CivicScience engages directly with consumers, collecting over one million survey responses daily, to turn real-time insights into high-performing advertising campaigns. See how leading brands use CivicScience to drive campaign performance here.

Whataburger, the Southern and Southwestern fast-food burger chain, is one of the many national and regional QSR brands that CivicScience surveys consumers about. New data among those familiar with the chain show that more than 40% of respondents view the brand favorably, driven by adults 18-45, households earning under $100K, and parents. Beyond demographics, CivicScience can also uncover Whataburger fans’ spending intentions and the key trends likely to influence their purchasing decisions moving forward.

What motivates them?

Key Insight: Whataburger customers are value-driven and loyal, yet still open to change.

- They’re 2X as likely to say loyalty programs are ‘very’ important in where they shop, and a whopping 9 in 10 report being at least ‘somewhat’ loyal to their favorite brands.

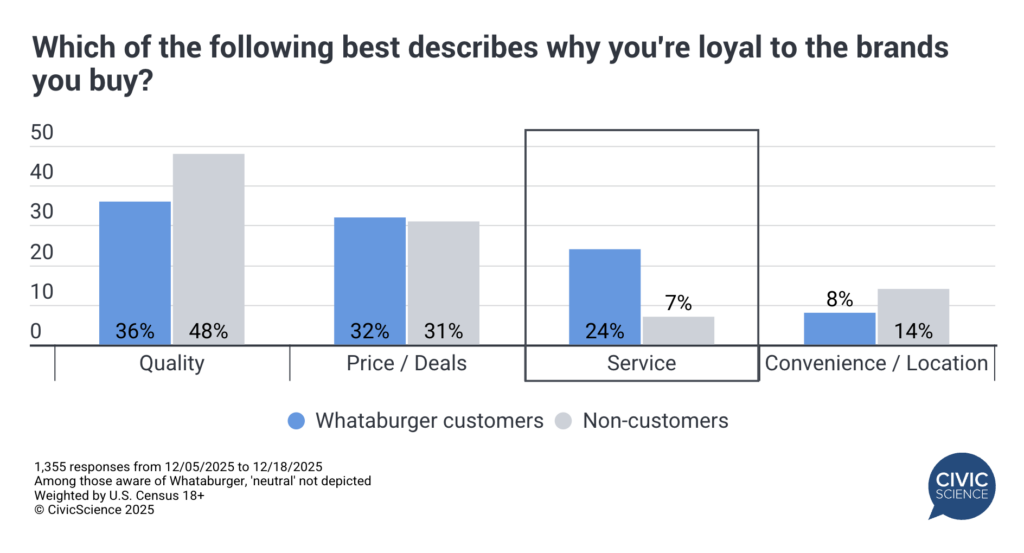

- While food quality and price drive loyalty most, this group is 3X more likely than non-customers to say service is a key driver, and they’re less concerned about location.

- Nearly 40% say they research a brand’s stance on social issues, nearly doubling the share of non-customers. They’re also 10+ points more likely to switch to brands that align with their values.

- Despite strong loyalty, they remain open to novelty, over-indexing in saying they seek out and try new foods more than most other people they know. This openness extends beyond food, with a higher intent to switch in other spending categories, such as banks, cable providers, and mobile carriers, in the near future.

How do they feel financially?

Key Insight: Whataburger customers are optimistic about their financial future, but pragmatic in the present, with selective indulgence.

- Nearly half expect their income to be higher in six months, while just 14% anticipate a decline. Similarly, they’re 2X as likely to expect more disposable income in 2026 compared to 2025.

- That comes with a caveat, though, as one-third expect to take on debt for holiday gifts, and a quarter are ‘very’ concerned about needing to use Buy Now, Pay Later services to manage household expenses in the near future. This differs from non-customers, who are already current BNPL users.

