A version of this article originally appeared in ROAR Forward as part of a collaboration with their quarterly ROAR Report. CivicScience clients and partners have access to our millions of daily survey responses, allowing them to generate actionable, forward-looking strategies. See how leading brands use CivicScience to drive campaign performance here.

The year 2025 is on a path to close out much as it unfolded, with persistent economic uncertainty. All signs suggest this volatility will stick with consumers into 2026, and consumer sentiment has softened across the board compared to this time last year. Even Americans aged 55 and above, who typically enjoy a greater financial cushion than their younger counterparts, are feeling the pressure. So where does that leave holiday shopping as it enters the home stretch, and what does it signal for the 55+ demographic heading into the new year? Here’s what they’re telling CivicScience:

State of Holiday Shopping

Despite ongoing economic headwinds, recent CivicScience intent data indicate that many holiday shoppers aged 55+ plan to maintain their spending from the 2024 holiday season into this year’s holiday shopping season. Sixty-three percent of U.S. holiday shoppers in the 55+ demo say they expect to spend ‘about the same’ (49%) or ‘more’ (14%) on 2025 holiday shopping, compared to 2024’s holiday season. Meanwhile, 37% expect to spend less this year.

Additional data paint a clear picture of where the 55+ cohort’s priorities lie when it comes to the “where” and “what” of holiday shopping. Nearly half of these holiday shoppers (47%) say they are likely to spend the most at big-box stores, more than double the percentage of those who will spend the most at small businesses or locally owned stores/boutiques (23%). Brands are much less likely to find these consumers shopping from department stores (16%), dollar stores (9%), or specialty chain stores (5%).

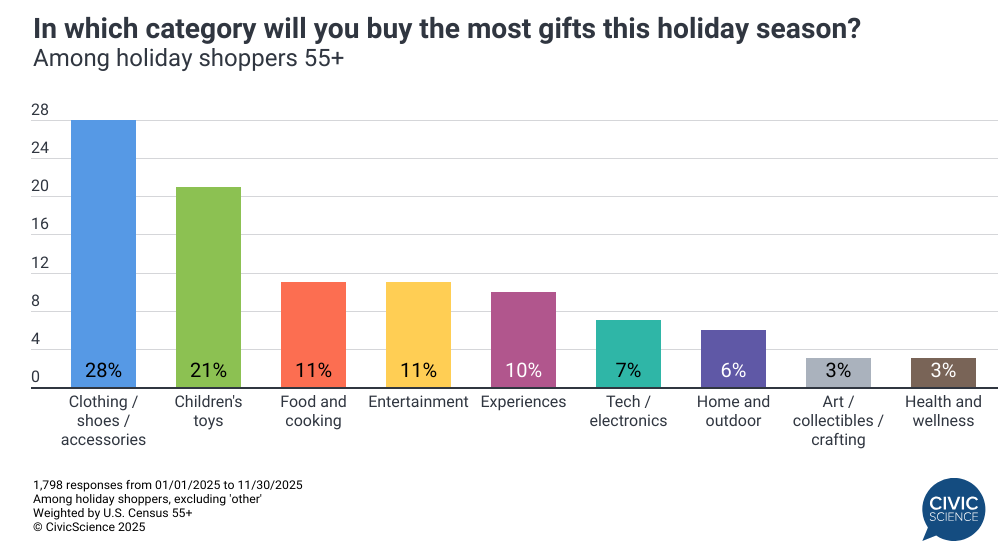

Clothing, shoes, and accessories, and children’s toys are by far the most common categories of gifts shoppers 55+ will be purchasing this year (excluding ‘other’).

