, but advertisers should also note that nearly 9 in 10 shoppers at both retailers consider themselves at least ‘somewhat’ loyal to their favorite brands, providing brands with an opportunity to reinforce that loyalty while still influencing end-of-season choices.

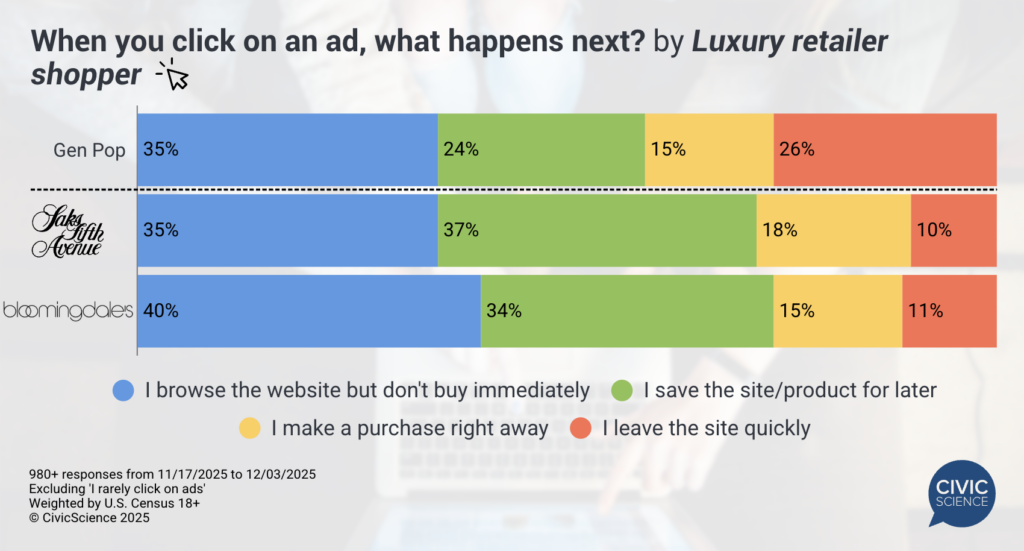

Their reported reactions to ads offer additional insight into how they engage with brands. When asked what they usually do after clicking on an ad, most shoppers in both groups either browse the website, save the page for later, or make a purchase, with ‘saving for later’ at least 10 points higher than the Gen Pop. Saks’ customers are also more likely to make a purchase immediately after clicking on an ad (18%) compared to Bloomingdale’s and the Gen Pop (15%). And, only about 10% of both audiences say they leave the page immediately, compared to 26% of the Gen Pop.

Finding New Products Online

Product discovery also reveals nuances: Saks customers are more likely to find new products through online marketplaces (e.g., Amazon), search engines, and brand or retailer websites, while Bloomingdale’s customers have a slight lead in discovering products through social media ads and blogs or article-based advertisements.

Targeting The Right Audience

Overall, these insights offer an early glimpse into how these shoppers may spend as they head into 2026. CivicScience intent data indicates that the majority of both shopper groups expect to have similar or higher disposable income levels in the year ahead. Understanding the nuances in how they discover products, respond to ads, and make decisions is essential, as these patterns are likely to continue shifting in 2026. With CivicScience’s real-time, always-on data, brands and advertisers can detect these changes as they happen and stay ahead of evolving consumer behavior rather than relying on historical trends.