A version of this article originally appeared in ROAR Forward as part of a collaboration with their quarterly ROAR Report. This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

As we enter the first full week of 2025, it’s time to focus on what lies ahead in the coming year. The new year promises to be shaped by lingering uncertainties following one of the most closely contested U.S. elections, which paved the way for Donald Trump’s return to the White House. The prospect of change that is likely to come under the new administration is already impacting consumer spending.

Americans aged 55 and older often enjoy more robust financial stability and well-being, but how are they approaching their income and spending as they head into 2025 in a post-election landscape? Understanding their mindset could reveal crucial insights retailers need in order to navigate the year ahead. Here’s what the latest CivicScience data through the lens of Americans 55+ show:

Income Optimism Grows Among Boomers, but Most Remain Bearish

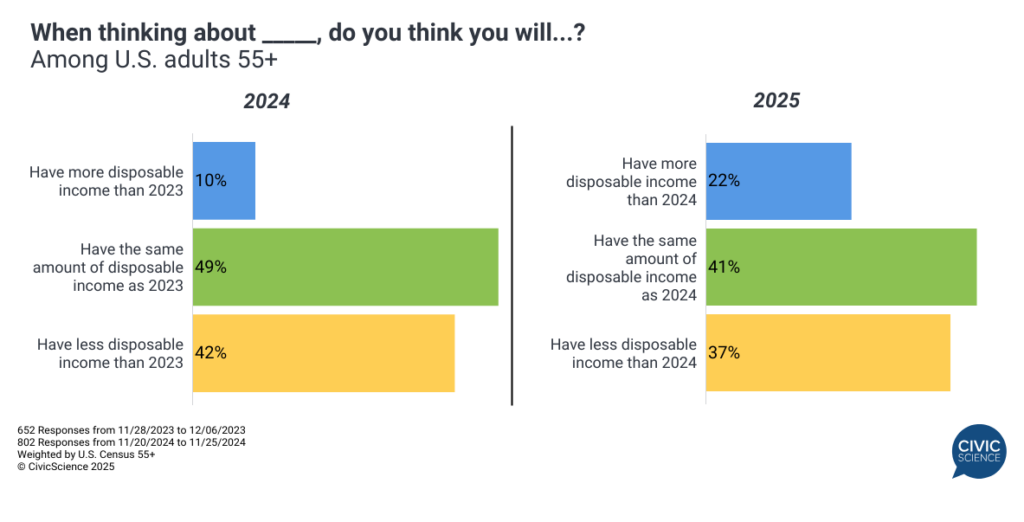

New CivicScience data find Americans 55 and older are much more optimistic about their income in 2025 than they were about 2024 this time last year – 22% expect to have more disposable income this year, compared to 10% who said the same about 2024.

Even with this strong surge in optimism, they’re still far more likely to believe their income will remain the same or decrease in 2025.

Let Us Know: Do you think your personal financial situation will get better or worse in 2025?

