The Gist: Millennials and Gen Xers and earners from all income brackets report high rates of job burnout; they also raise concerns for public health and consumer confidence.

What leads to job burnout?

Is it the changing nature of jobs in the U.S. — longer hours, increased demands on employees, email overload, and even the trend to work more than one job? Or is it workaholism, anxiety about work, the inability to say no, the need to over-achieve and outperform, and never truly leave work?

Research shows that it’s likely a combination of factors, but the evidence is clear: we are a nation of burnouts. Just take a look at the result of our survey that asked whether or not respondents are experiencing or have experienced job burnout.

We see that 22% of adults currently feel burned out regarding their jobs, while 50% have experienced burnout at some point in time. That leaves only 19% who have never felt burned out on the job and 9% who either have never worked or have yet to enter the workforce.

To be clear, 72% of respondents are dealing or have dealt with job burnout.

The question then is, Is job burnout in the U.S. inevitable? Or, is it something that can be prevented? Is it a growing trend? Job or occupational burnout is recognized by leading health organizations as a stress-related health problem, characterized by emotional exhaustion and instability, loss of energy, and feeling withdrawn, overworked, and under-supported.

It’s estimated that workplace stress costs anywhere from $125 to $190 billion dollars per year and represents 5 to 8% of national spending on health care, not to mention it leads to a loss in workforce retention. So, there is indeed a financial impetus to curb burnout.

And looking at who exactly is getting burned out may be key to seeing what lies ahead for employers, employees, and public health.

Young and Burned Out.

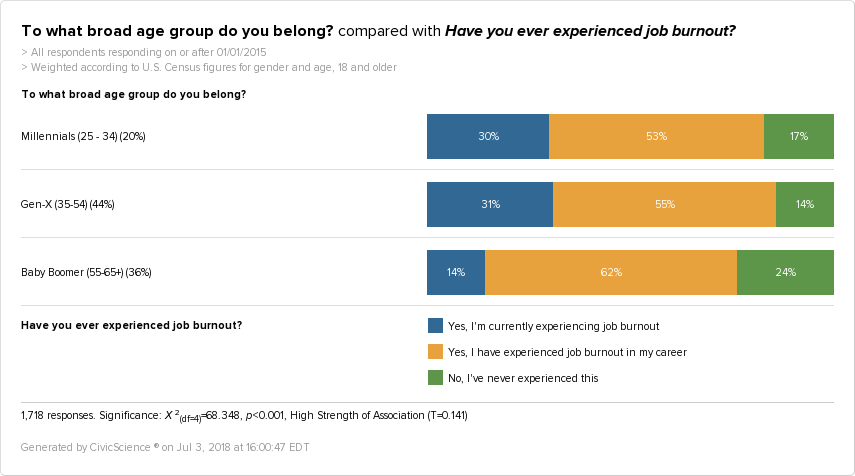

You’d expect burnout to be highest among older generations (Gen X and Baby Boomers) who have had more time to get burned out, but we are seeing an alarmingly high amount of job burnout among Millennials aged 25-34, many of whom are barely a decade into the workforce.

53% of those Millennials say they have experienced job burnout before and 30% say they are experiencing it now.

When we look at Baby Boomers, we see the lowest total job burnout rates. If Millennials (and Gen Xers) are already more burned out on their jobs than Baby Boomers (53% of whom are now retired), what will things look like when they are older?

Low Income Doesn’t Necessarily Equal Job Burnout.

We already know that Millennials report the highest levels of stress, which we covered in a past post, and higher stress is related to lower income levels; Millennials, in general, make less than older generations, so it’s expected they would have higher stress levels.

When it comes to job stress specifically, things are more complicated — we’re seeing that there isn’t a direct correlation between job burnout and low income. In fact, the sweet spot for job burnout is in the $125-150K income range, 60% of whom have experienced job burnout and 25% who say they currently are.

We’re seeing high rates of job burnout throughout nearly all income levels, and looking at a breakdown of jobs in the U.S. further helps to make sense of that. Service workers and craftsmen, laborers, and farmers together are the most burned out, by a landslide. Service jobs, in particular, are on average lower paid positions, but they are also some of the most physically demanding as well as the most insecure jobs.

