In the nineties, the Rosetta Stone CD-ROM was the cutting-edge way to learn a new language. Today, there’s an app for that, along with dozens of language learning apps such as Duolingo and Babbel. At the same time, the demand for English language learning is growing, as highlighted in a recent report. Duolingo notes that more than half of their millions of users worldwide are studying English.

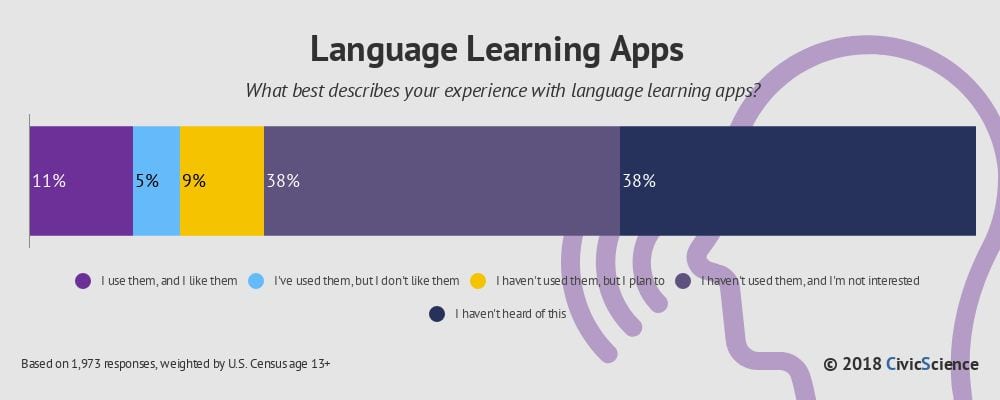

That said, what does the market for language learning apps look like in the U.S.? In a survey of 1,900 U.S. respondents aged 13 and up, CivicScience found that the majority of people fall into two camps: those who have no interest in using the apps or those who aren’t aware of their existence. However, 20% of those surveyed are favorable to language learning apps, split between current users (who use them and like them) and those who plan on using them in the future.

However, 20% of those surveyed are favorable to language learning apps, split between current users (who use them and like them) and those who plan on using them in the future.

Language Apps and Age

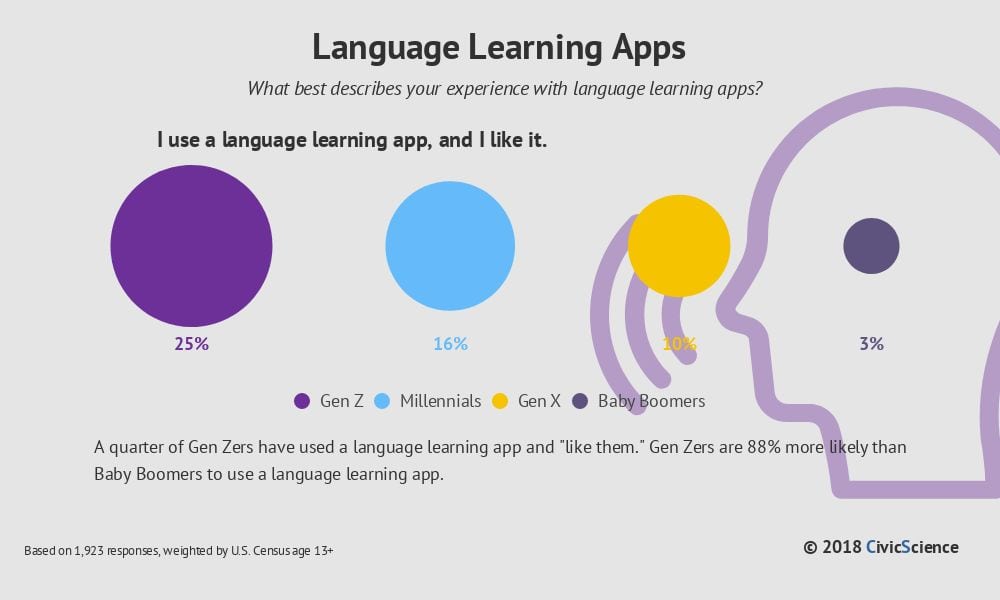

Findings show that the apps appeal slightly more to women and younger crowds, especially those under 18; one-quarter of respondents who use a language learning app and like it is Gen Z. Baby Boomers are the least interested in language learning apps.

Tech adoption also plays a role. The survey shows that smartwatch owners are more likely to use language learning apps and like them. Those who own eReaders, such as Kindle, are more than twice as likely to be current users.