Economic Sentiment and Personal Financial Outlook Present Turbulent Pictures

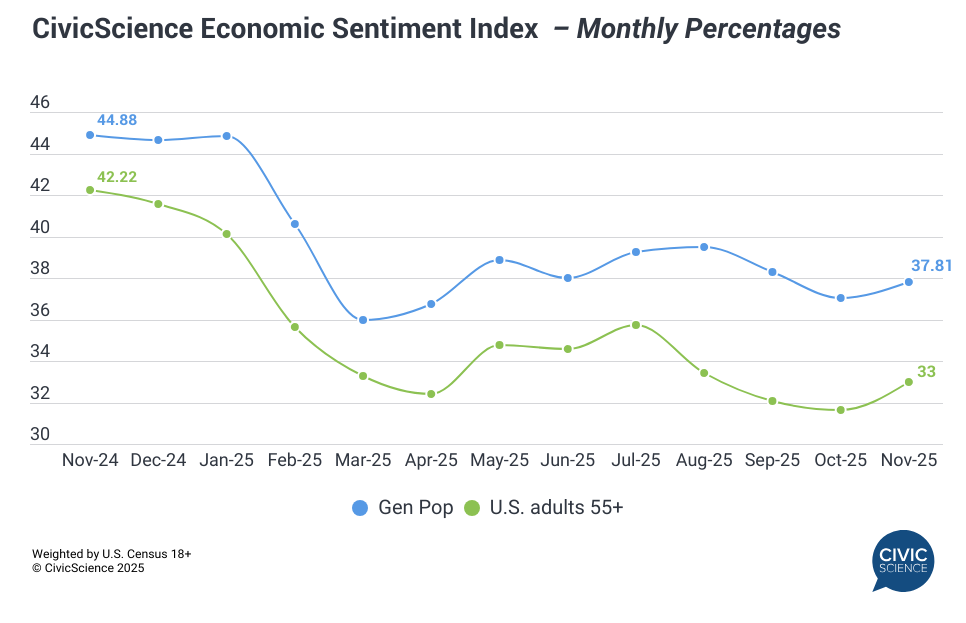

Given the chaotic feel of the economy throughout this year, it comes as no surprise that the outlook of the U.S. consumer has been up and down, with an emphasis on down. The CivicScience Economic Sentiment Index (ESI), which tracks consumers’ six-month outlook on the economy, the job market, and major purchases, is well below where it stood at the time last year. Still, the prospect of a Fed rate cut may be driving some late Q4 optimism in the outlook. Despite the uptick to round out November in the post-government shutdown aftermath, the ESI among 55+ is down nearly 10 points from its November 2024 level.

Let Us Know: Do you plan on retiring at the age of 65?

