Months may have gone by since many Americans have worn non-soft pants. Sweat pants, joggers, and other comfy clothes have moved into the spotlight of peoples’ wardrobes, winning MVP since March (when lockdowns began).

In all seriousness, with large swaths of the workforce working from home – and staying home more in general to prevent the spread of the coronavirus – the hypothesis is people are wearing a lot more leisurewear. According to some new research, that is the case.

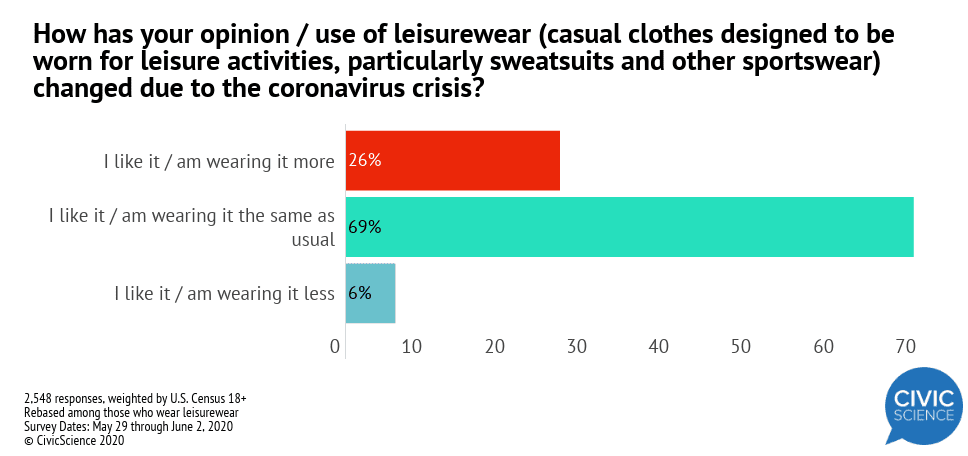

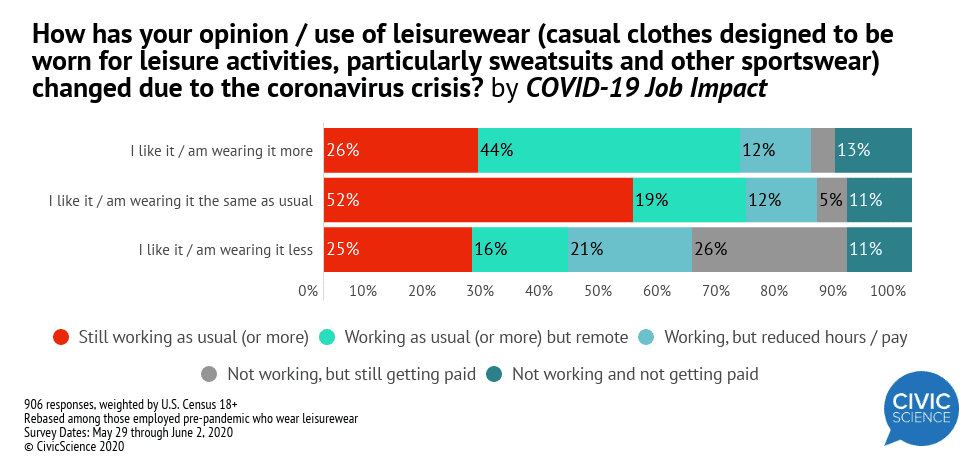

In a CivicScience survey answered by more than 2,500 adult respondents, 26% of those who wear leisurewear say they like and are wearing leisurewear more than they were before.

