CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

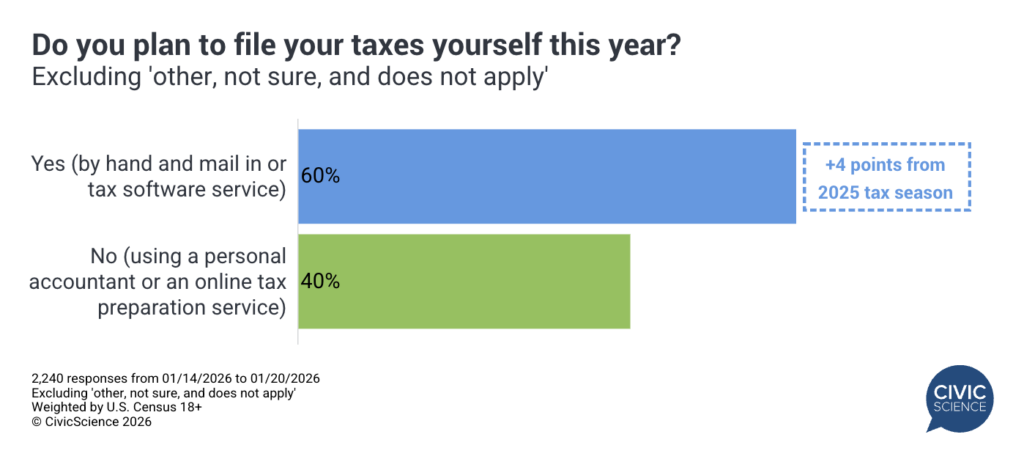

With the 2026 tax season officially beginning on January 26, millions of Americans are already thinking about how they’ll approach filing this year, especially with changes to the tax laws coming into effect. CivicScience’s annual tracking shows that 60% of taxpayers plan to prepare taxes themselves, either by hand or with the help of tax software – a share that’s grown by four points since the 2025 tax season. The remaining 40% plan to use a personal accountant or have an online tax preparation service to do it all for them (excluding those who are unsure or selected ‘other’).

Beyond how they plan to handle their taxes, those who plan to prepare their taxes themselves stand out in meaningful ways in terms of timing, spending intent, and brand preferences during tax season. Here’s a look at what CivicScience data reveals.

How Self-Preparers Approach Tax Season

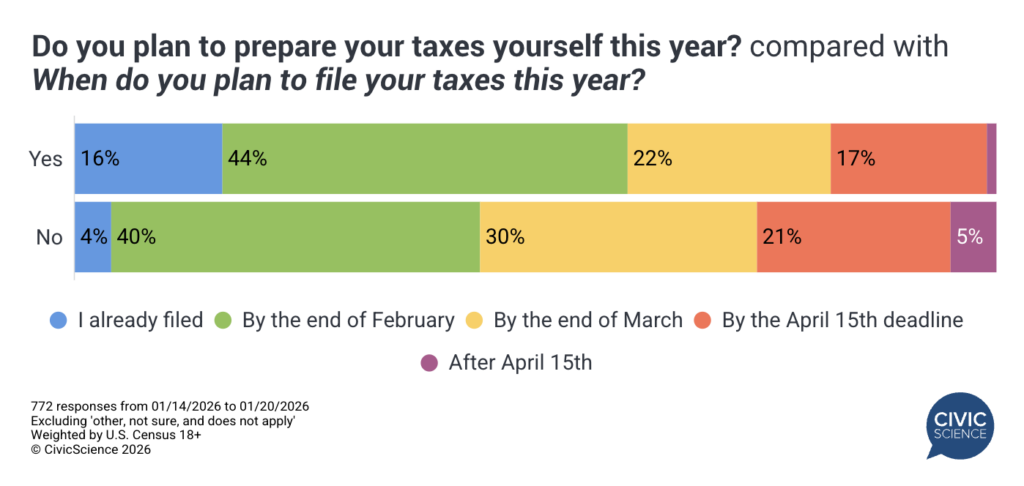

They move quickly. Nearly 6 in 10 self-preparers say they plan to file by the end of February, outpacing those who don’t plan to do their own taxes by 17 points.

