Maybe we were always going to be in advertising.

I withstood it for years. In my defense, I’m in good company. Sergey Brin and Larry Page were once effusively opposed to advertising as a revenue model, before eventually turning Google into the most lucrative ads business in history. Netflix waited years to delve into it. Sam Altman is resisting it until he doesn’t.

I’d always considered ad tech repugnant, at best, and the main culprit in many of our socio-cultural ills, at worst. I wasn’t exactly wrong. But I’ve also learned that transparent and responsible advertising can be extremely effective, without collateral damage. Advertising doesn’t have to be creepy to work.

By the end of this year, our less-than-two-year-old advertising business will blow past the consumer research business we spent sixteen years building. I’m only mildly bitter about it. The former could never exist without the latter.

It shouldn’t shock anyone. The U.S. advertising industry is over 13X bigger than the market research industry ($466B vs. $36B). It hit me at the Cannes Lions event in June. As far as the eye could see, there were dozens of massive yachts occupied by companies I’d never heard of – most of them obscure cogs in the labyrinthian ad tech machine. Maybe 5 consumer research companies could afford boats that big.

Research has another big, if unfair, structural disadvantage. The impact of insights is nearly impossible to empirically measure or prove. For one, companies seldom make decisions based on a single source. They’re taking in multiple signals and considerations, such that the value of one can’t be parsed from another. Typical A-B or control-variable tests aren’t practical. CEOs don’t say “this week I’ll make one choice based on this information, next week I’ll make a different choice based on that information and see which one worked.”

Insights are about improving the odds, even if we never know how the game would’ve turned out without them. They’re essential, nonetheless.

In advertising, however, we can quantify the impact of an insight. We can build multitudes of “audiences” based on the billions of poll questions they’ve answered, test different ads in small batches, learn which insights are driving the best results, then optimize the right ad for the right audience. We can say “The campaign that incorporated this insight, performed 83% better than the campaign that didn’t.” It’s not rocket science. It’s just the same magical data that compels you to read this email every week.

I suppose it was inevitable. Our unique and timely knowledge about people was bound to find its way to the table with the highest stakes.

I’ll forgive myself for not letting it happen sooner.

Here’s what we’re seeing:

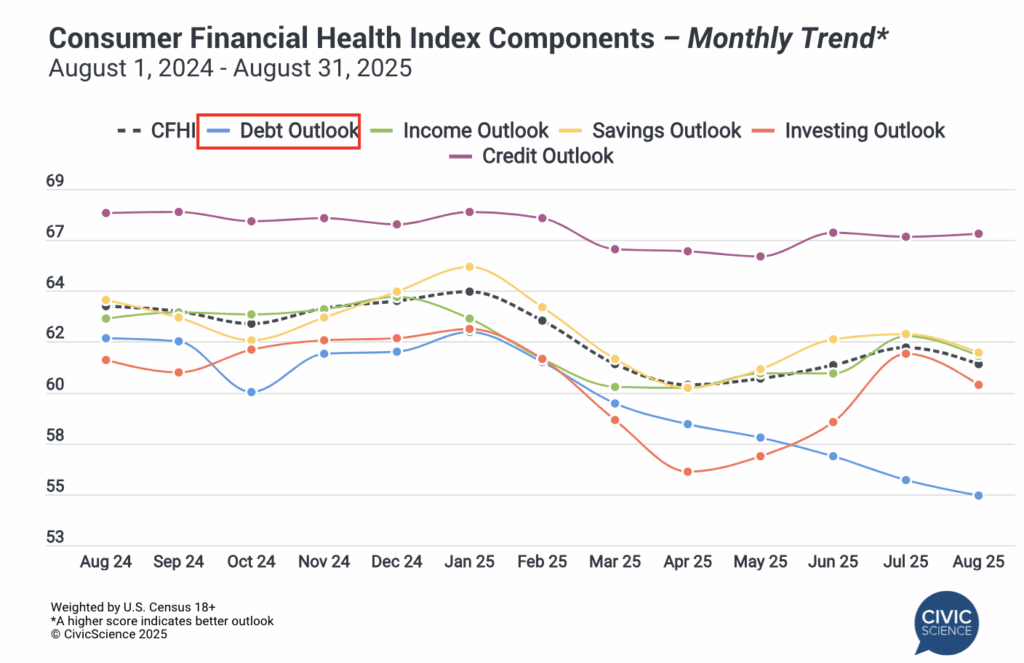

Americans are feeling a heavy debt burden, but it may not dampen their holiday spirit. Our public (see: free) Consumer Financial Health Index came out this week, showing a decline in August, after three consecutive months of improvement. All but one indicator (credit) fell, but the big story is the continued freefall of household debt outlook. For the seventh straight month, our debt indicator deteriorated, reaching the lowest levels we’ve seen since launching the CFHI in 2018. It’s early, but these debt concerns don’t seem to be deterring people’s plans for holiday retail. The percentage of shoppers who plan to use a Buy Now, Pay Later service this holiday season is up appreciably year over year.

