CivicScience continually tracks current and anticipated consumer trends. Here are three key insights marketers should know this week. All insights are derived from the CivicScience Social | Political | Economic | Cultural (SPEC) Report, a weekly report available to clients covering the latest news and insights. Start here to learn more.

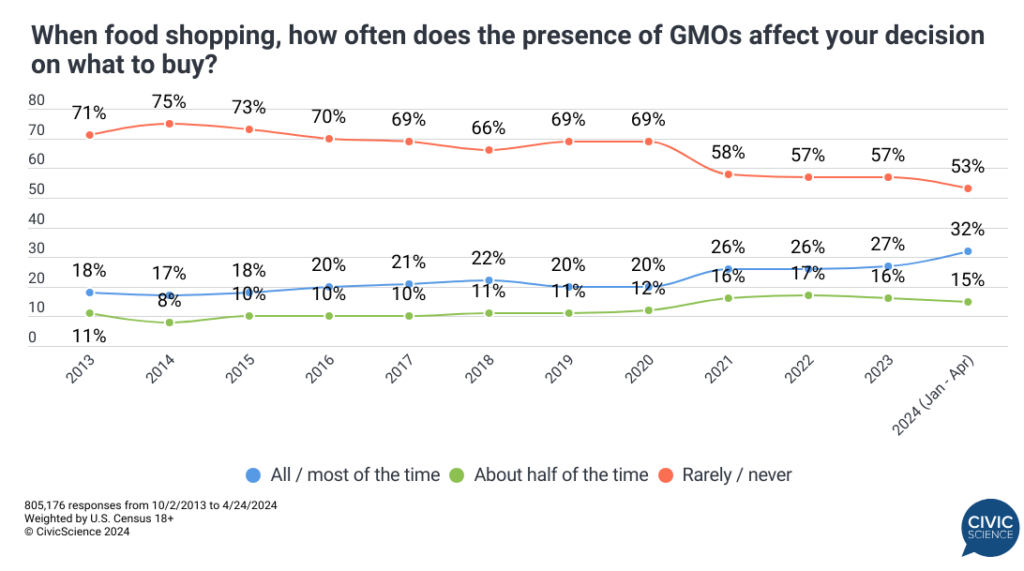

1. Consumers are growing increasingly concerned about GMOs at the grocery store.

Genetically modified produce items have been on grocery store shelves for 30 years now, but CivicScience data show concerns about GMOs have been on the rise for at least a decade. The percentage of consumers who say that the presence of GMOs affects which food products they purchase has risen by nearly 20 percentage points over the past ten years – nearly 1-in-2 report GMOs affect what they buy.

Additional data find consumers are far more likely to say that non-GMO foods are tastier, healthier, and better for the environment than GMO foods. But despite their misgivings about GMOs, price is still much more important to most consumers. Only 11% are willing to pay ‘significantly’ more for non-GMO foods, and 54% are likely to only buy non-GMO food products that cost the same amount or less than their GMO equivalent. See more in-depth insights in the full SPEC report.

Join the Conversation: Are you concerned about the safety of genetically modified (GMO) foods?

