Consumer behavior does not exist in a silo; their decisions are impacted by forces outside the narrow purview of any industry or brand. So how do brands better understand their current and potential customers to ensure they make the right business decisions? In essence, they need consumer-centric information that is trustworthy, timely, and relevant. This is why we partnered with some of our best clients to create The CivicScience 360 Report.

The 360 Report scans the CivicScience database of thousands of always-on questions. It discovers key insights for your brand by comparing them to competitive and consumer segments, identifying differences and similarities, and alerting you to shifts in categories like financial outlook, media consumption, and health and wellness. So you never miss an opportunity or threat.

We ran the 360 Report for Starbucks customers and compared them to Dunkin’ customers to provide a small sip of what this product has to offer. Below you’ll find insights from three of the report’s verticals.

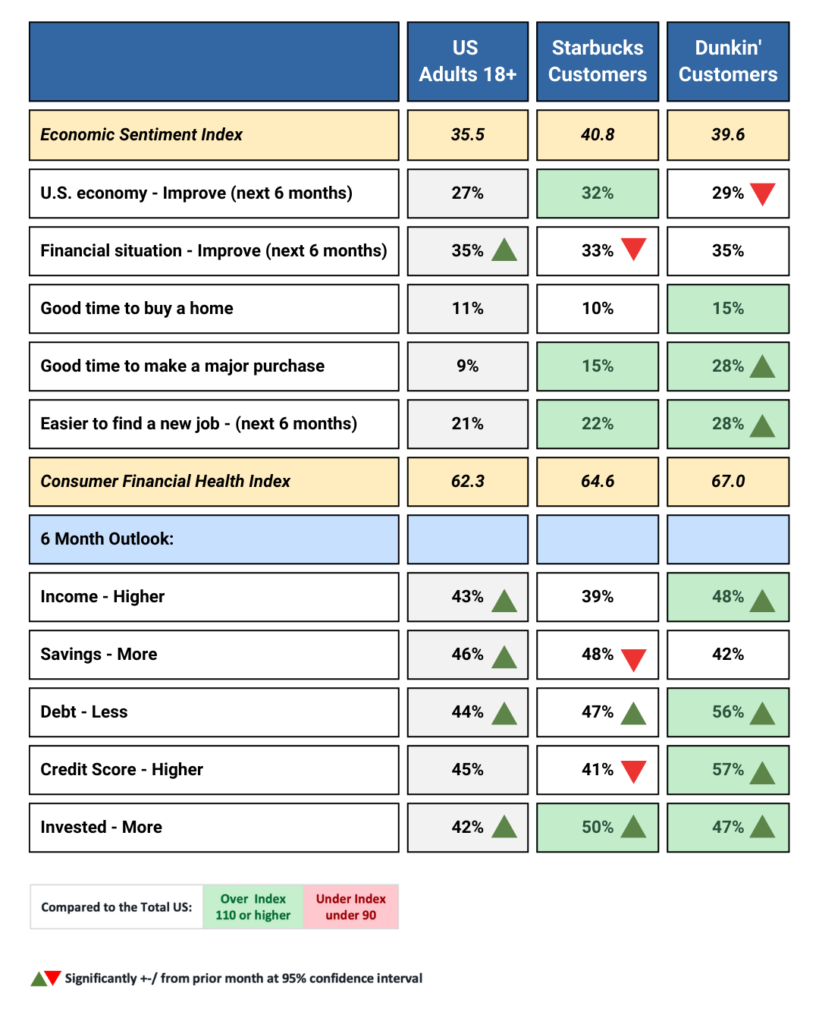

Financial Outlook

The Economic Sentiment Index for Starbucks customers indicates that they currently have more confidence in the U.S. economy than the average adult. They are more likely to think it’s a good time to make a major purchase and to think the U.S. economy will improve over the next six months.

While CivicScience’s Consumer Financial Health Index shows that both restaurant chain customers are financially healthier than the average U.S. adult, Starbucks customers are not quite as optimistic as Dunkin’ customers about their finances. Nearly half (48%) of Dunkin’ customers think their income will be higher in the next six months, 5 percentage points higher than the average U.S. adult and 9 points higher than Starbucks customers. Dunkin’ customers also think they will have less debt and a higher credit score.

Media Consumption

Concerning media consumption, both restaurant chains’ customers are significantly less likely than the average adult to spend more than an hour daily with print media (newspapers and magazines.) It’s no surprise that U.S. adults are heavy digital media consumers, yet Starbucks customers spend even more time daily on the internet and social media.