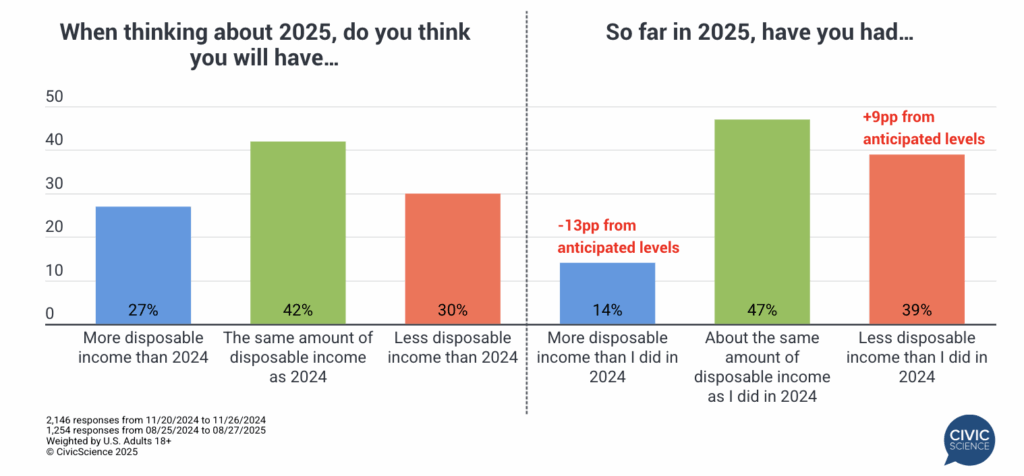

Suffice to say, the year isn’t turning out – economically – the way many people had hoped. In our 3 Things to Know this week, we looked back at a question we asked last November about people’s financial outlook for 2025, then compared it with their current reality. In short, people may have been misguided in their optimism. We also learned that over half of U.S. workers consider themselves “underemployed” – meaning they’re doing a job they consider below their pay grade – and it’s particularly prevalent among Gen Z. In my day, we called this “paying our dues.” Finally, it appears that music videos are having something of a renaissance, with viewership climbing, thanks to YouTube and other streaming services.

As the popularity of live TV streaming services continues to grow, we’re beginning to see how the subscriber base of each platform is taking shape. We published two studies over the past couple of weeks, looking specifically at the audiences of Hulu and YouTube TV, respectively. We also examined them through the lens of which brands (restaurants in the case of Hulu, and apparel retailers in the case of YouTube TV) should advertise there. As expected, subscribers of these ad-supported services skew younger and tech-savvy, but they also diverge. YouTube TV has attracted a lower-income audience, although it’s a group that expects to increase its holiday spending this year (see above: debt). Hulu reaches more young parents (likely due to the Hulu + Disney bundle), who are a bit more financially conscious. Still, both platforms are attractive targets for mass-appeal brands.

People are bursting at the seams to move. The long run of high interest rates has Americans clamoring to swap their homes, enticed by hopes of rate cuts coming soon. The percentage of U.S. adults who are considering listing their home for sale in the next six months has nearly doubled (up 6pp) since Q4 of last year. The number who plan to purchase their next residential property in the next year has likewise climbed six points in the same period. Likely sellers and buyers are predominantly in the U.S. South, but split evenly between suburban and urban dwellers. They heavily over-index between the ages of 25 and 44 – with kids.

The toy industry might have the most to fear from tariffs this holiday retail season. Toy retailers, perhaps more than any other industry, live at the epicenter of tariff-related uncertainty. For starters, many, if not most, toys are manufactured in places hit hardest by the Trump Administration’s new wave of policies. At the same time, the young adults who are most likely to be in the market for toys for their kids are also the most likely to be feeling the strains of elevated household debt, housing/rent expenses, and a tenuous job market. As a result, likely holiday toy buyers are planning all manner of measures to stretch their dollar – from waiting to shop on Black Friday to buying fewer items to trading down to cheaper brands.

More awesomeness from the InsightStore over the past two weeks:

- Our Economic Sentiment Index showed a marked improvement in the final weeks of August, buoyed by hopes for interest rate cuts in the coming weeks;

- Bucking an otherwise lackluster summer trend, travel was up over Labor Day weekend, but so was Labor Day sale shopping;

- Last week’s 3 Things to Know: Gen Z shops and eats late, age verification rules run up against privacy concerns, and dirty soda might be more popular if it wasn’t called dirty soda.

The most popular questions this week:

How important do you think it is to teach conflict resolution in schools?

To what extent do you agree or disagree that the traditional 9-to-5 workday is becoming obsolete?

Do you think it’s worth paying extra for sprinkles on ice cream?

Have you ever participated in a world record attempt?

Do you typically cook outdoors during the summertime?

Answer Key: Sure, if someone is willing to pay for it; Parents should teach it; Agree; Yeah, because it costs more; Yes, unsuccessfully; Several times a week.

Hoping you’re well.

JD