Making sense of economic news is super hard.

It doesn’t help that it’s become so weaponized. Partisans can find almost any numbers they want to support their agenda, to credit or blame the people in power, to validate their tribe membership. The press seldom scrutinizes economic reports, publishing them sight unseen.

Whatever you do, don’t fall into the trap.

Over the past week, the two most tenured and trusted consumer confidence gurus – the University of Michigan and The Conference Board – released their January results. These were the respective headlines, just four days apart: From the Wall Street Journal on January 23rd:

From the Wall Street Journal on January 27th:

I’ve followed these reports for most of my adult life and can’t remember them ever diverging so dramatically. In fact, they’re very highly correlated over time (0.8 for the stat geeks keeping score at home).

So, what happened?

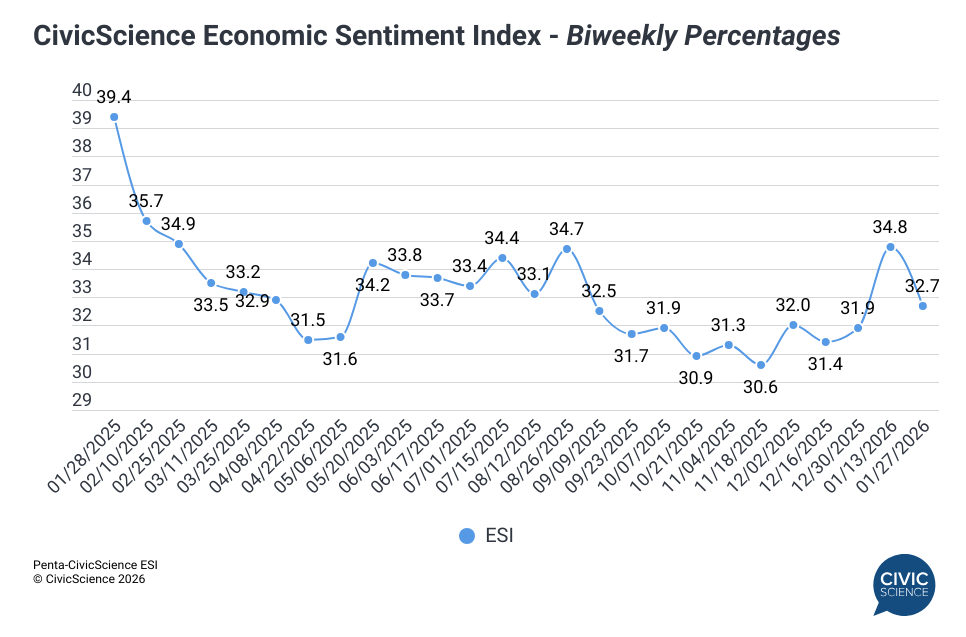

Naturally, the first thing I did was check our data. Unlike UMich and the Conference Board, we publish our Economic Sentiment Index biweekly. If you read this email as vigilantly as you should, you know that our last reading on January 14th was a banger. Sentiment improved significantly during the first two weeks of the month.

However, our latest numbers came out on Wednesday, and they plummeted. It turns out a severe decline in sentiment started on January 24th, perhaps explained by the murder of Alex Pretti and/or the snowstorm and arctic blast that hit most of the country. UMich’s January 23rd release missed this critical period. The Conference Board did not.

That’s all it took. Four days, and the headlines changed wholesale. Meanwhile, government data, such as job reports and GDP, can take months of revisions before they’re reliable.

So, what are you supposed to do about it?

First, stop hanging on a single piece of economic news for hope or doom. Look for consistent, sustained trends and triangulated sources to know when something is meaningful.