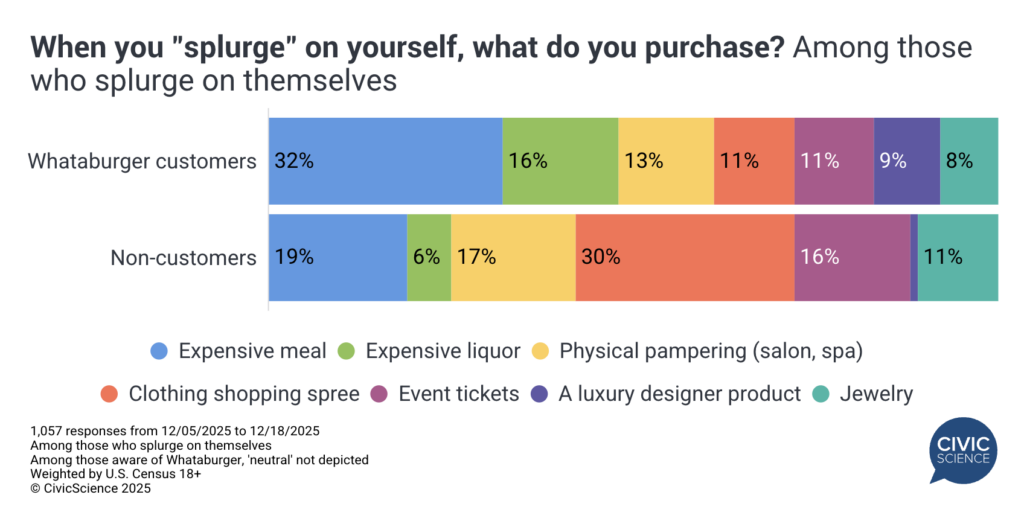

- They still prioritize indulgence – more so than non-customers – and are most likely to report splurging on expensive meals, followed by premium alcohol.

How do you reach them?

Key Insight: Whataburger customers are digitally engaged with a strong readiness to purchase.

- A majority (52%) use video to learn about products or inform purchase decisions, more than double the rate of unfavorable consumers.

- Nearly half (48%) say they ‘always’ or ‘often’ notice digital display ads, compared to 16% of non-customers.

- Over a quarter of respondents report making a purchase immediately after seeing an ad.

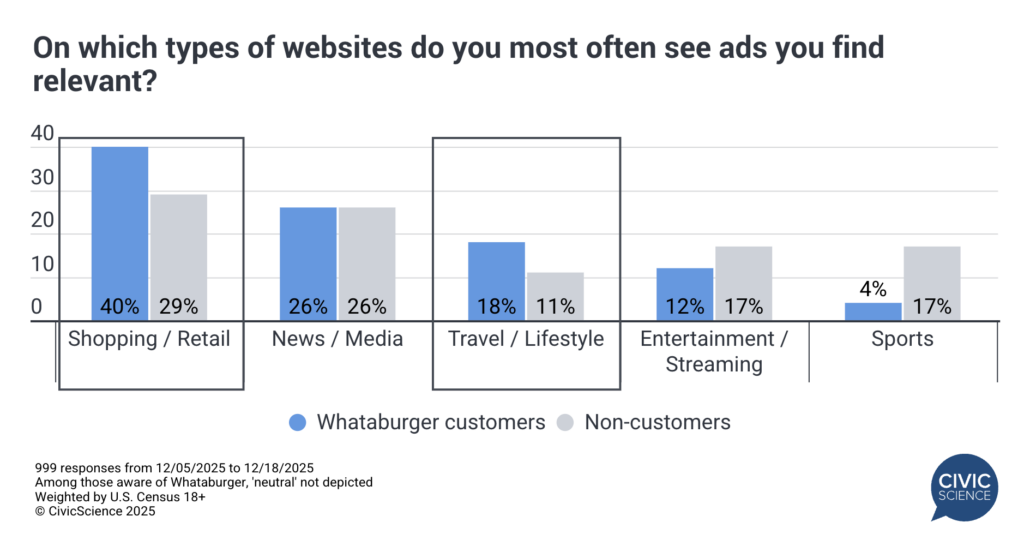

- They’re most likely to find relevant ads on shopping and retail sites, and also over-index on travel and lifestyle content. Conversely, they under-index in finding relevant ads on entertainment, streaming, and sports websites.

- New product discovery most often occurs via search engines and social media, but levels are equivalent to or less than those of non-customers. Instead, they tend to over-index in product discovery with influencers, brand/retail sites, and blogs or articles.

Whataburger customers represent a highly intentional consumer segment – thoughtful about how they spend, what they value, and which brands earn their loyalty. For advertisers, this creates both opportunity and risk: loyalty must be continually earned and reinforced, as these consumers are open to new foods and willing to switch when brands no longer align with their values.