Amazon announced in September that ads are coming to its Amazon Prime Video streaming service, with the change officially starting Monday, January 29. Prime subscribers and those with a standalone Prime Video subscription can avoid the new ads by paying an additional $2.99 per month. Amazon is far from the only streaming platform utilizing ads – CivicScience recently examined Netflix users as they faced a price hike on their ads-free plans.

Here’s how Amazon Prime Video users feel about the impending addition of ads, as shown by the CivicScience InsightStore™:

Just 9% of Amazon Prime Video users plan to upgrade to ads-free.

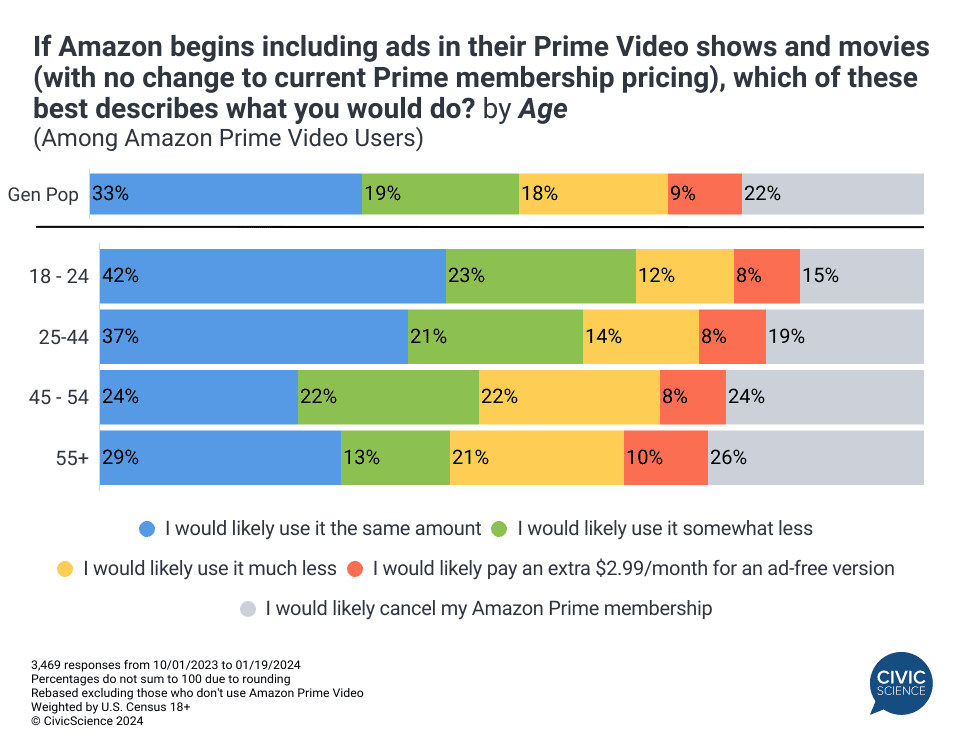

Polling data following the September announcement show just 9% of all U.S. adults who use Amazon Prime Video say they’re likely to upgrade to maintain their ad-free experience, which is less than the 22% of users who feel it’s likely they would cancel their Prime subscription altogether. The plurality (37%) say they’ll simply use the platform less rather than make any payment changes, while one-third of users report it’s unlikely they’ll make any changes despite the new ads.

Younger users are the least deterred by the inclusion of ads, while older adults are the most likely to make changes. Notably, adults aged 55 and older are most likely to upgrade to the ad-free version but are also at least seven points more likely than younger adults to say they would cancel.

Join the Discussion: Do you think Amazon Prime Video’s plan to add ads to its streaming library is a good or bad move?