But accounting for significant job burnout rates in the higher income brackets are the professionals/managers and tech and medical workers, reporting similarly. Between 59-60% of these workers have experienced job burnout and 23-25% are currently.

Let’s not neglect the unemployed; 85% of those not currently employed for pay (neither retirees nor homemakers) say they have experienced job burnout in their careers.

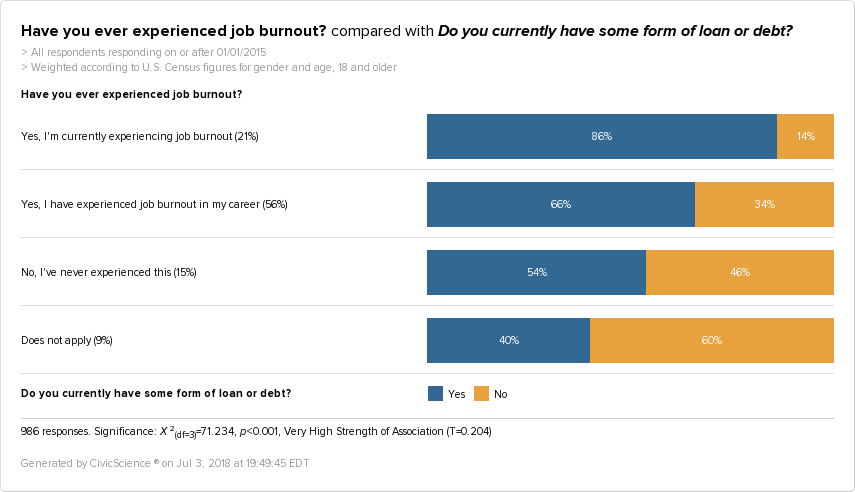

What we can see a direct correlation with is debt, which our data show 62% of American adults have some form of. An overwhelming majority (85%) of those currently experiencing job burnout have some form of loan or debt to their name, while 66% of those who have experienced job burnout in the past do as well. That’s more than those who have never been burned out.

Considering that Millennials and Gen Xers have higher rates of burnout and also more debt than Boomers, it’s not surprising there would be a correlation. However, it does make us wonder what role debt itself plays in the volatile cocktail of job stressors that lead to burnout.

Job Burnout Isn’t Healthy for Workers or the Economy.

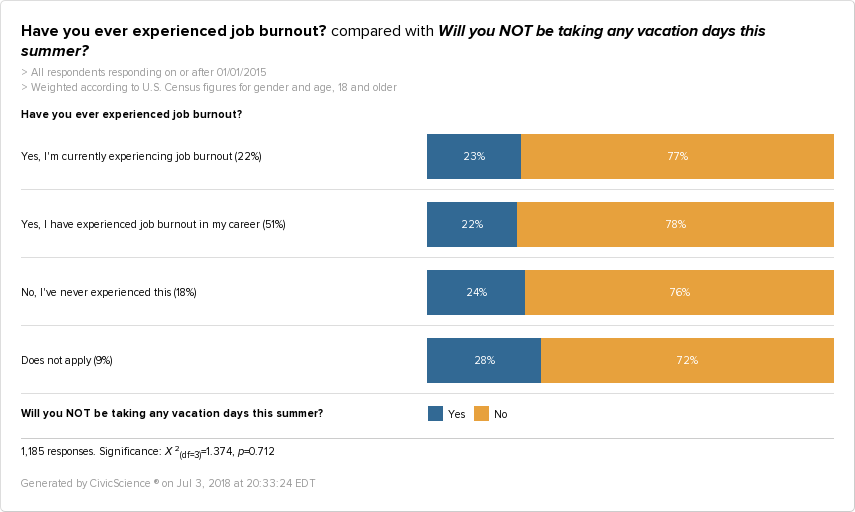

Vacation time and time off work are seen as key for mental health. The good news is that 77% of those experiencing burnout and 78% of those who have in the past are likely to take vacation time.

Still, research has shown that while vacation and relaxation time is important for mental health and productivity, it doesn’t always prevent employees from barreling headlong into burnout; the same stressors will be there when they return. Other factors to be considered are U.S. labor laws, workplace culture, and personal habits.