Regarding TV viewing, streaming video has become commonplace, with nearly half of U.S. consumers saying they stream video for 1+ hours daily (average time is just under 2 hours), which is higher than cable and broadcast. When looking at streaming providers, there are some interesting differences across demographic groups and Starbucks and Dunkin’ customers. For instance, 7 out of 10 Starbucks customers use Amazon Prime Video, which is significantly higher than the average U.S. adult (58%) and Dunkin’ customers (48%.)

Quick Service Restaurant Industry

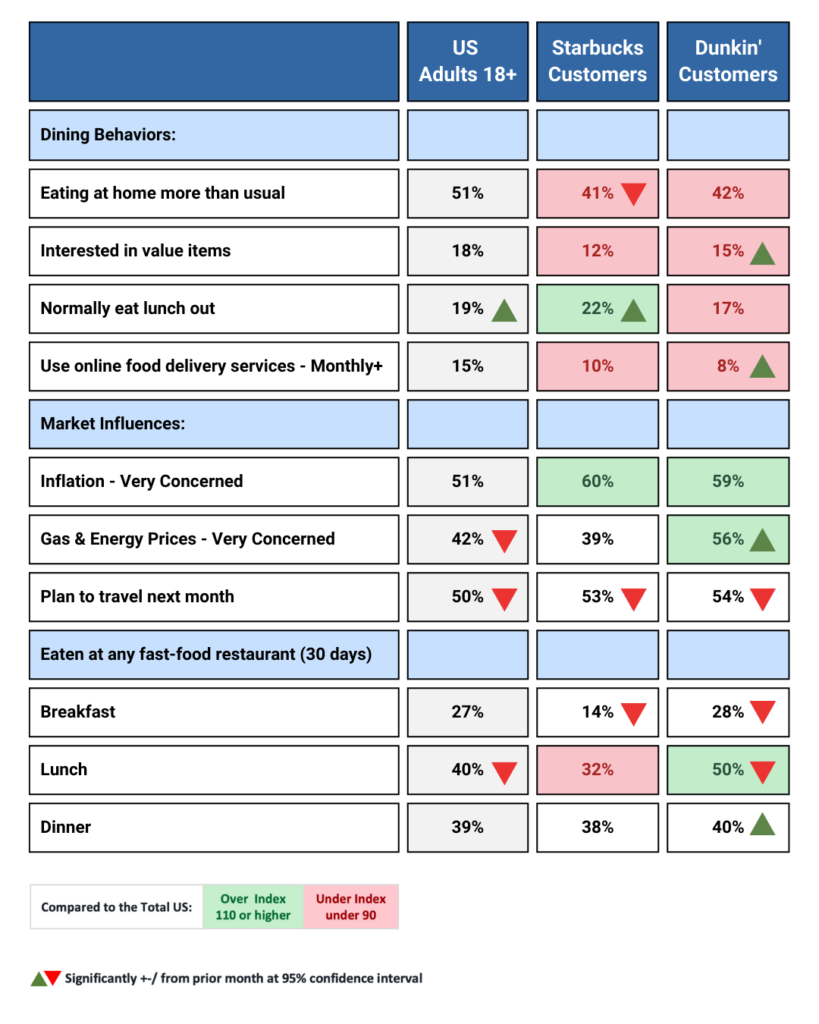

The QSR industry has seen some dramatic changes since the start of the pandemic, and it continues to be affected by market conditions, like inflation and high gas/energy prices. While CivicScience data tell us that Starbucks and Dunkin’s customers are more concerned with inflation than the average U.S. adult, it doesn’t seem to affect their dining behaviors. Both are less likely to say they are eating at home more than usual, less interested in value items, and put less importance on price when dining out.

As mentioned above, price is less of a factor when dining out. Both Starbucks and Dunkin’ customers say that diverse menu options and a higher level of service are what they care about most.

Surprisingly, when it comes to online food delivery services, Starbucks and Dunkin’ customers are trailing the market in adoption, down 5 percentage points and 7 percentage points, respectively. Younger consumers, 18-34, are quickly embracing this trend, with over a quarter (29%) using these services each month. [Data not shown] Restaurants trying to reach young consumers will want to understand and embrace new services emerging in the market.

About the 360 Report

The 360 Report covers topics and categories beyond what is shown above. The report covers industry-specific categories, emerging trends, shopping behaviors, social issues/concerns, and more.

Only CivicScience paints an always-on, ever-evolving, 360-degree picture of your current and potential customers – ensuring you never miss an opportunity or risk.

The 360 Report:

- Delivers a complete and timely view of trends and shifts in consumer attitudes, lifestyle, and intent.

- Predicts consumer behavior and powers more forward-looking strategies and marketing investments, maximizing growth and profitability.

- Provides invaluable, timely knowledge to accelerate decision-making and give you a unique competitive edge.

- Alerts you to trends and changes as they happen, ensuring you never miss an opportunity or threat.

Ready to build your custom 360 Report? Start here.