The Gist: From July 2016 to April 2017, the number of U.S. consumers who own a Virtual Reality (VR) product jumped from 5% to 11%. Perhaps this is part of the traditional tech life cycle, or perhaps it’s something more. In addition, consumers who are aware of VR technology, but are not planning to purchase, are more likely to be price-sensitive and tend to lean older, which presents surprising opportunities for VR retailers.

When you think of virtual reality, what comes to mind? Do you think of the future? Maybe you feel excitement – or even fear? According to our data, whatever consumers are feeling about this futuristic technology, it’s getting them to buy.

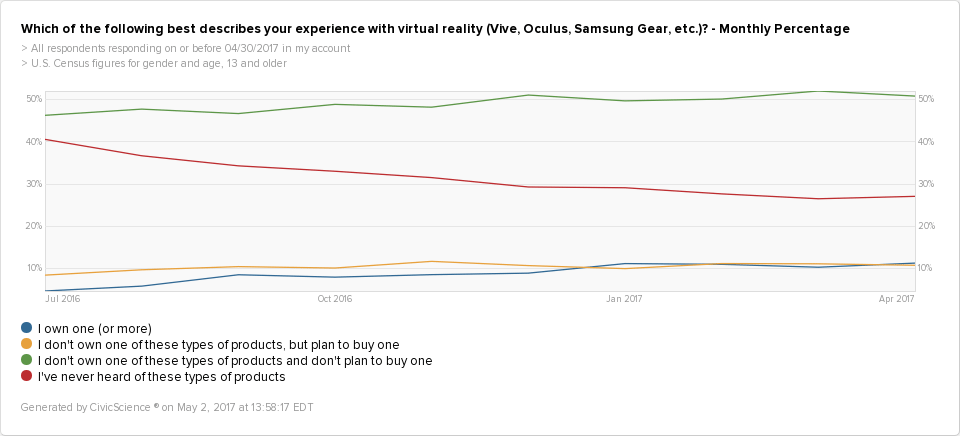

Check out this trending data:

There are three preliminary trends to notice:

- VR Ownership: In July 2016, only 5% of U.S. Consumers (13+) owned one or more VR product. As it stands now, that number rests at 11% – more than double what it was less than one year ago.

- VR Intended Ownership: Intended purchases are up 3% over the same period. However, those who are aware of VR technology but don’t plan to purchase a VR product have risen as well, by 5%.

- Awareness: Over the same timeframe, awareness of VR technology, in general, has increased by 14%.

Given the rising prevalence of VR technology, this spike in awareness and ownership might not be too shocking. However, the rate at which this spike has occurred is fascinating. We rarely can say that a trend, and an expensive one at that, has doubled in popularity in less than one year. Of course, maybe this is just part of the traditional tech adoption cycle.

However, this could also help to explain:

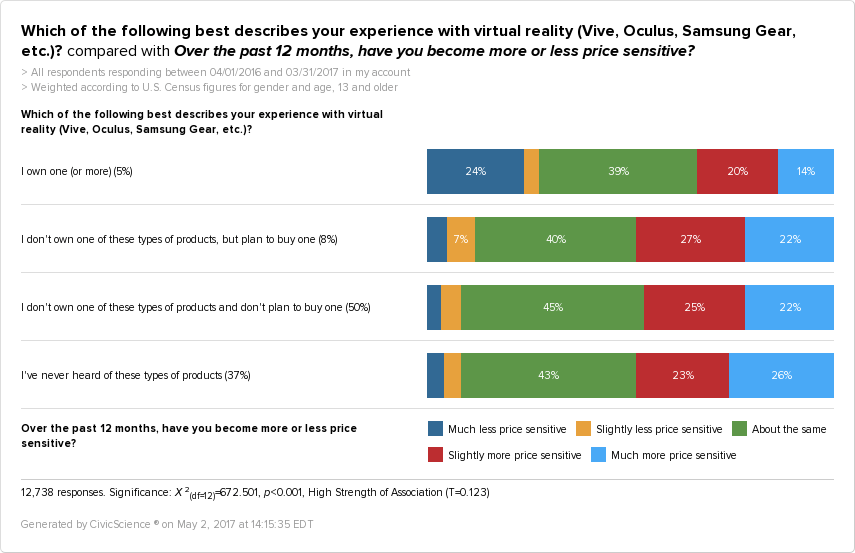

When focusing solely on data collected over the past year, we found that those who own one or more VR product are over 400% more likely than others to say they have become “Much less price sensitive” over the past 12 months.

Perhaps this group’s lack of price-sensitivity could benefit other consumer tech industries as well.

NOW THAT AWARENESS OF VR TECHNOLOGY IS UP, WHAT’S NEXT?

Now that 73% of the population is aware of VR technology such as Oculus and Samsung Gear, what’s next? Unsurprisingly, price comes into play yet again, and age as well.

One of the top insights that surfaced about those who don’t own any VR products, and don’t plan to buy any, is that they are price-sensitive, in everything from their food to e-commerce purchases. For VR retailers and suppliers, this may be one way to bring in consumers who aren’t yet swayed by VR technology.

What we mean is that current VR technology has been developing in numerous ways, and has been heavily focused on providing experiences that consumers can’t attain otherwise. Virtual reality provides access to experiences like travel, concerts, events etc. These events would normally be incredibly costly, but new technology provides greater access.

So, perhaps hesitant consumers could be convinced to purchase VR products if they knew a $300 product could provide a similar experience to a $1,000 trip, for example.

I’ll stop myself and say that experiencing a beach through a pair of glasses and experiencing a beach firsthand are two different things. However, when the first is not possible due to cost, or other reasons, perhaps VR technology can fill the gap.

Lastly, a recent Quartz article details that Virtual Reality technology could alleviate chronic pain. They cite that 100 million Americans suffer from chronic pain, many of them over the age of 55, and that in one small study, patients reported that their pain fell by 60–75% during their VR session, and by 30–50% immediately afterward.

According to our data, those over the age of 55 are much less likely to intend to purchase VR products. So, if the VR industry pursues this research surrounding the positive benefits of VR technology on health issues that highly affect Baby Boomers, in particular, perhaps this could bring them into the VR fold.

Interested in other insights? Check out our recent posts on Uber’s self-driving cars, decreasing concern for consumer privacy, and our answer to the question – why are people buying smart home assistants?