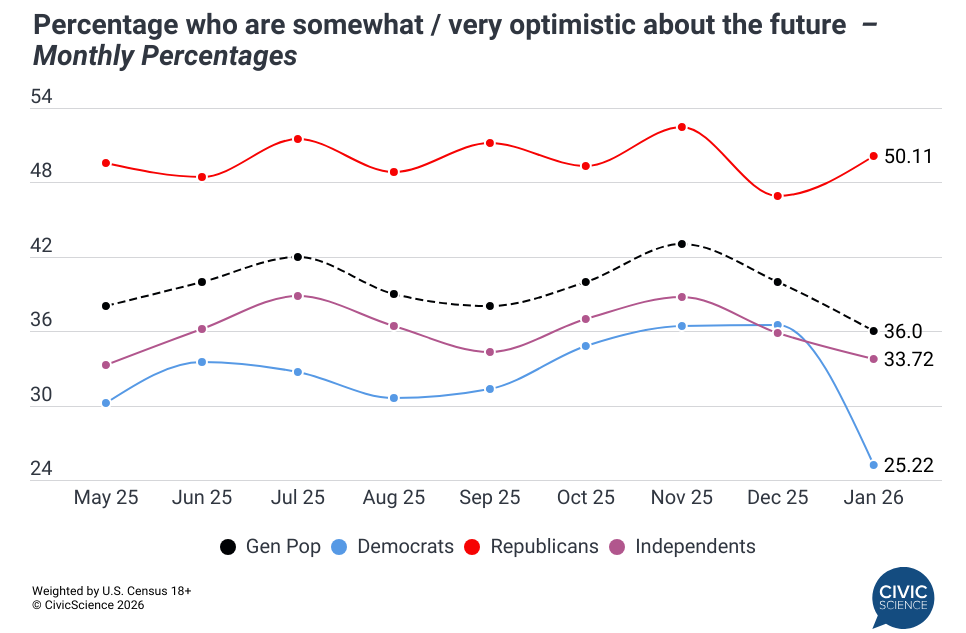

Then, dig below the headlines for nuance and context. Gen Pop numbers are misleadingly obtuse. How does your customer feel about the economy or life in general? That’s what you should be focused on.

If you do those things well, it can inform short-term shifts in your marketing strategy; if not, you’re long-term planning. We know from our advertising work that price-based promotions will land with some customers, at certain times, better than others. We also know that when a consumer is feeling particularly down, they’re more likely to respond to emotional or inspirational advertisements. When they’re happy, they respond to funnier ads. Personalization – and agility – are key.

But it all starts with a grounded, sober, and always-on understanding of the numbers.

None of this is easy. You have to do the work.

Here’s what we’re seeing:

Like I said, consumer confidence tanked over the past two weeks. Our Economic Sentiment Index basically gave back all the gains we saw after the holidays. While the weather and Minnesota could’ve contributed, so too could have the trade tensions with Europe spun up in Davos, the flurry of big-company layoffs announced, Christmas credit card bills arriving, or any number of other things. All we know is that the consumer mood soured dramatically – each of our five main metrics fell by more than a full point, led by confidence in making major purchases.

Incredibly, nearly one in five Americans has no strong opinion about Donald Trump. In our 3 Things to Know this week, we took the rare (for us) step of publishing our presidential approval numbers. We found that 32% of U.S. adults approve of the job Trump is doing, compared to 51% who disapprove. Before you go comparing that to other polls you see in the news – where DJT has approvals in the high 30s or low 40s – understand that we aren’t only surveying likely voters (by design). Also, if we throw out the 17% who (amazingly) don’t fall into either bucket (which most news polls do), the numbers look a lot more like 40/60. In related news, we also learned that Democrats are growing increasingly pessimistic about the long-term future, and everyone is more pessimistic about short-term energy costs.

