The Gist: 11% of US adult pharmacy customers get their prescription from an online pharmacy.

With Amazon’s recent acquisition of online pharmacy PillPack and a growing prevalence of other online pharmacy options, we wondered just how prevalent adoption of them was among the US adult population.

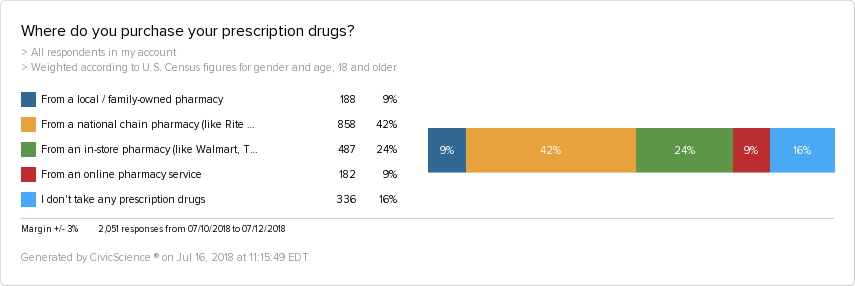

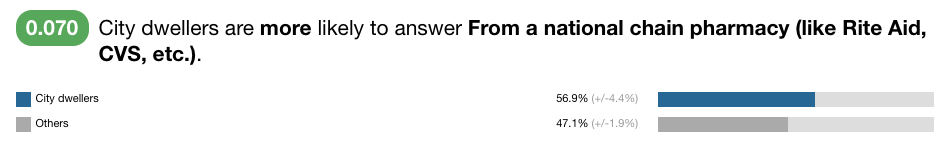

It’s no surprise that the majority of people who take prescription drugs purchase them from a national pharmacy chain, such as Rite Aid or CVS.

Second-most prevalent is getting scripts via an in-store pharmacy, like a location inside a Walmart or grocery store.

Online pharmacy services are used by 9% of US adults for their prescription needs, the same percentage as those who rely on a local, family-owned pharmacy.

When you remove the portion of the population who do not purchase prescription drugs, here’s what we’re left with:

Over 10% of people who purchase prescriptions use online pharmacies. In a time when saturation of online pharmacies is likely not there yet, that’s a hefty percentage.

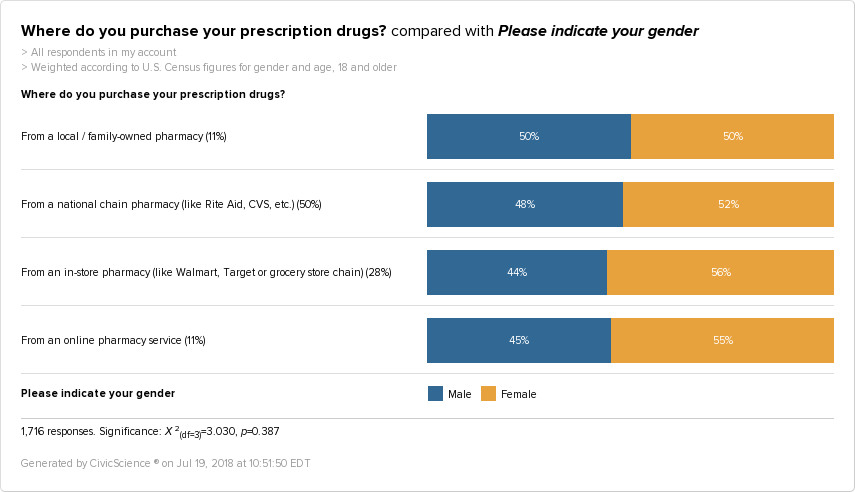

Comparing this to gender, we found that women are slightly more likely to get their medication from an online pharmacy, or an in-store pharmacy. We predict both reasons could be all about convenience:

We also looked at online shopping habits (excluding pharmacy and grocery items) to see if people who don’t yet buy prescriptions online are still shopping online for other items.

It comes as no surprise that online pharmacy customers are also avid online shoppers, and local pharmacy customers shop more in stores. But interestingly enough, 13% of those who get their prescription filled at a local pharmacy do all or almost all of their shopping online.

Our take on the above graph is that online pharmacies should have a go with ‘stealing’ prescription customers from all other types of pharmacies because in small or large ways, people have migrated at least some part of their shopping online.

Media Consumption

So what are these prescription buyers viewing?

