CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

As consumer behavior ebbs and flows, CivicScience data consistently show that well-being is a key indicator of what drives these changes. For businesses, media publishers, and advertisers seeking to stay ahead of shifts in consumer spending, understanding how these feelings impact when and how shoppers open their wallets is essential.

The CivicScience Well-Being Index (WBI) offers a comprehensive view of the well-being of the American consumer and how feelings translate into real-time impacts on spending during the holiday season and beyond.

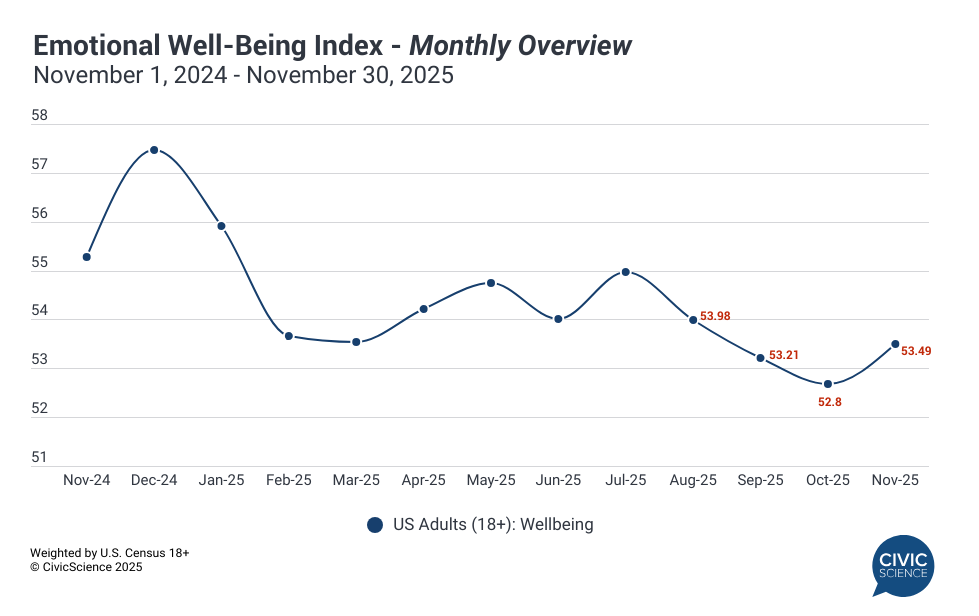

The latest reading, through the end of November, shows that well-being among U.S. adults 18+ has increased slightly to 53.49, ending a months-long streak of declines as the winter holiday season approaches. This figure represents a slight 0.69 point increase since October. Despite the uptick, overall well-being still hovers 2.04 points lower than in November 2024.

After months of leading the decline, adults aged 35-54 were the only age group to experience a positive shift in well-being in November, with a 2.64-point increase. Meanwhile, Americans aged 18-34 experienced a 1.32-point decrease, while those aged 55+ saw a 0.21-point decrease. However, given the strong upward pull of those aged 35-54, the decreases among the remaining age groups were not enough to stop the overall rise in well-being sentiment.

