CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

It has been a trying year for American consumers, as seen in the CivicScience Well-Being Index (WBI). The index reached a new low over the past year, with negative emotions (e.g., sadness, worry, fear) on the rise. CivicScience’s daily collection of one million survey responses enables the exploration of consumer well-being across nearly 1,300 audience segments. The distribution of WBI scores (a higher score represents higher well-being) among every combination of demographics has flattened slightly in the past year. While the highest WBI scores have remained fairly consistent, the lowest scores became even lower in 2025.

U.S. adult respondents with very low levels of emotional well-being (Low WBI) are more likely to be women, aged 25-44, have lower household incomes (less than $50K annually), and identify as politically liberal. In comparison, respondents with very high levels of emotional well-being (High WBI) are more likely to be men, aged 55+, have higher household incomes ($150K+ annually), and self-identify as politically conservative.

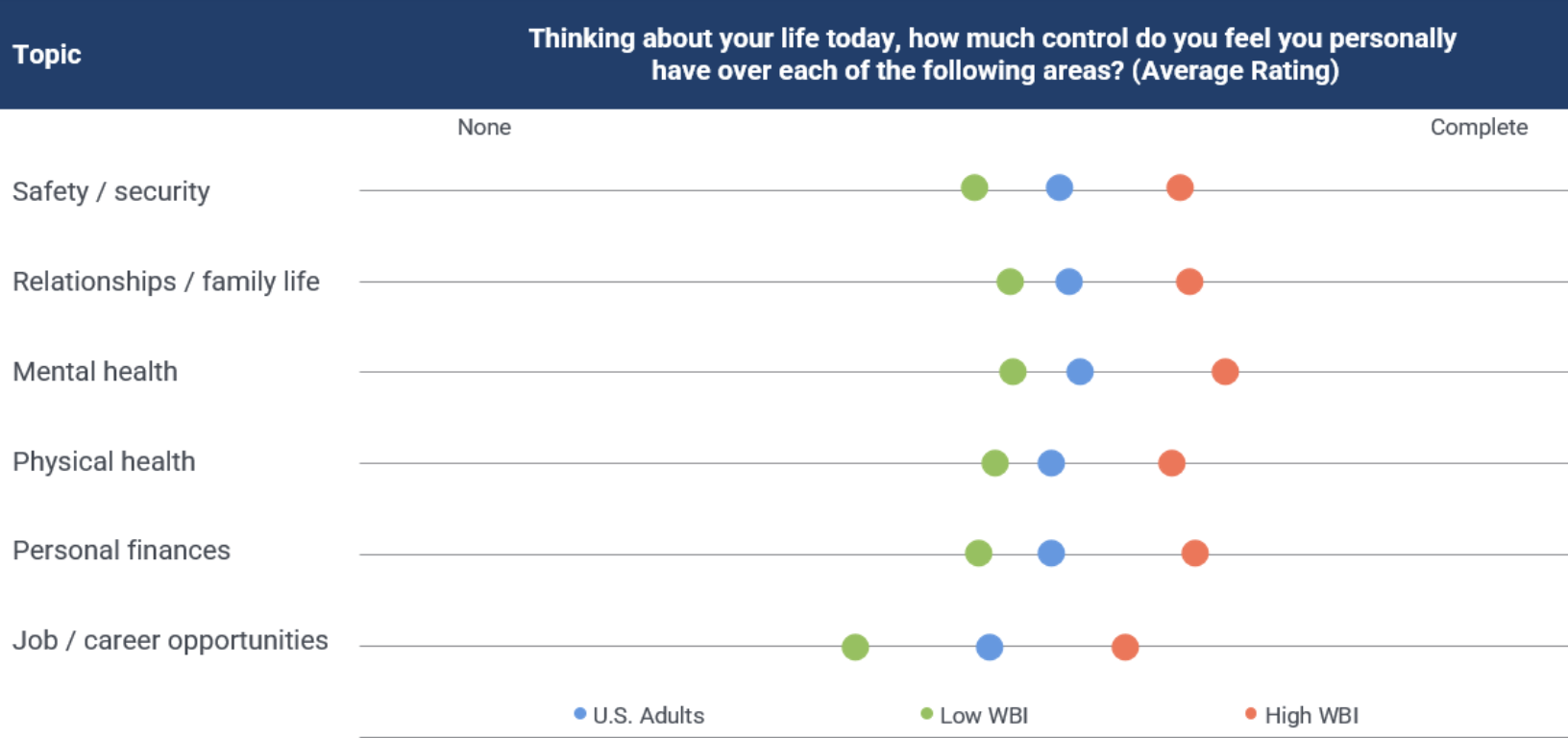

Beyond demographics, emotional well-being is strongly linked to the level of control individuals perceive they have over various aspects of their lives (e.g., relationships, health, etc.). Low WBI respondents report the lowest amount of perceived control over all categories. Principal among them is job/career opportunities, with 42% of Low WBI respondents reporting that they have ‘no’ control in