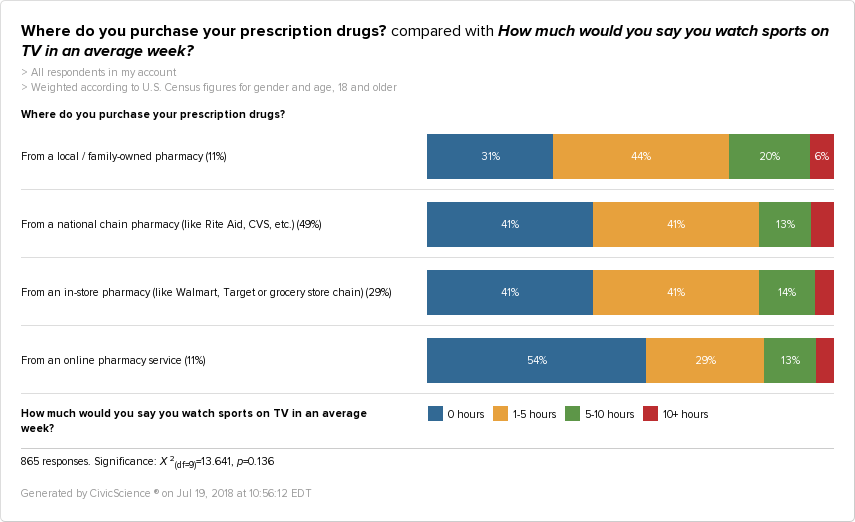

For one, sports. The main insight we found is that a good portion of pharmacy customers are watching sports in an average week. Especially those who go to local pharmacies, perhaps giving online pharmacies an in if they are buying commercial airtime with sports networks.

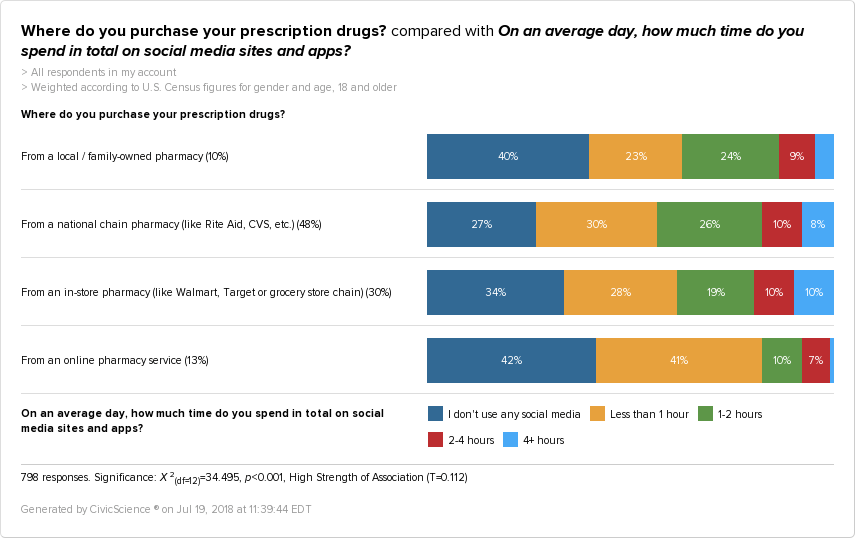

Those who have prescriptions of any kind are more likely to be heavy social media users than people who do not purchase prescriptions.

People who purchase their prescriptions from a chain or instore pharmacy use social media more than those who purchase their prescriptions from a local pharmacy or online. This is yet another opportunity for online pharmacies to get consumers to make a switch online with influencers or other advertisements on social platforms.

Other Misc. Insights about Online Pharmacy Users:

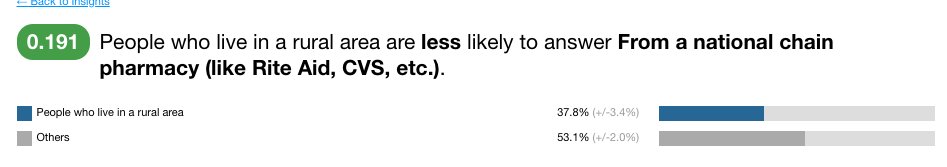

People Who Live in Rural Areas Might Be Good Customers for Online Prescription Services:

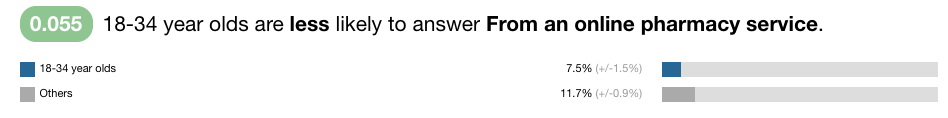

Younger Customers Aren’t Purchasing Prescription Drugs Online:

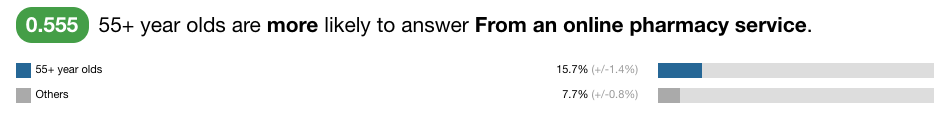

Older People Are More Likely to Buy from an Online Pharmacy:

Lastly, we found some insights about these non-prescription takers when comparing them to the general population and other segments:

- Heavy social media users are less likely to answer they don’t take any prescription drugs.

- Parents are less likely to answer they don’t take any prescription drugs.

- No surprise around age. Typically, the older you get, the higher the likelihood you are to be taking a prescription.

- 18-34-year-olds are more than twice as likely to answer I don’t take any prescription drugs.

- 55+-year-olds are less likely to answer I don’t take any prescription drugs.

- Women are less likely to answer they don’t take any prescription drugs, and men are more likely to.

Seeing as PillPack isn’t the only online pharmacy consumers can choose from, we’ll be interested to see how the needle moves on the adoption of online pharmacies over time, given the number of US adults purchasing medication for themselves or their family.