In fact, our data shows that job burnout and sleep patterns are related. Those currently experiencing burnout get the least amount of sleep; 12% report getting under 4 hours of sleep per night and 33% only get 4-6 hours.

Whether they’re losing sleep due to workload, stress-related insomnia, or something else isn’t clear, but it’s likely that sleep habits play some part in job burnout.

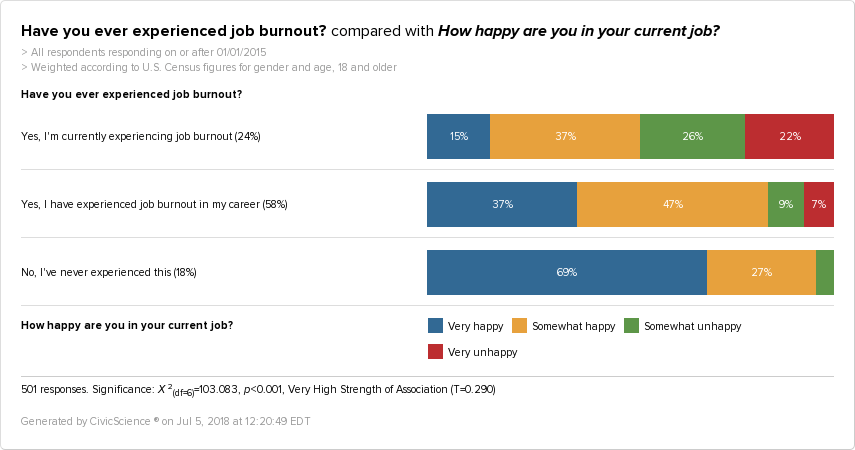

Yet another measure of wellness (and potentially work productivity) is self-perception of job happiness; it’s not surprising to see that getting burned out and feeling unhappy in your job are related. Those who currently feel burned out are the most unhappy in their jobs, with 48% saying they are somewhat or very unhappy. However, those who have felt burned out in the past are significantly happier in their jobs now, with 84% reporting they are very or somewhat happy.

Perhaps the effects of career burnout linger on for the 58% of people who say they’ve been burned out in their careers, considering that those who have never experienced burnout in their careers are the happiest — a massive 96% say they are very or somewhat happy in their jobs.

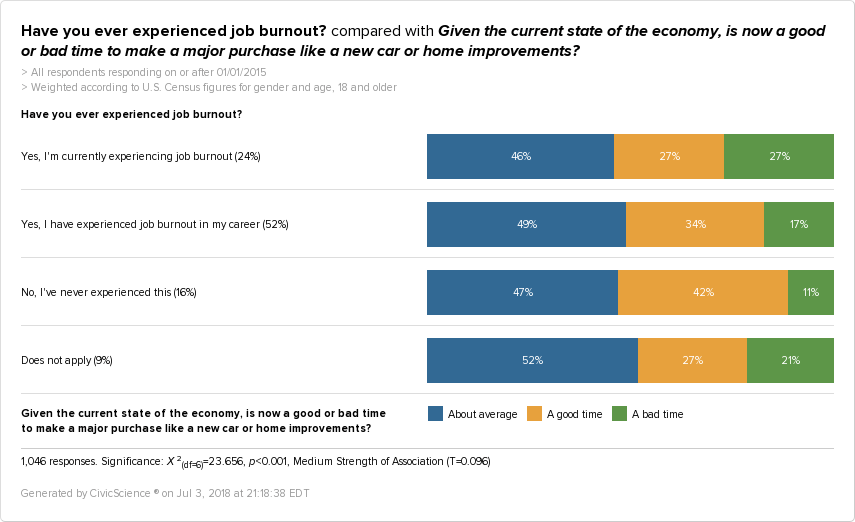

How does job burnout affect spending habits? When it comes to making major purchases, those who are currently experiencing burnout are the most likely to think that in terms of the economy, it is a bad time to buy a home or car (27%).

Job burnout may cast a dark cloud over consumer confidence and hinder investment for those going through it.

Overall, job burnout in the U.S. is not a pretty picture. With high rates seen among Millennials and Gen Xers across all income levels, it’s a far-reaching complex problem and one that is bound to affect the future of the workforce in the U.S.