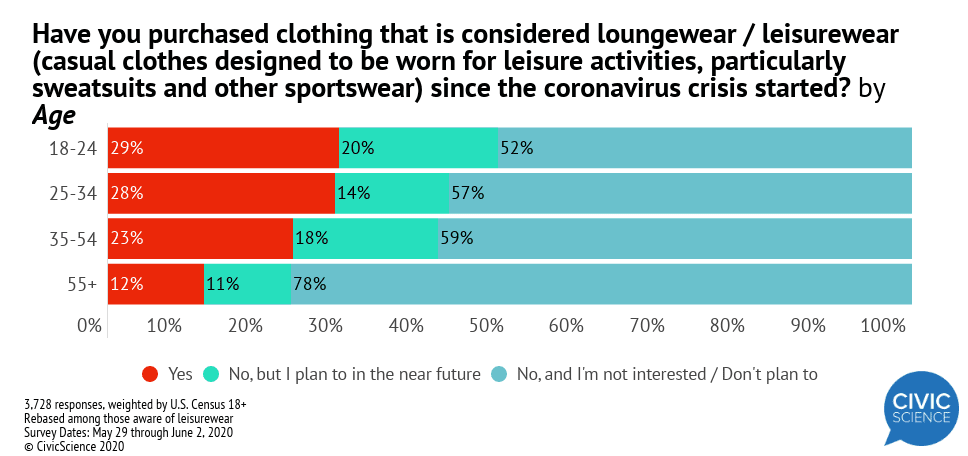

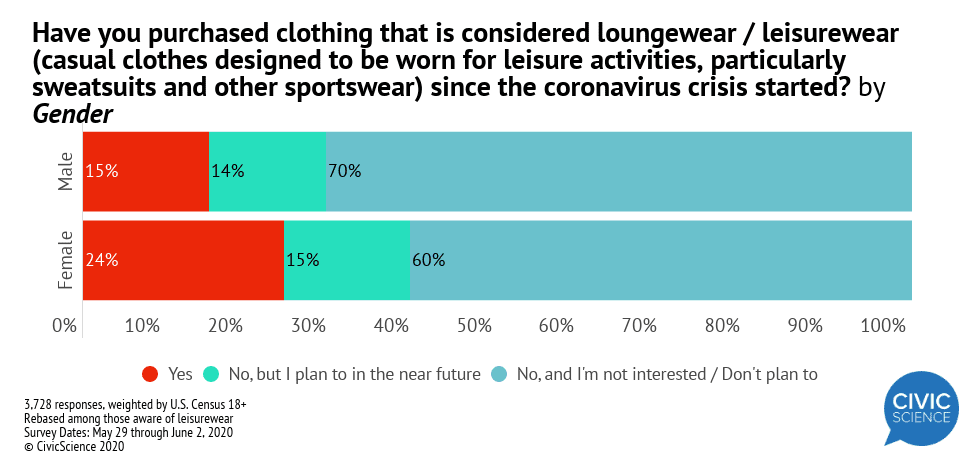

Furthermore, in a survey of more than 3,700 U.S. adults who have heard of leisurewear (which is 90% of the U.S. adult population), 20% say they have purchased leisurewear since the coronavirus crisis started, with another 15% answering that they plan to in the near future.

Twenty percent.

That’s a lot to unpack and indicative of a larger trend. We split this study into 4 parts, highlighting the favorability towards wearing leisurewear, buyers and intenders of leisurewear due to staying at home more, work status, and where brands fall in the trend / inclinations towards this category.