Language Apps and Travel

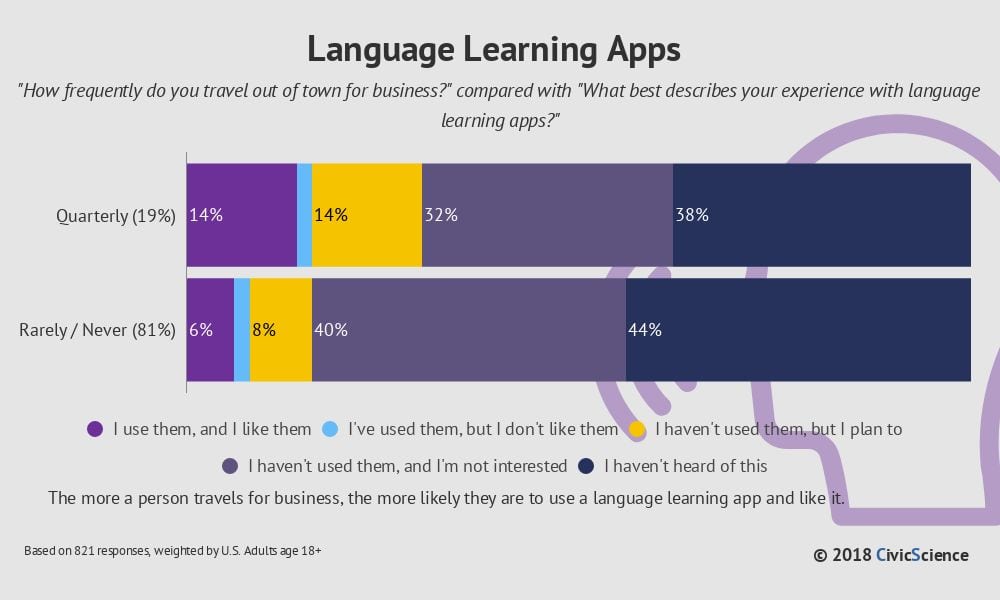

Some reasons may be driving the use of apps, such as relocation and travel. The survey reveals that 33% of current adult app users travel at least quarterly for business and those business travelers, in general, are more likely to use or plan to use language learning apps than infrequent or non-business travelers.

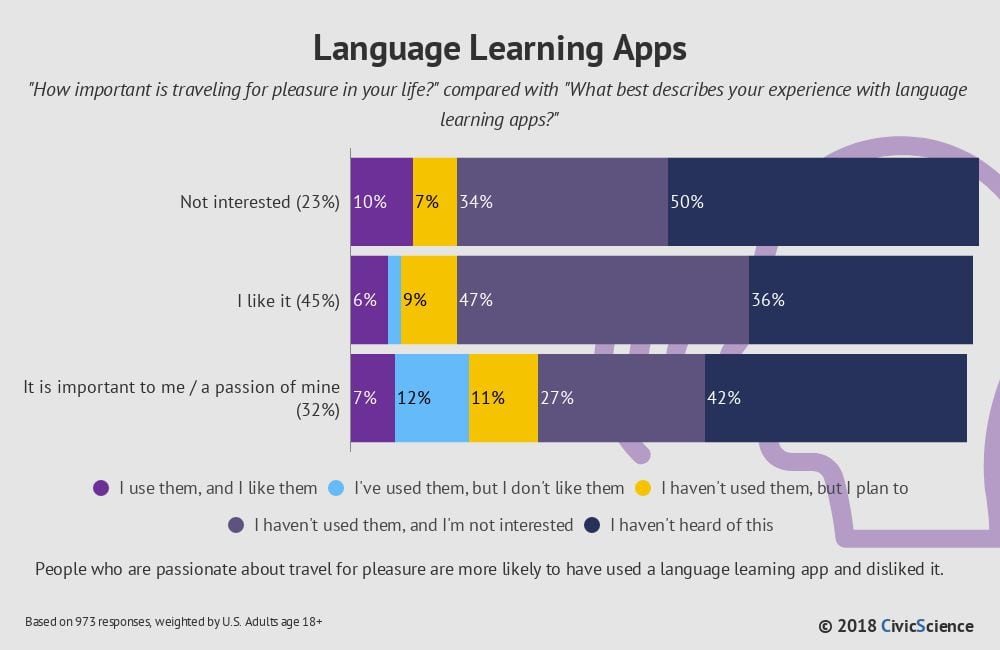

At the same time, things look different when it comes to personal travel. U.S. adults who highly value traveling for pleasure are much more likely than business travelers to have used the apps but disliked them.

Language learning apps appear to be finding niche audiences in the U.S. and have a promising future among tech-savvy Gen Z. However, they still have a ways to go regarding generating greater awareness, as well as customer retention among travelers. While frequent travelers make up a significant portion of app users surveyed, those who travel for pleasure are more dissatisfied with the apps than business travelers.