Platform preferences are shifting. Among taxpayers planning to use tax software to prepare their own taxes this season, specifically, brand loyalty appears to be softening. While Intuit TurboTax and H&R Block remain the most widely used platforms, interest in using both has declined by more than five points compared to Q1 2025. At the same time, interest is shifting toward other platforms, including TaxSlayer, Cash App Taxes, and Jackson Hewitt.

They have different spending priorities. While saving money or paying down debt remains the most common plan among those expecting a refund this year, DIY tax preppers are more than twice as likely to say they’ll use the money to go shopping, and less likely to invest it, compared to those who plan to use a personal accountant or professional tax preparation service.

Tax refunds play a meaningful role in financial health. Among those expecting a refund this year, nearly 60% of self-filers say their anticipated tax refund is at least ‘somewhat’ important to their overall financial health, compared with about 40% of those who do not plan to file themselves.

Together, these behaviors point to a self-preparer audience that approaches tax season with urgency and intention. That mindset doesn’t stop at filing – it also shapes how, where, and when these consumers engage with advertising.

Key Advertising Touchpoints

While this year’s self-preparers are most likely to say they pay attention to television advertising overall, they report doing so at notably lower levels than those not filing themselves. Instead, this group is more likely to notice ads across online, radio, and billboard formats. That lower attentiveness to traditional TV may also reflect differences in viewing behavior: self-preparers are over 20 points more likely to say they have at least one video streaming service specifically to watch sports.

Context also plays a key role in how advertising is received. Self-preparers are most likely to say ads feel relevant when seen on retail or shopping sites, whereas those not filing themselves tend to find advertising most relevant on news or media platforms. This difference suggests that self-preparers may be more receptive to ads that appear alongside purchase-intent moments, rather than general information consumption.

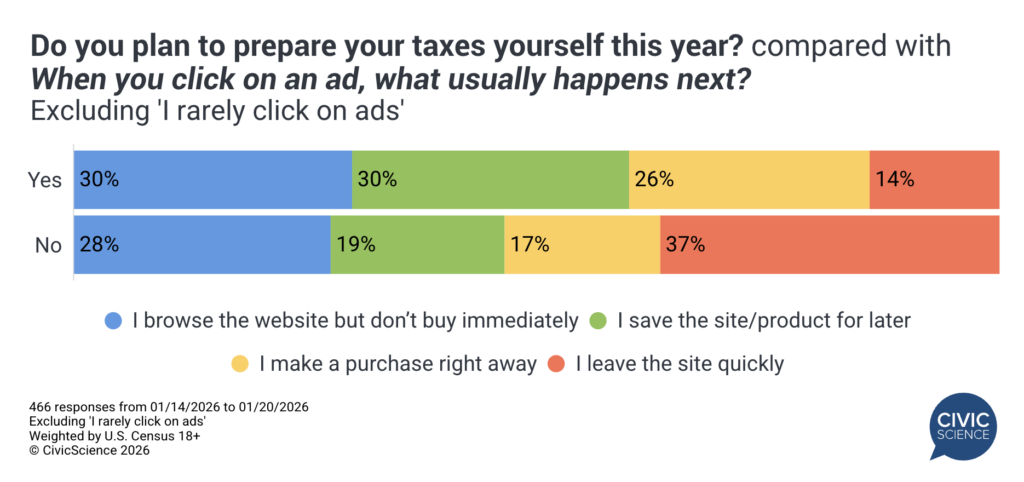

That receptivity often extends beyond initial exposure. Those who plan to file themselves are more likely to say they click on ads overall and, once they do, are more likely to browse a site, save it for later, or make a purchase right away. By comparison, those not filing themselves are more likely to leave a site quickly after clicking on an ad, highlighting a gap in post-click engagement.

As tax season gets underway, self-preparers stand out as an audience already in the decision-making process – they’re moving quickly, reassessing brands (among those using a tax service), and engaging with advertising in more intentional ways. For brands looking to connect during tax season, the early weeks offer a key moment to reach consumers as preferences take shape.