THE GIST: Cryptocurrencies are reaching all-time highs and have made early adopters of these digital currencies (i.e. “market mavens”) very wealthy. Is this a bubble? We wanted to take a pragmatic approach and analyze Blockchain for its potential utility to end-users.

QUICK HISTORY

This isn’t the first time we’ve seen a boom when it comes to cryptocurrencies. Per Coindesk, we saw a spike in 2013-14, then a subsequent decline and malaise until activity rebounded in 2016.

For those who aren’t familiar, cryptocurrency is a digital asset designed as a medium of exchange using cryptography (

CURRENT STATE

Given this newfound interest in Blockchain, we wanted to analyze Blockchain’s unique advantages vis a vis traditional competitors. The goal being to see which drivers are most likely contributing to current and expected future demand.

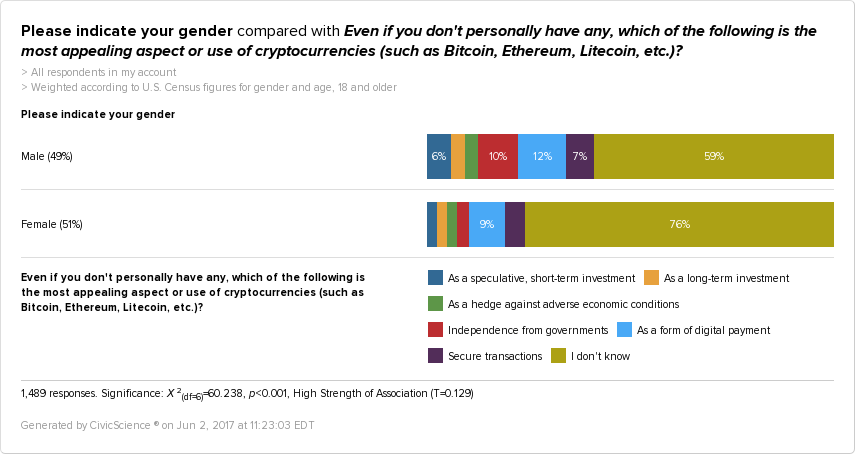

GENDER

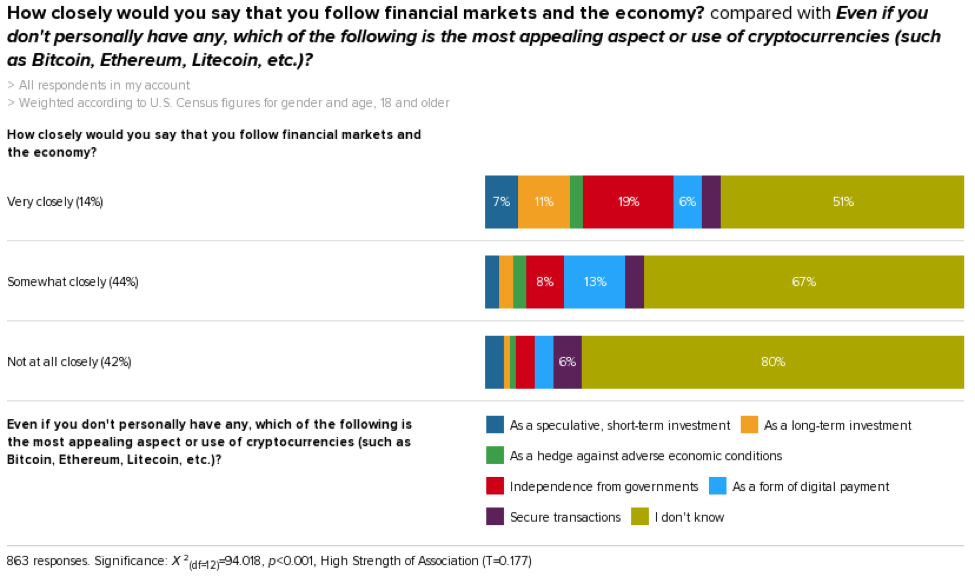

FINANCIAL MARKET TRACKERS

STREAMING SERVICES USERS

RESULTS

The results are quite interesting between these various segments. Regarding gender, both men and women see value in Blockchain’s utility around digital payments and secure transactions. In addition, men seem a bit more cavalier when it comes to libertarian utility and price speculation. Regarding financial markets, unsurprisingly, “close followers” see the utility of Blockchain more heavily for potential investments. Regarding streaming services, “users” seem to find value with digital payments and secure transactions, in addition to governmental independence.

CONCLUSION

Our data show that Blockchain is like “31 flavors,” it has something for everyone. This is encouraging for Blockchain enthusiasts, new companies, and potential partners because it may indicate long-term viability in a variety of capacities to a variety of consumers. Additionally, our data may serve as a warning shot to those companies that currently compete with Blockchain applications or may in the future; lest they may find themselves on the wrong side of “The Innovator’s Dilemma.”