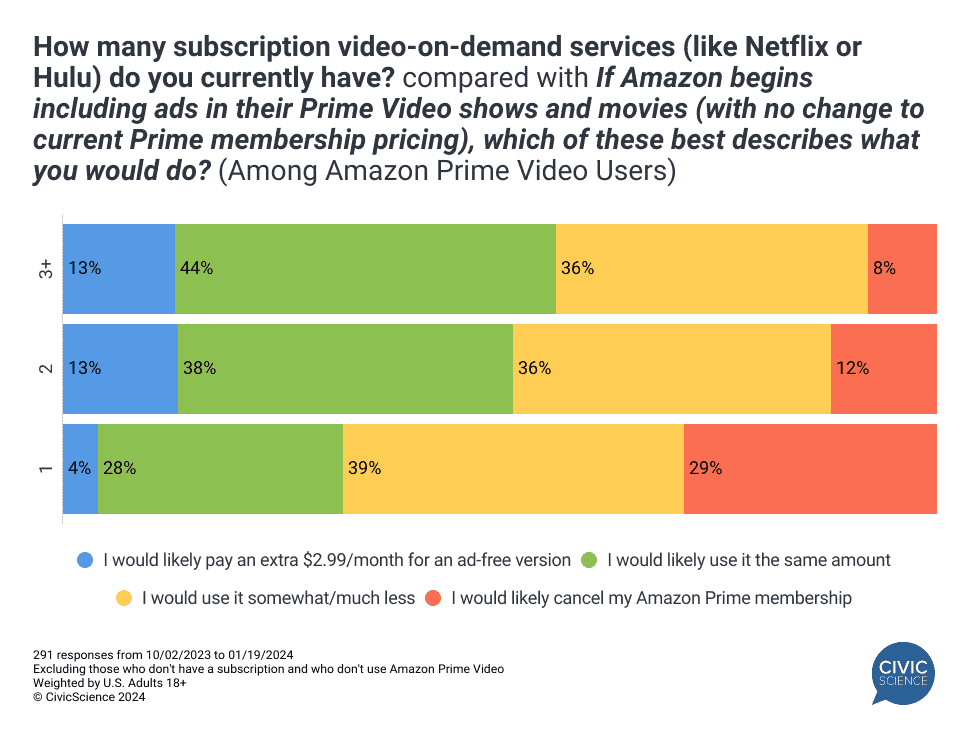

The correlation between the number of video-on-demand streaming subscriptions.

The InsightStore reveals additional key insights about Prime Video users in the wake of the transition. CivicScience data show that 61% of U.S. consumers have multiple video-on-demand subscriptions – so how does the number of video-on-demand streaming subscriptions factor into how consumers will handle ads on Prime Video? Findings reveal a correlation between multiple subscription usage and the likelihood to upgrade. Users with multiple subscriptions are far more likely to upgrade and at least ten points more likely to watch Prime Video with ads compared to those with a single streaming subscription.

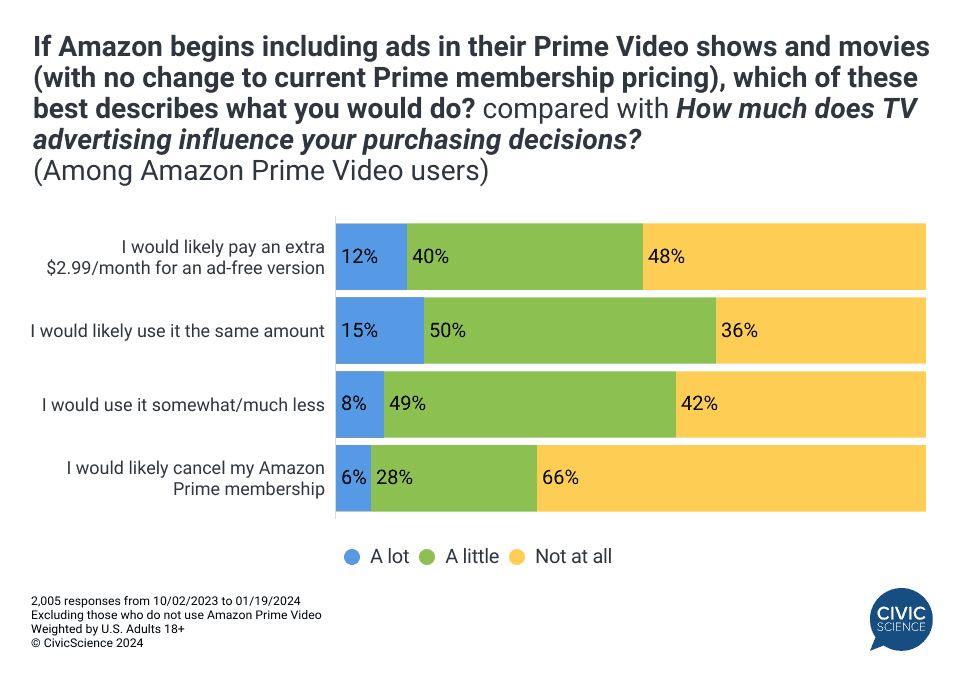

Advertising is less likely to influence purchasing decisions for potential cancelers.

What is motivating consumers to consider canceling? One possible driver for likely cancelers is that some don’t factor advertising into their purchasing decisions. For example, two-thirds of those who are likely to cancel their Prime membership say TV advertising has no sway on what they purchase at all, a full 30 percentage points higher than those not planning to change their subscription or viewership and 24 points higher than those who simply plan to use Prime video less.

The good news for Amazon is that for 7-in-10 Prime Video users, ads aren’t likely to affect their subscription status. The bad news is viewership rates may decline, and the platform potentially faces a higher percentage of those likely to cancel rather than upgrade. Could offerings like a bundle package with other platforms be the answer?

Take Our Poll: How likely do you think it is that you will cancel at least one subscription streaming service within the next month or two?

Want to better anticipate how consumers will respond to changes in your industry before they happen? Get in touch now to see how you can leverage our database of over 500k crossable polling questions and stay ahead.