The Gist: The adoption of mobile payment apps in the U.S. is slow-going, and fears over security trump the concern over privacy.

Whether setting your smart thermostat, requesting a ride, or depositing a check, our smartphones are rapidly becoming our everything tool. So naturally, shouldn’t we be able to pay for our groceries at the supermarket or a drink at the bar using our phones, too?

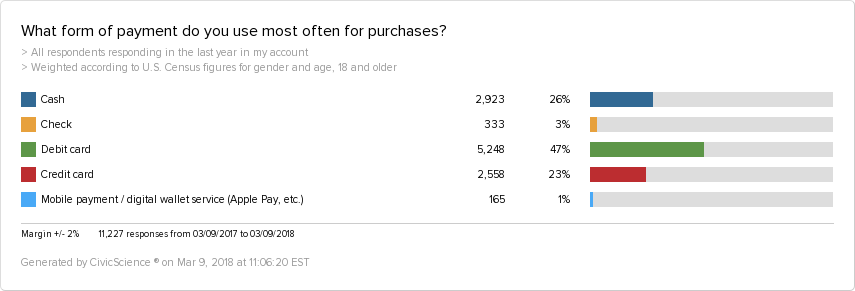

Well, you can, sometimes. Even though about 36% of the country’s retailers accept payment through Apple Pay, the most popular mobile payment app in the U.S., most American adults still reach for the plastic and paper, as evidenced here:

Compared to China, U.S. adoption of mobile payment apps that can be used at POS (point of sale), such as Apple Pay and Google Pay, is strikingly low. The Wall Street Journal reports that an estimated three-quarters of all fast food transactions in China are done using two giant mobile payment apps (WeChat and Alipay), which have quickly become key components in China’s growing digital ecosystems.

What’s the hold up in the U.S.?

For one, necessity may play a role. Credit cards aren’t as available in other countries as in the U.S., creating a higher demand for a novel form of cashless payment.

But then, there are cultural considerations, like data privacy. Mobile payment apps used in China are constantly collecting data and tracking what users buy. Are Americans just more wary about forfeiting privacy for convenience?

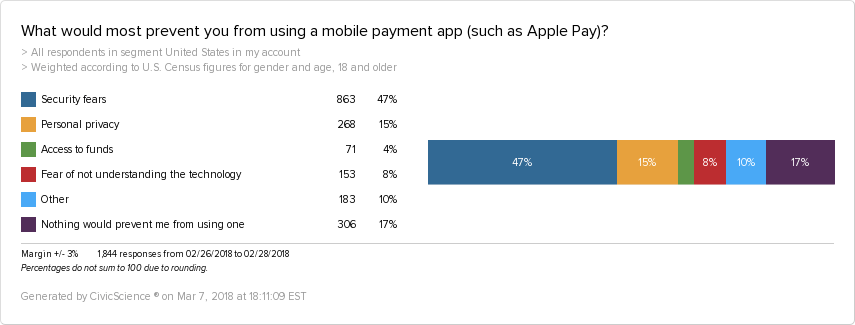

We decided to dig deeper, and it turns out, not really. When it comes to mobile payment apps, we found that Americans are most concerned about security, trumping fears over personal privacy.

Americans seem to be considerably more worried about hackers breaking into mobile payment apps than they are with the app companies storing or sharing their usage data.

Will digital natives pave the way?

Millennials (18-34) are the least likely to worry about security, the most likely to say that nothing would prevent them from using a mobile payment app, and the most likely to actually use mobile payment apps. However, at the end of the day, 40% of Millennials still harbor concerns over security.

That leaves us wondering if 40% of Millennials, and the larger 47% of American adults, are just a bit paranoid, or if their safety concerns are valid?

It’s probable that major cybersecurity breaches, like the Uber and Equifax hacks of 2017, feed into public fears over security. However, experts and mobile payment companies assure us not to worry; the apps are secured through advanced authentication and encryption technology.

Either their message isn’t being received, or it isn’t being believed. It looks like the companies behind mobile payment apps (e.g., Apple, Google, Amazon) have their work cut out for them if Americans are going to do as the Chinese and trade in their leather wallets for digital ones.