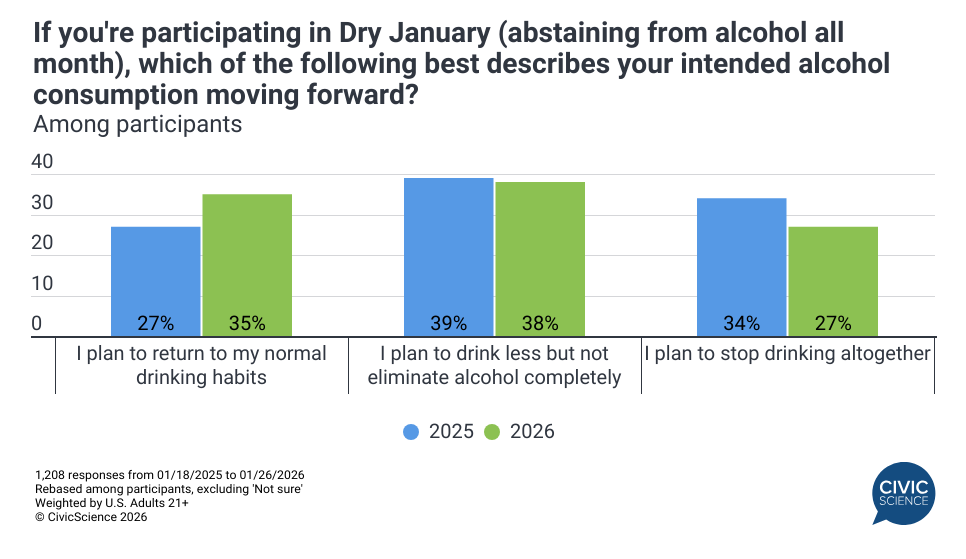

In further related news, people bailed on Dry January in droves. I guess this is a welcome development for alcohol companies – if not for public health – but once-aspiring January teetotalers fell off the proverbial wagon in record numbers this year. It’s worth noting that this year also marks the largest group of people we’ve ever seen attempt Dry January. Gen Zs were the biggest failures – nearly half of them entered the month with hopes of not drinking, only to throw in the towel. Per below, even the people who stuck with it are more likely to resume their pre-January booze-y ways this year. I suppose a bunch of geopolitical strife, economic malaise, and being stuck under a foot of snow in single-digit temps will drive just about anyone to drink.