this category. High WBI respondents, on the other hand, report greater perceived control, beyond the average U.S. adult, particularly regarding their mental health (67% report ‘complete’ control) and personal finances (57% report ‘complete’ control).

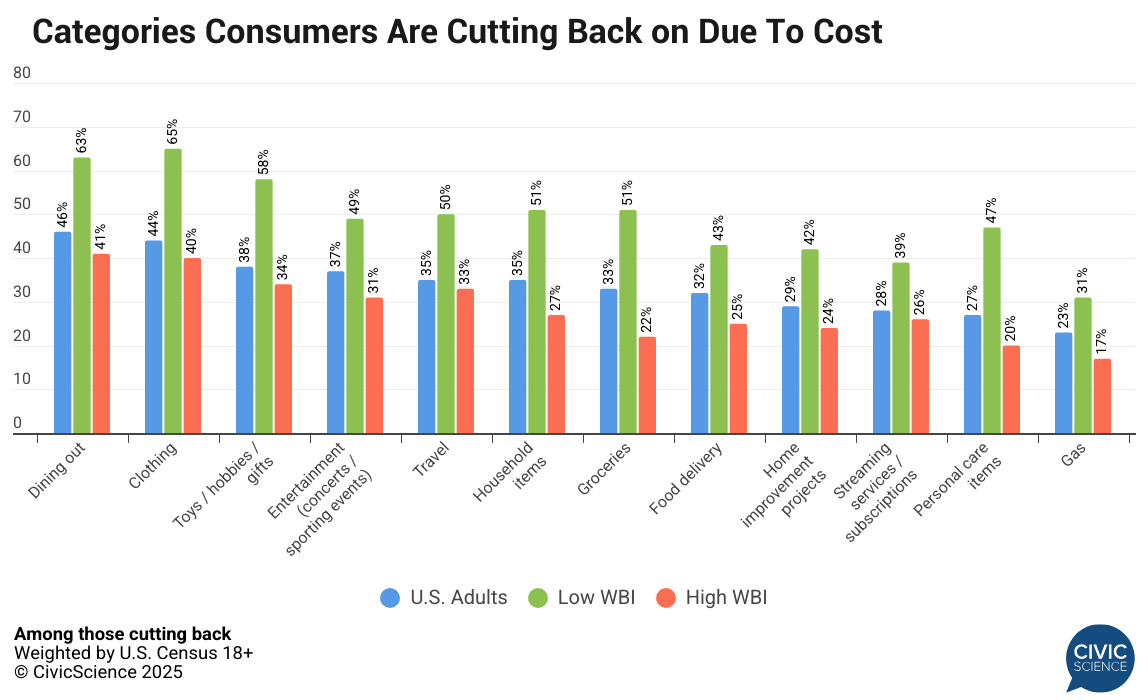

This matters because emotional well-being is strongly associated with consumer spending, with Low WBI respondents reporting a far greater likelihood of cutting back on spending across all categories, and High WBI respondents reporting a lower likelihood.

A look at the key areas for cutting back shows that dining out and clothing are the most common across the board. Relative to U.S. adults, Low WBI respondents over-index on cutting costs for personal care items (1.5x), groceries (1.6x), and toys/hobbies/gifts (1.7x).

These findings reveal a critical intersection between emotional well-being, perceived control, and consumer behavior. As Americans with low emotional well-being increasingly pull back on spending—particularly in discretionary categories—businesses across sectors must recognize that economic pressures alone don’t tell the whole story. The strong correlation between well-being and both feelings of control and spending patterns suggests that brands and policymakers who address consumers’ sense of agency may be better positioned to engage those most affected by declining emotional well-being. Understanding these psychological drivers will be essential for organizations seeking to navigate shifting consumer behaviors in the months ahead.