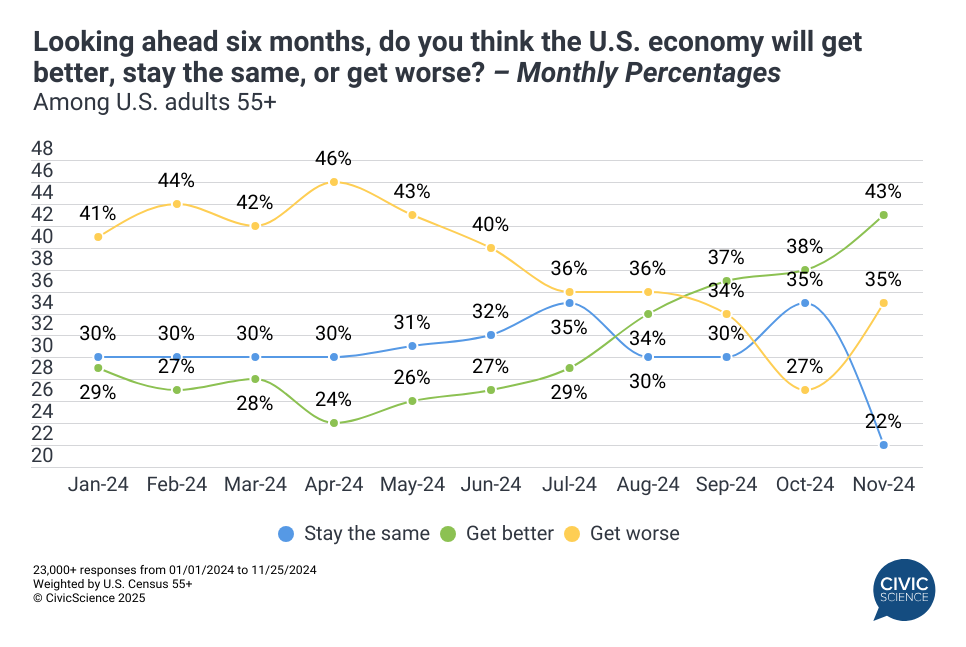

The outlook on the U.S. economy among Americans aged 55 and older reveals a polarized shift in sentiment following the election. The share of those believing the U.S. economy will “get better” in the next six months has climbed five points to 43% over the past month, its highest level since June 2021. However, those expecting the economy to “get worse” rose by an even more significant eight points, reaching 35%, highlighting the stark divide in views within this demographic.

Contrasting Spending Goals for the Year Ahead

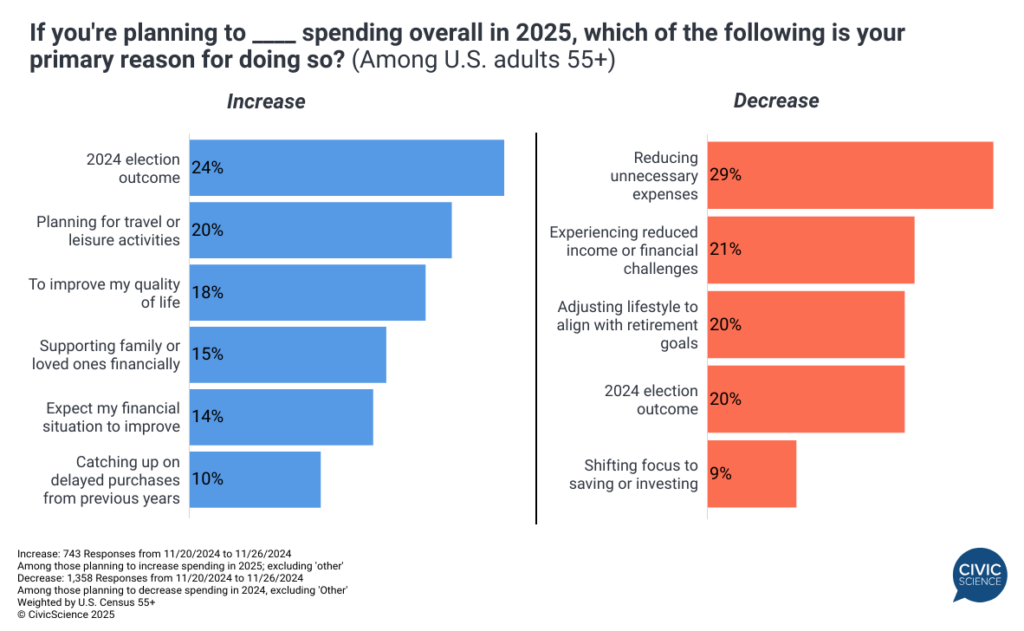

Outlooks, however, are only one piece of the puzzle shaping spending plans in the year ahead. Americans 55+ also have a variety of motivators that will guide purchasing decisions in 2025, whether they plan to spend more or cut back.

For those planning to spend more, the election’s outcome emerges as the leading factor influencing their decision. Other top motivators include investing in travel and leisure and enhancing their overall quality of life.