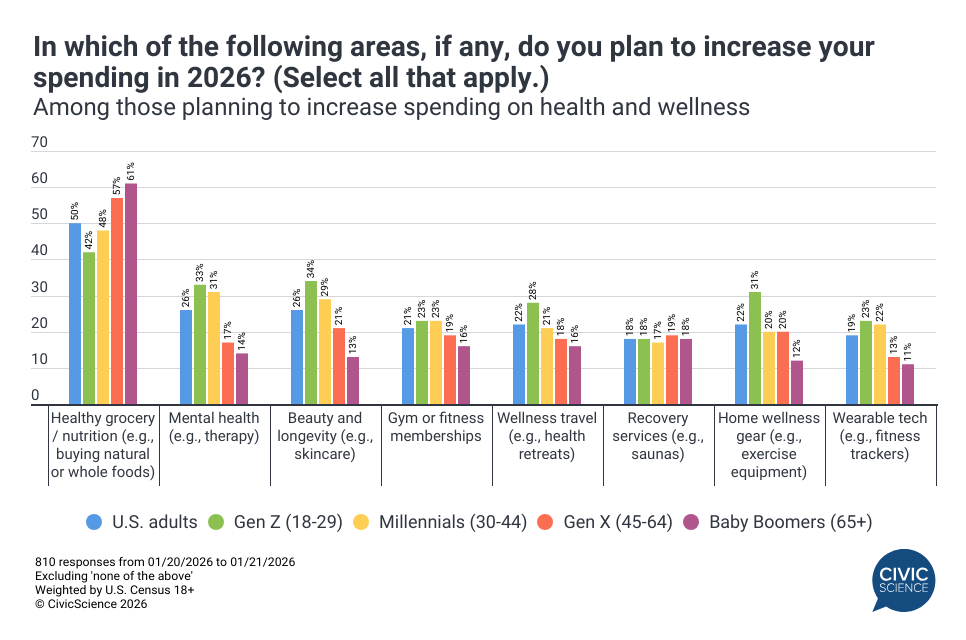

Nonetheless, Americans appear committed to other forms of self-care in 2026. For the second year in a row, health & wellness remains the one and only area of retail where Americans plan to (deliberately) increase spending year over year. Contributing to that trend is a widely expanded definition of the category – it’s not just health foods and gym memberships anymore – driven by the rise of mental and emotional wellness. No surprise, women appear to be far better and more intentional at managing their mental well-being through “small wins,” indulgences, and creative means of connection and escape.

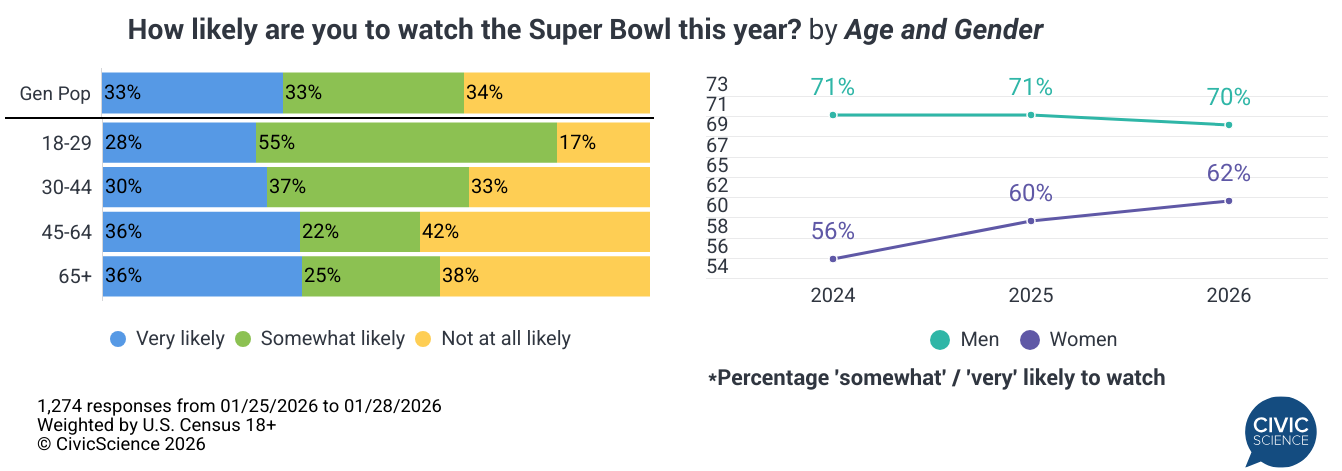

Evidently, Taylor Swift wasn’t the only reason women were flocking to the NFL. Even though Travis Kelce came about as close to playing in the Super Bowl as I did, female fan interest in the upcoming big game in Santa Clara is even higher than it was last year. While the Swift-Kelce effect was measurable in past seasons, it tells us that the league – along with other tactics aimed at attracting female fans – turned it into lasting interest. And even if you can’t afford to drop $8M on a 30-second Super Bowl commercial this year, you should be thinking about how to find these female fans anywhere they go, anytime of year. They’re significantly higher spenders, economically optimistic, and prone to click on ads they see.

More awesomeness from the InsightStore™:

- Gen Z is working out for different reasons than older generations, and other fitness trends to watch in 2026.

The most popular questions this week:

How recently have you had a mocktail?

To what extent do you support or oppose the use of artificial intelligence in educational settings?

Were you a high school athlete?

Do you have any superstitions when it comes to your favorite sports teams?

What’s your favorite type of joke?

Answer Key: Maybe in a past life?; What choice do we have? Yeah, if golf counts; Several; All of them.

Hoping you’re well.

JD

Not on the list to receive this weekly email? Subscribe now by clicking here.