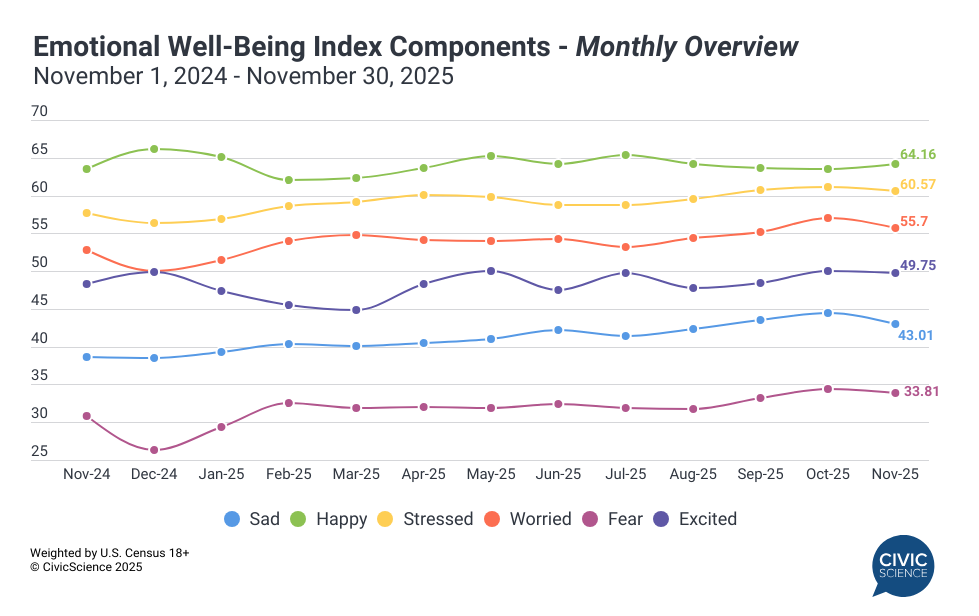

In a strong turnaround from last month, all negative emotions decreased, while happiness saw a slight increase. Sadness saw the most significant drop (1.43 points), followed by worry (1.21 points), fear (0.51 points), and stress (0.5 points). This downward shift in negative emotions coincides with a 0.63-point increase in happiness, all of which overruled a slight decrease in feelings of excitement.

Financial Stress Has a Hold on Holiday Shoppers

Despite the improvements in well-being in November, stress remains the second most commonly felt emotion in the index. Additionally, a substantial subset of consumers reports that their stress levels increase during the holiday season.

The latest consumer-declared data finds 52% of celebrators saying they’re more stressed during the holiday season than they usually are. That figure has increased two percentage points since this time last year. Millennials lead in self-reported increased stress, surpassing Gen Z respondents who had previously held the top spot for stress in 2023 and 2024.

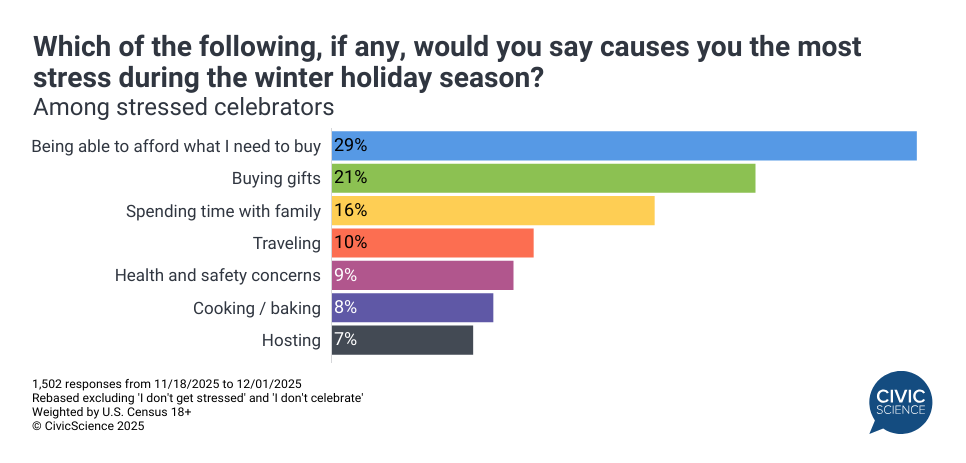

As the data show, being able to afford what they need to buy causes the most stress, followed by buying gifts and spending time with family. With two of the top three stressors linked to spending, it’s clear that the commercial aspects of the holiday season are taking a toll.

Those who are more stressed during the holiday season are already planning to spend more this year compared to last, and some are even anticipating taking out debt to purchase gifts. And since nearly half of this high-stress group has already started their holiday shopping, it’s possible they’re already seeing their credit card bills begin to add up.

Despite a slight rebound in the Well-Being Index in November–a positive change in sentiment for the first time in months–holiday stress prevails. And with the leading cause of this season’s stress coming from financial obligations–and the efforts required to check off every item on the list–what could be a good sign for businesses looking to make holiday sales may not be a great sign for well-being in the months ahead.