This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

Today’s economy has many Americans relying on credit cards to foot the bills for everyday expenses. A total of 41% of U.S. adults say they rely on credit cards to cover purchases throughout the month after paying for monthly expenses such as rent/mortgage, car payments, and childcare, according to CivicScience consumer polling this month.1

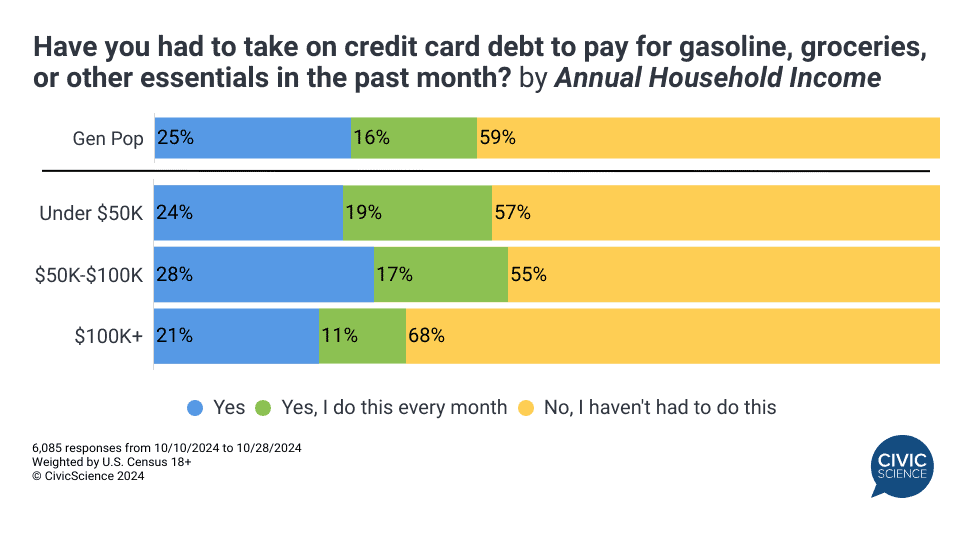

And many Americans are going into debt as a result, adding to the growing amount of national credit card debt,, which reached $1.14 trillion this year. New CivicScience data show that 25% of U.S. adults reported they took on credit card debt in the past month to afford gas, groceries, and other essentials. An additional 16% said this is a common occurrence, as in something they do every month.

All in all, that adds up to 41% of Americans who are living in a state of debt just to get by. Data show these individuals are more likely to be aged 35-54, parents of school-aged children, people with student loan debt, and middle- to lower-income earners (less than $100K annually). In fact, 45% of households earning between $50-$100K yearly have taken on credit card debt to afford basic necessities. Hispanic American adults also over-index as both having taken on credit card debt in the past month and on a monthly basis.

Let Us Know: Are you carrying any debt?

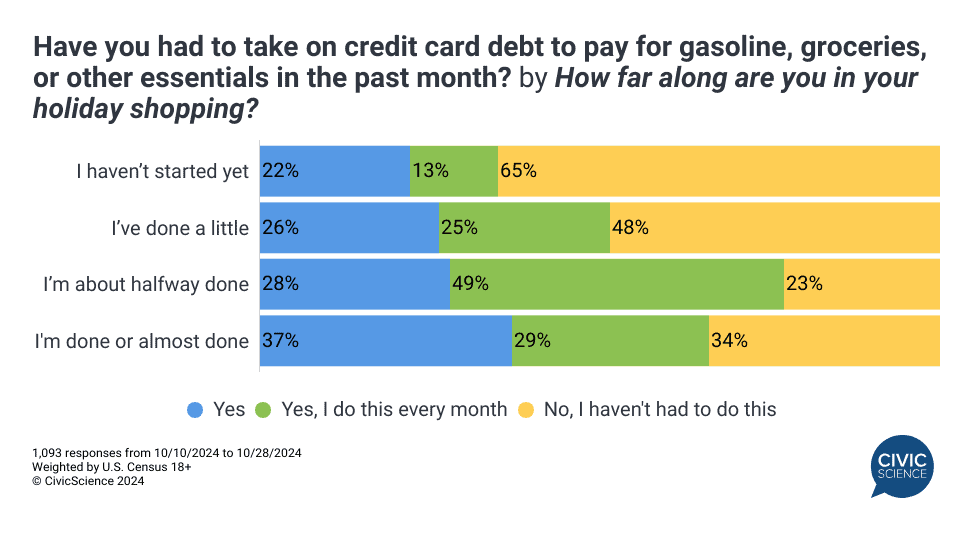

The upcoming holidays are one reason driving credit card debt. Generally speaking, the more likely someone is to have already started their holiday shopping, the more likely they are to have taken on debt in order to afford basic expenses. Those who are ‘halfway done’ shopping are the most likely to have gone into debt to pay other bills.

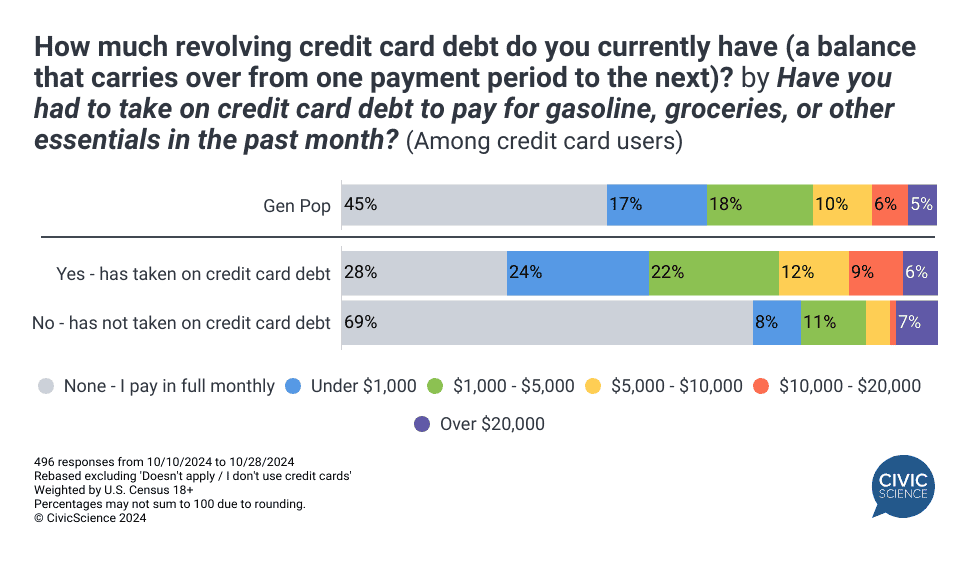

Paying by credit is common, but how many people are taking on debt that they’re planning to pay off in their next monthly balance? Data suggest not many – that debt will carry over with interest to the next pay period for the majority of Americans. CivicScience data find that 56% of credit card users report they have some kind of revolving credit card debt, while 45% pay off their balances monthly. Among those with revolving debt, roughly 40% say they’re carrying a balance of more than $5,000.

Looking at people who have taken on debt from purchasing necessities, just 28% say they typically pay off their balances monthly, while nearly 50% have some amount of revolving debt under $5,000.

Join the Conversation: Do you have more credit card debt now than you did at this time last year?

Credit cards are an essential means of living today for a significant percentage of the U.S. population. Holiday shopping and travel is likely to amplify this dependency and cause more to incur debt, further adding to the national debt owed.

See beyond the data – With CivicScience, you can leverage insights like these to build highly targeted audience segments for successful advertising campaigns. Learn how with our free eBook.

- 5,233 responses from October 10, 2024 to October 28, 2024 ↩︎