Favorability Towards Leisurewear

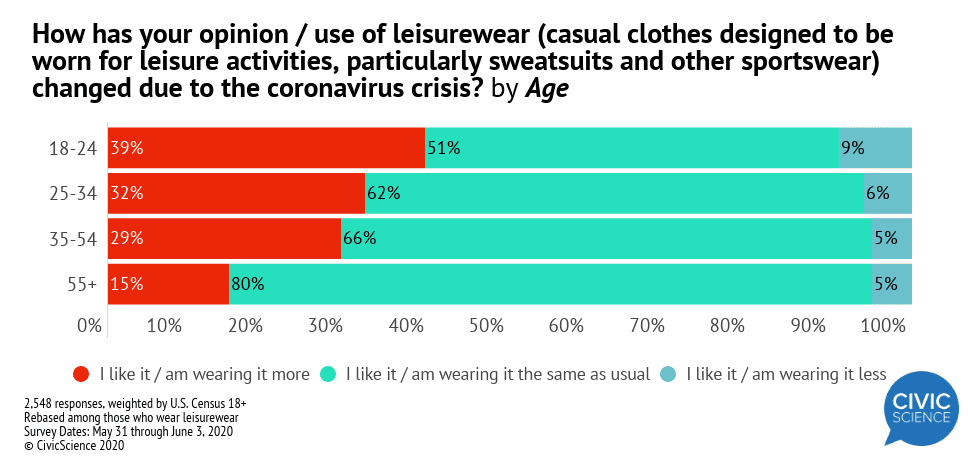

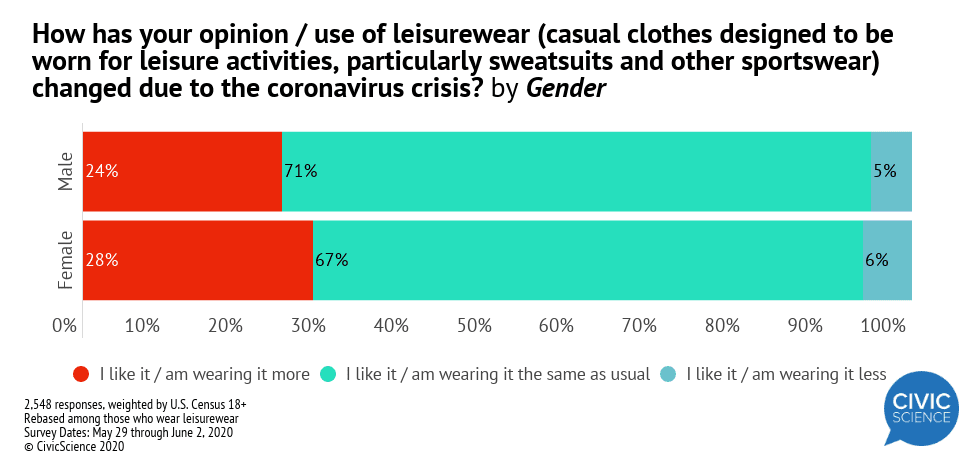

Women and younger individuals are the most amped about leisurewear and most likely to report they’ve been wearing it more. Males aren’t too far behind females, though, when it comes to reporting wearing it more.

Purchasers and Intenders

Those who have purchased leisurewear since the coronavirus crisis started are much more likely to be female than male. However, men and women have nearly identical rates of intent to purchase in the near future. Furthermore, all age groups from 18 all the way up to 54 are nearly just as likely to report having made these purchases or intend to. Those under 34 are slightly more likely than those 35-54 to have already made these purchases, but it’s very close.

Work Status

To the surprise of nobody, those who report wearing leisurewear more are much more likely to be working remotely than their counterparts.

Brand Affinity

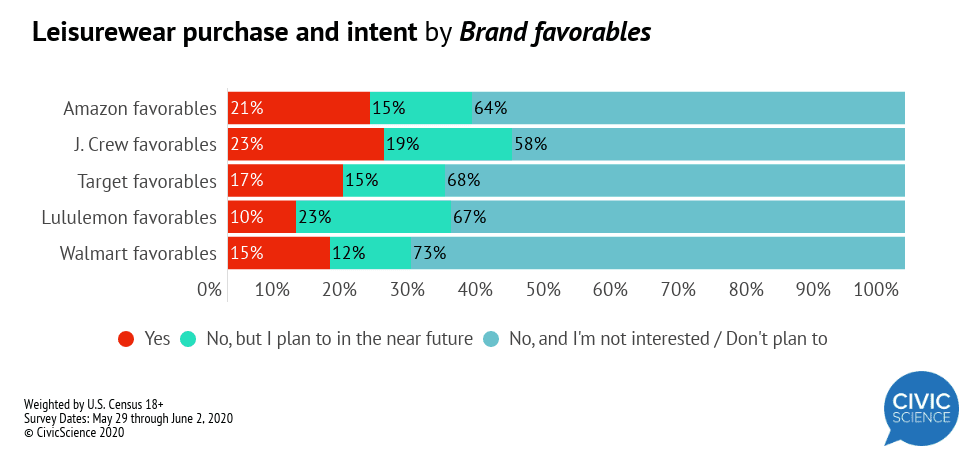

When looking at 5 top brands, Lululemon and J. Crew fans respectively have the highest intent to purchase leisurewear soon, and both Target and Amazon fans are just as likely as the general population to intend to. Walmart fans slightly under-index compared to the gen pop when it comes to intent to purchase.

When it comes to those who have already made a leisurewear purchase, Amazon and J. Crew favorables are slightly more likely than the general population to already have.

Leisurewear is taking off even more now than the trend already had been pre-COVID. CivicScience tracks these trends and countless others, providing clients with even more in-depth segmentation and insights. If you want more on this topic or any others, like how quickly your brands’ favorables want to come back to in-person experiences, let’s talk.