On the flip side, the plurality of those reducing their spending cite the need to cut back on unnecessary expenses as the primary driver. Additional factors include financial challenges, retirement planning, and the election result.

The Priorities for Increased Spending

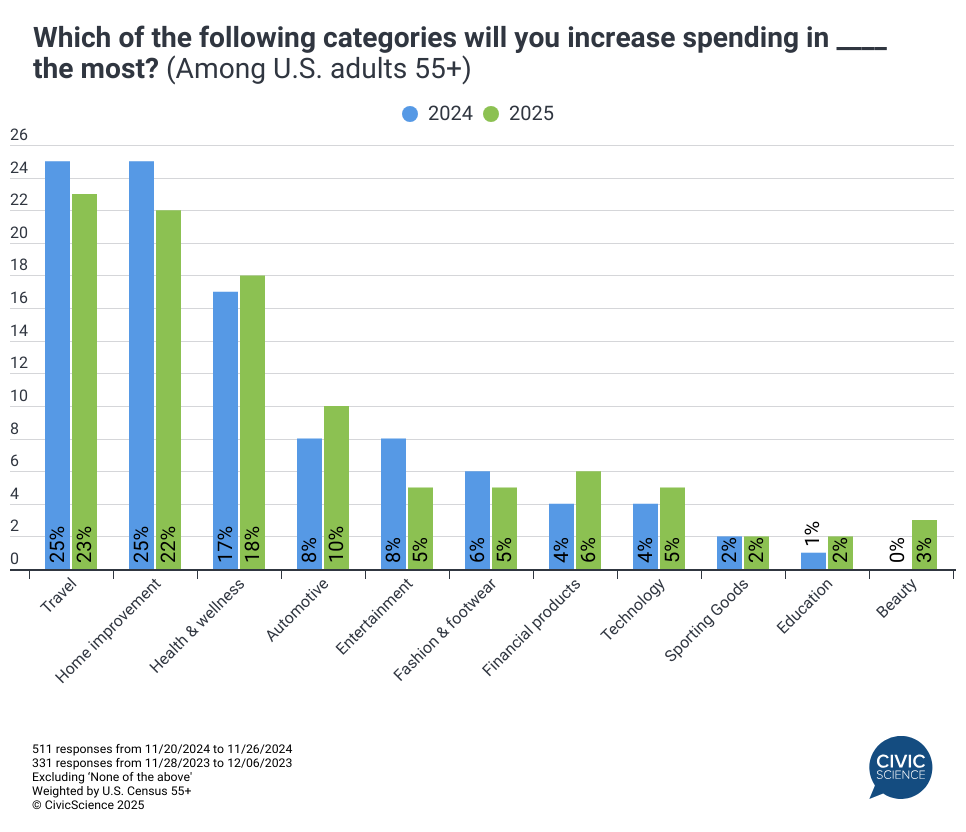

Sixty-two percent of Americans aged 55 and older plan to increase spending in at least one of the following areas, up from 51% who expressed similar intentions in 2024. While this marks a notable shift, the overall priorities for increased spending remain broadly consistent with last year. However, there is a slight uptick in interest in categories like automotive, financial products, and beauty.

Areas for Decreased Spending Change Little Year-Over-Year

This segment also became more likely to report decreasing their spending on these categories – 72% will cut back in at least one of these areas, up from 60% in 2024. Once again, however, the critical areas for cutting back remained the same as last year with marginal differences, led by a 3pp drop in fashion and footwear.

Join the Conversation: Has the 2024 election result impacted your spending plans for 2025 at all?

Politics and the economy seem to have had an outsized impact on the 2025 outlook of Americans 55+. There is a surge in optimism about income and deepening polarization about the economic outlook. Still, the lack of significant change in spending priorities suggests a careful, wait-and-see approach amid uncertainty about the impacts of the new administration. Retailers and brands aiming to capture this group’s attention in 2025 should emphasize value and flexibility, catering to both the cautious customers and to the optimistic consumers who are looking to invest in quality of life and targeted indulgences like travel, home improvement, and health/wellness.