This is just a glimpse of the insights available to CivicScience clients. Want to see the full picture? Let’s talk.

The Paris Summer Olympics officially came to a close, but it was not before records were set for NBC and the Peacock streaming platform. But viewership isn’t the only thing consumers are breaking records in – sports betting on the Olympics also looked to have a record high volume. Just how many bet on the Paris Olympics and how does that compare to the intent for some of the upcoming American sports betting in the fall?

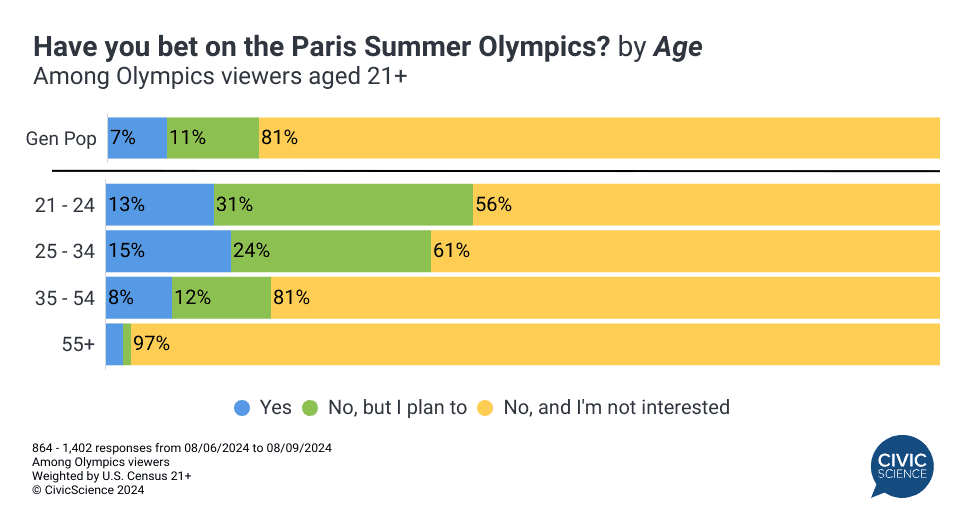

CivicScience data as of August 9 show that 7% of American Olympic viewers placed bets on Olympic events, and another 11% planned to do so before the games wrapped up. And while American athletes took home a total of 126 medals, they weren’t the only ones winning – 32% of those who bet on the Olympics say they won some amount of money.

Olympic betting patterns differed quite a bit depending on how Olympic viewers tuned into the games – those who watched via antenna were roughly twice as likely as the Gen Pop to have bet on the Olympics. Olympic viewers under the age of 35, meanwhile, were the most likely to have bet on the Games.

Take Our Poll: Do you ever bet on sports?

What does American sports betting look like as fall sports season nears?

With the Olympics now over and the fall sports season approaching, CivicScience data show overall betting intent for the rest of the year has increased by six percentage points from October 2023 – 30% of U.S. adults aged 21 and older now indicate they are at least ‘somewhat’ likely to place a sports bet this year, with 11% saying they are ‘very’ likely to do so.1

Online sports betting is the most popular method, just beating out betting among friends and family and placing bets locally in person. Online sportsbooks, which offer the ability to place things like prop bets, have a prominent presence in sports and are a notable subset of online betting. CivicScience data show that about 10% of bettors say they use and like online sportsbooks while another 10% express interest in trying one (among those aware of online sportsbooks). 2

Two-thirds of online sports bettors say their average bet amount is $25 or below. High-end betting, those with averages of $50+ or more per bet, has fallen by five percentage points since 2023, with a corresponding four-point rise in those betting under $10 over the same timeframe.

The NFL looks to attract the most betting among upcoming fall sports.

Bettors are overwhelmingly focused on the NFL as sports seasons start back up in late summer and early fall. College sports attract 40%, while the NBA (29%) and NHL (18%) lag behind in betting interest this year.

Let Us Know: Do you think online sports betting will increase or decrease overall across the US over the next five years?

The Paris Olympics perhaps offered a preview of betting habits to come in future Olympics, with lots of room to grow now that sports betting is legal in some form in 38 states (compared to 22 during the Tokyo Games). The spotlight now shifts to fall sports, where betting interest is strong but tempered by smaller wagers. This trend points to a broader, yet more conservative, approach to sports betting, as bettors balance enthusiasm with financial prudence.