National chain pharmacies still lead among all American pharmacies. A report released earlier this year by CivicScience found that more than 40% of U.S. adults purchase prescription drugs at national chain pharmacies, such as CVS and Walgreens.

However, online pharmacies such as the Amazon-owned Pill Pack are gaining traction and disrupting, albeit slowly, the traditional brick-and-mortar-led market.

In the growing battle for Rx slips, what’s driving Americans to choose one pharmacy over another?

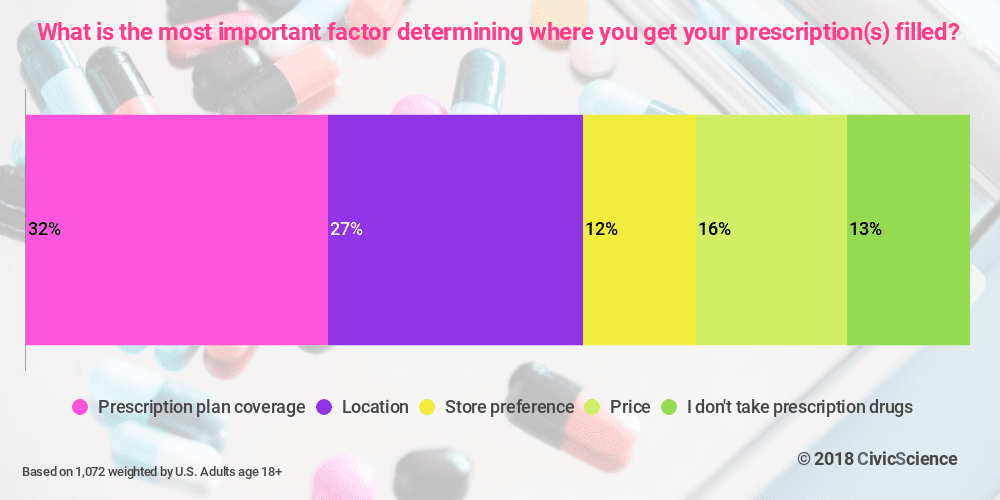

Recent findings show that health insurance coverage is the leading factor in determining where Americans get their prescriptions filled, followed by pharmacy location. In a November poll of 1,072 U.S. adults, CivicScience found that nearly one-third of respondents are most likely to choose where they buy prescription drugs based on their prescription plan coverage options, followed by location, more so than price or store preference.

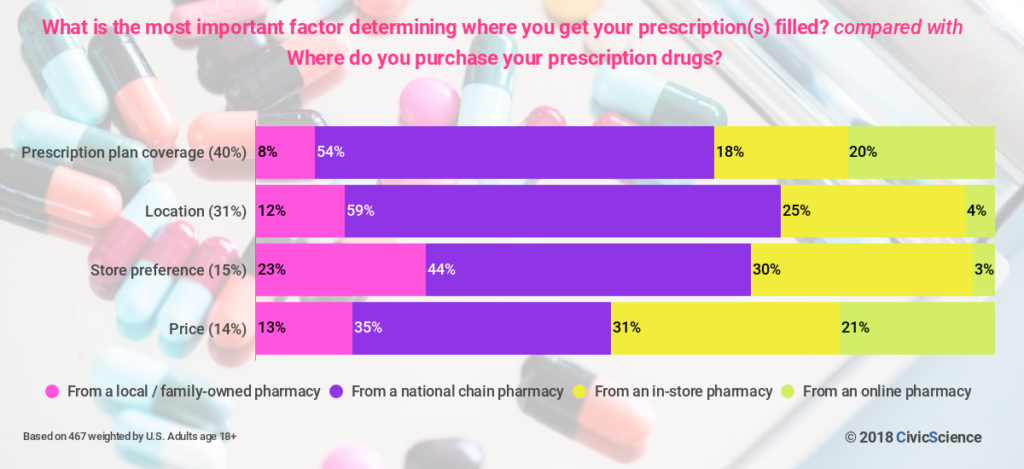

And when it comes to where those particular Americans go to fill prescriptions, national chain pharmacies have an advantage. More than half of those who choose pharmacies based on plan coverage or location use national chain pharmacies to purchase their prescription drugs, instead of local/family-owned pharmacies or in-store pharmacies, like those in Target or grocery stores. In contrast, those who choose pharmacies based primarily on store preference are more likely to use local or family-owned pharmacies.

However, at the same time, those who choose pharmacies based specifically on plan coverage are among the most likely to buy from online pharmacies, alongside those who choose pharmacies based on price.

In the midst of an increasingly diversifying market, some traditional chain pharmacies are making bold moves. Drugstore giant CVS is set to acquire Aetna, the third largest health insurer in the U.S., by the end of the year. This would be the nation’s first merger of a retail pharmacy, a pharmacy benefit manager, and a health insurer.

CVS claims the merger will help to revolutionize the consumer experience, but some investors are worried about the company’s future, while others question what the concentration of power could mean for consumers, market competition, and drug costs.

