CivicScience clients and partners have access to our millions of daily survey responses, allowing them to generate actionable, forward-looking strategies. See what you’re missing here.

As brands struggle to reach spend-ready consumers in crowded markets, WNBA fans offer a clear path forward—an engaged audience 3x more likely to think now is a good time to make a major purchase and actively open to switching brands. With the league tipping off its postseason, following its most-watched regular season ever, these fans present an ever-growing opportunity. Who are they, and how can advertisers connect with them? CivicScience breaks it down:

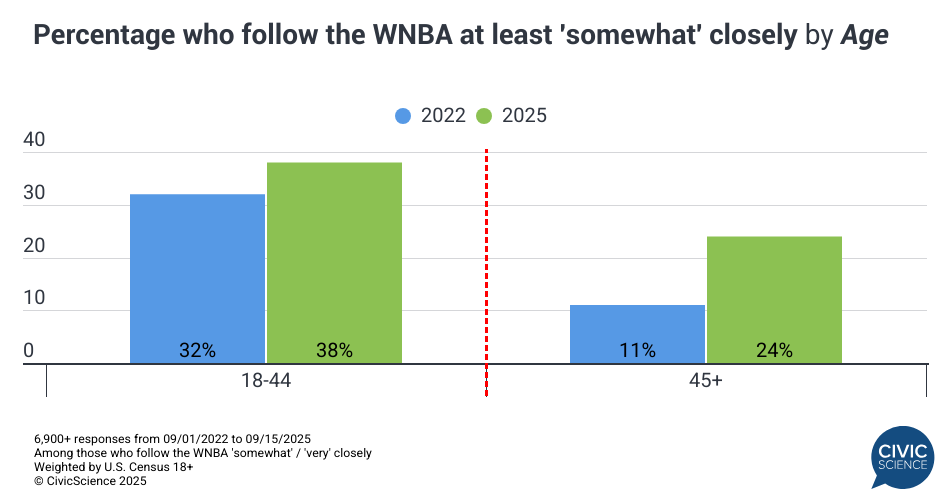

The WNBA is Still a Young Person’s Game, But 45+ is Catching On

Fresh CivicScience data from ongoing real-time tracking shows that 30% of U.S. adults now follow the league at least ‘somewhat’ closely, up from 22% in 2022. Younger viewers lead the way (aligning with early 2025 data about women’s sports interest), but the standout story is the 45+ audience, where interest has more than doubled in three years.

Let Us Know: Are you a fan of the WNBA?

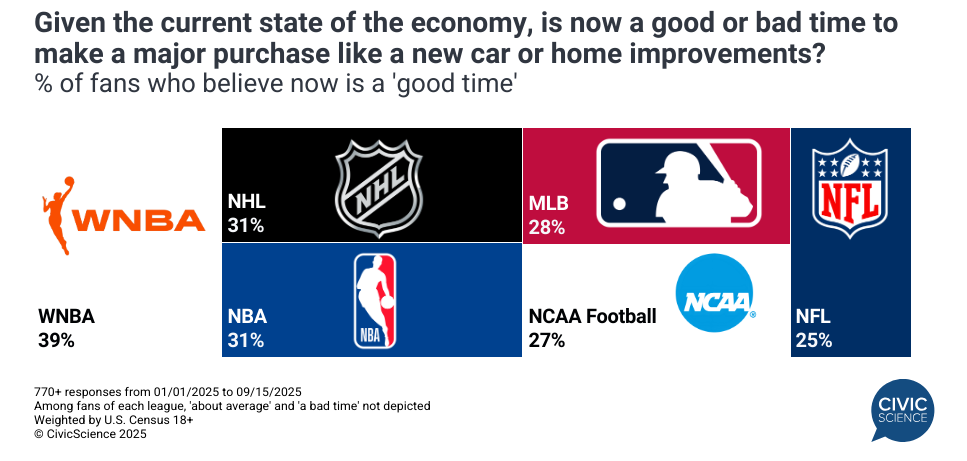

What Brands and Advertisers Need to Know About Today’s WNBA Fan

WNBA fans stand out as an audience exceptionally primed to spend. Nearly 39% say now is a good time for a major purchase—triple the U.S. average and well above other sports fans. This spending confidence translates into action, with fans reporting higher-than-usual spending over the past week.

Potentially even more compelling for advertisers: these fans are actively open to change. As economic uncertainty persists, WNBA fans far outpace the Gen Pop when it comes to intent to

- Switch banks (62% to 29% at least ‘somewhat’ likely),

- Smartphones (67% to 25%), and

- Mobile carriers (65% to 27%)

in the next three months, respectively – signaling a prime opportunity for acquisition campaigns.

Where and How to Reach WNBA Fans

Given their younger skew and as sports fans, they are unsurprisingly likely to be streamers and over-index compared to the average American in terms of paid sports content. However, CivicScience data offers the ability to pinpoint the platforms WNBA fans are most likely to frequent and how to appeal to them.

- Wellness-driven: WNBA fans are 2.4x more likely than Gen Pop to pay for health/fitness content.

- Ad-tier streaming subscribers: WNBA fans over-index the Gen Pop in usage of ad-supported video streaming tiers, making ad-supported streaming placements especially cost-effective for reaching this high-value audience.

- Emotional ads win: WNBA fans are nearly twice as likely as the average U.S. adult to say emotional ads resonate with them (excluding none of the above).

Industries Positioned to Win WNBA Fans

- Financial Services: High brand-switching intent signals a prime opportunity for banks and fintech

- E-commerce/Retail: Spontaneous shopping behavior + holiday self-gifting make for a strong opportunity for promotional campaigns, particularly as holiday shopping ramps up

- Health and Fitness: With an interest in cutting alcohol and frequent consumption of nutritional beverages

- Mobile carriers and phone upgrades: With WNBA fans significantly outpacing the Gen Pop on carrier-switching intent, telecom companies have a clear competitive advantage

Take Our Poll: Excited for the WNBA Playoffs?

While competitors rely on basic demographics, CivicScience’s proprietary data reveal the purchase intent and brand openness that drives real advertising results among this high-value audience.

Ready to reach your high-value audience? CivicScience’s advertising data allows you to build and target custom audiences using attitudinal insights precisely.