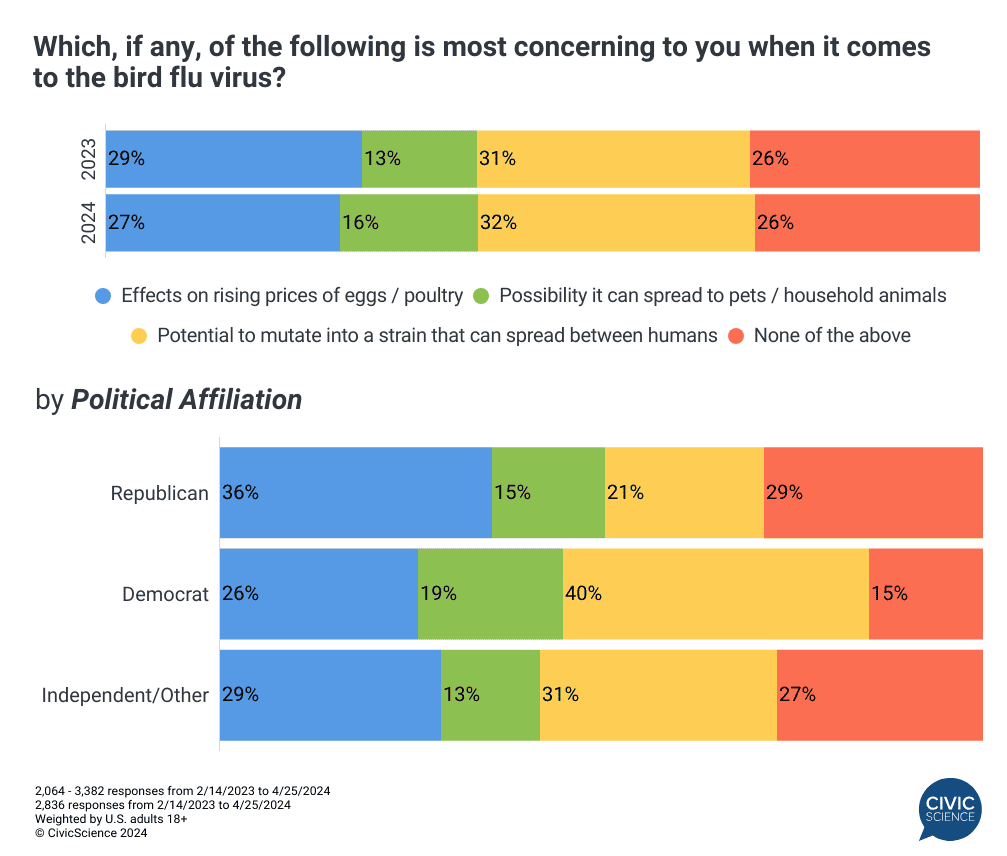

2. Americans are leery of the possible financial and societal costs of bird flu.

Bird flu is once again on the rise, killing thousands of marine mammals and spreading to American livestock for the first time. When U.S. adults were asked about their primary concerns regarding the bird flu virus, both financial and societal impacts emerged as top worries. Twenty-seven percent of respondents said their top concern was the impact on egg/poultry prices, down from the last outbreak in February 2023, while 32% were more concerned about a mutation leading to human transmission.

These concerns varied significantly among partisan lines – Republicans are more focused on the virus’s immediate financial impact, while Democrats and independents are concerned about its potential spread to humans.

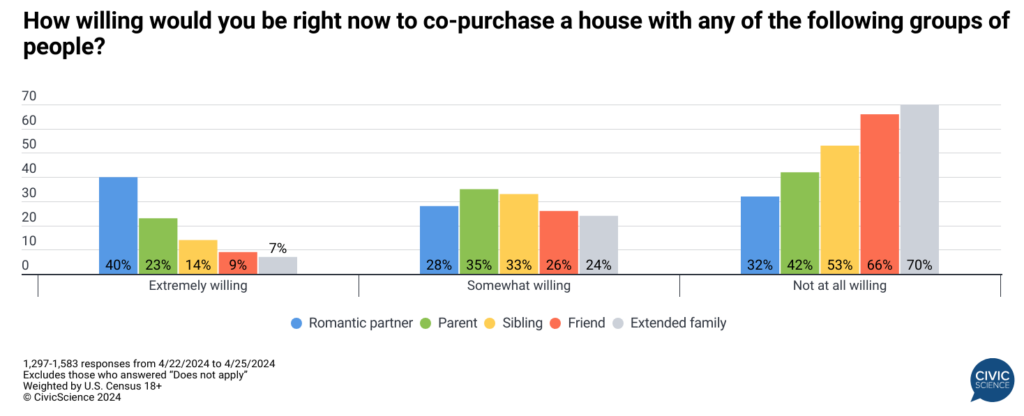

3. As housing costs rise, consumers express an openness to co-purchase with a non-romantic partner.

Amid uncertainties of the housing market and rising home insurance rates, co-owning a home with a non-romantic partner, such as a friend or family member, is gaining traction among Americans. While CivicScience data show living with a romantic partner remains the most prevalent choice among potential homebuyers, a noteworthy percentage are open to doing so with a non-romantic partner. Twenty-three percent of respondents say they’re ‘extremely’ willing to co-purchase a house with their parents, 14% would do the same with a sibling, and under 10% with an extended family member or a friend.

Take Our Poll: Would you consider co-purchasing a home with a friend?

Clients receive the SPEC Report in full, plus access to real-time insights driven by our database of over 500K questions. Contact us now to see it in action.