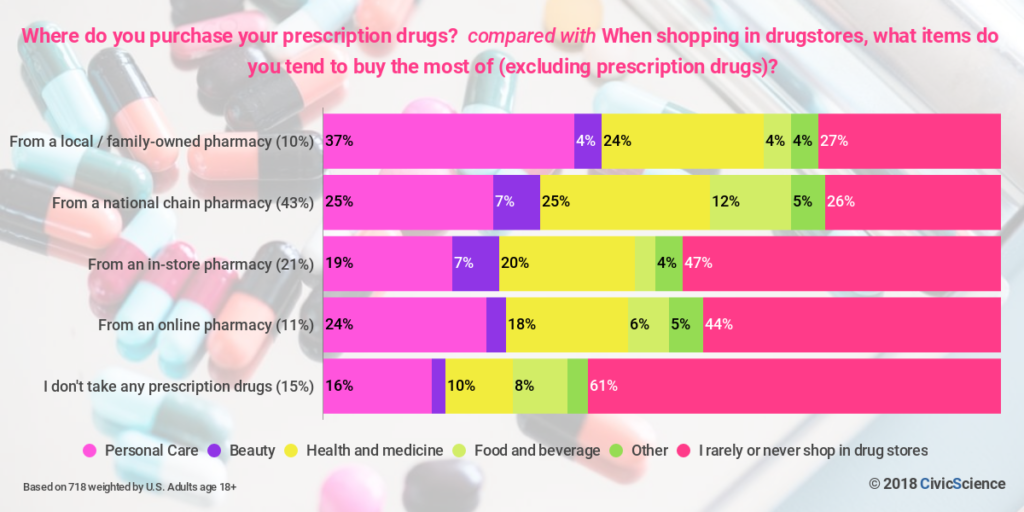

For CVS, it’s likely that if the merger brings in new pharmacy customers, it will also pull in more merchandise sales, which the stores, of course, depend upon. The CivicScience poll found that those who get their prescriptions filled at national chain pharmacies instead of at superstores, grocery stores, or online pharmacies, are significantly more likely to shop for other items there.

In fact, 74% shop for other items at drugstores, compared to 53% of those who get their prescriptions filled at superstores or grocery stores, 56% who fill their prescriptions online, and 39% who don’t take prescription drugs. That said, it’s likely that an increase in pharmacy sales would lead to additional merchandise sales for drugstores.

Personal care, and health and medicine items make up the bulk of items that chain pharmacy customers take home. That goes for all customers, as well, even those who shop at online pharmacies. Surprisingly, despite the wide selection of cosmetics at drug stores, beauty products only make up a small percentage of what shoppers purchase.

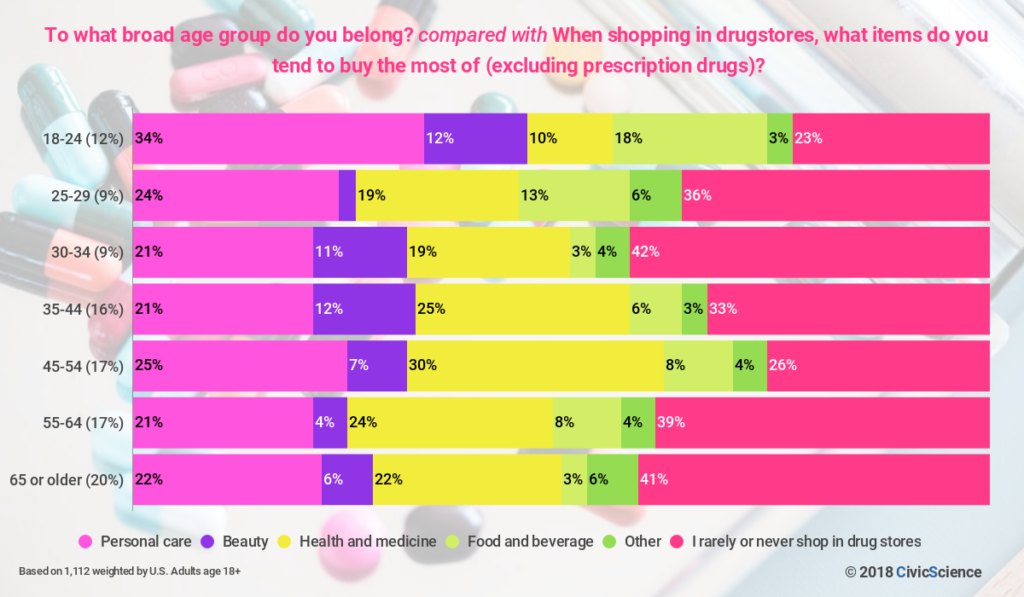

Also unexpected are findings that show young Millennials to be big drugstore shoppers. Even though young adults (18-24-year-olds) are the least likely to take prescription drugs, it turns out they are the most likely to shop at drugstores for other items. They buy more personal care items, significantly more food and beverages, and less medicine and health items than other age groups.

On the flip side, even though the oldest Millennials, 30-34-year-olds, get prescriptions filled at chain pharmacies at the exact same rate (42%) as their younger 18-24-year-old cohort, they are the least likely of all age groups to shop for other items in drug stores.

It’s clear that age plays a role in merchandise sales, among other factors that could impact the longevity of traditional chain drugstores, like CVS and Walgreens. As online pharmacies vie for customers, it seems the brands are still key for many. They cater to a broad spectrum of Americans, especially those who value being able to go to conveniently-located pharmacies and those limited by certain prescription plan coverage, which together makes up the majority of 59% of adults. Yet, time will tell how major developments like the CVS/Aetna will affect consumers.