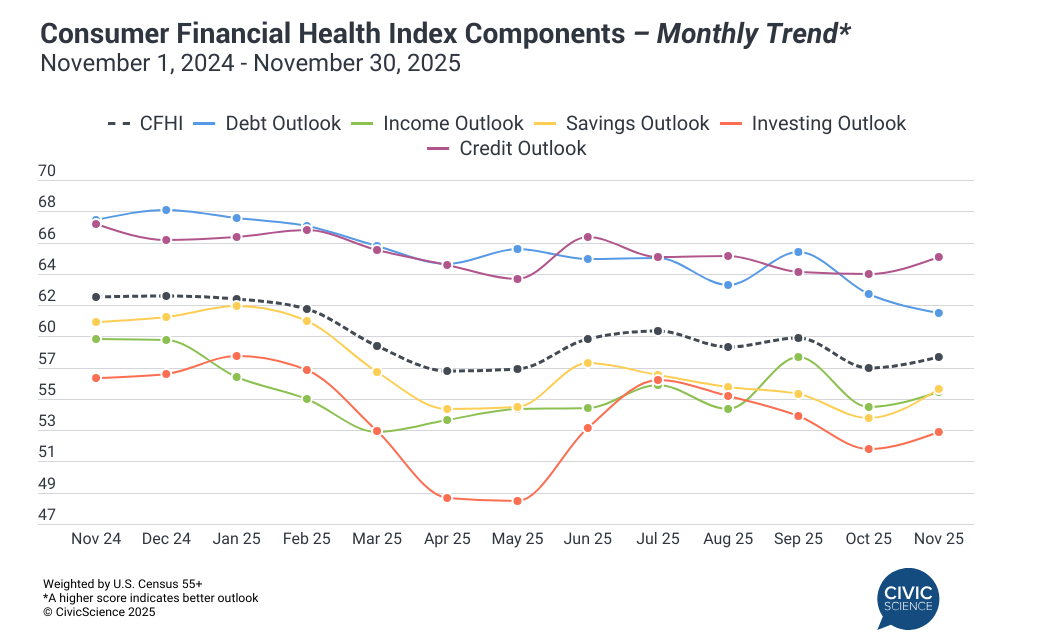

A look at the CivicScience Consumer Financial Health Index (CFHI), which measures personal financial health outlook, reveals another late rally in November, with all components rising except for debt outlook. Despite this recent upswing, the CFHI as a whole trails its position this time last year by four percentage points.

What Could Be in Store in 2026 for 55+

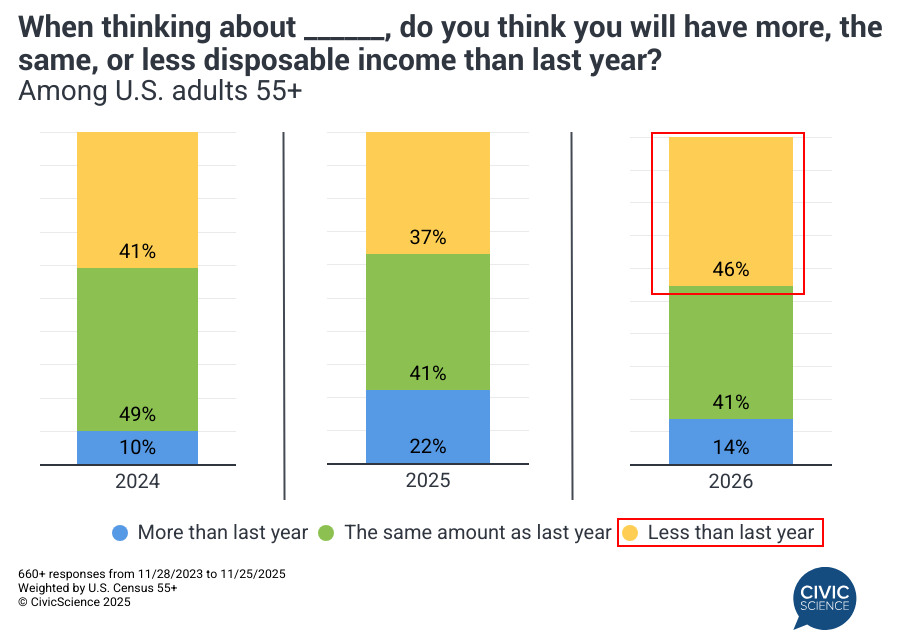

With 2025 now in its final weeks, how are Americans 55+ feeling about 2026? CivicScience has asked consumers to predict their income level for the coming year since 2023. For 2026, survey data indicate that 46% expect to have ‘less’ income than they did in 2025, the highest such percentage in three years. Amid this bleaker picture, more than half expect to have the same or more disposable income next year.

The pessimistic outlook on income isn’t holding back spending across the board entirely, however. There are still noteworthy areas where the 55+ crowd plans to increase their spending as they look ahead to 2026. In fact, additional CivicScience survey data show that 57% plan to increase spending in at least one of the categories studied. Among them, health and wellness, home improvement, and travel are the most common areas for increased spending – all of which likely serve as means to boost emotional well-being.

Coinciding with this emphasis on “feel good” spending to supplement well-being in turbulent economic times is self-care and splurging on oneself. The strong majority of Americans aged 55+ tell CivicScience that they either already practice or plan to start practicing self-care, which has risen by three percentage points over the past year, now at 90% from 87% in 2024.

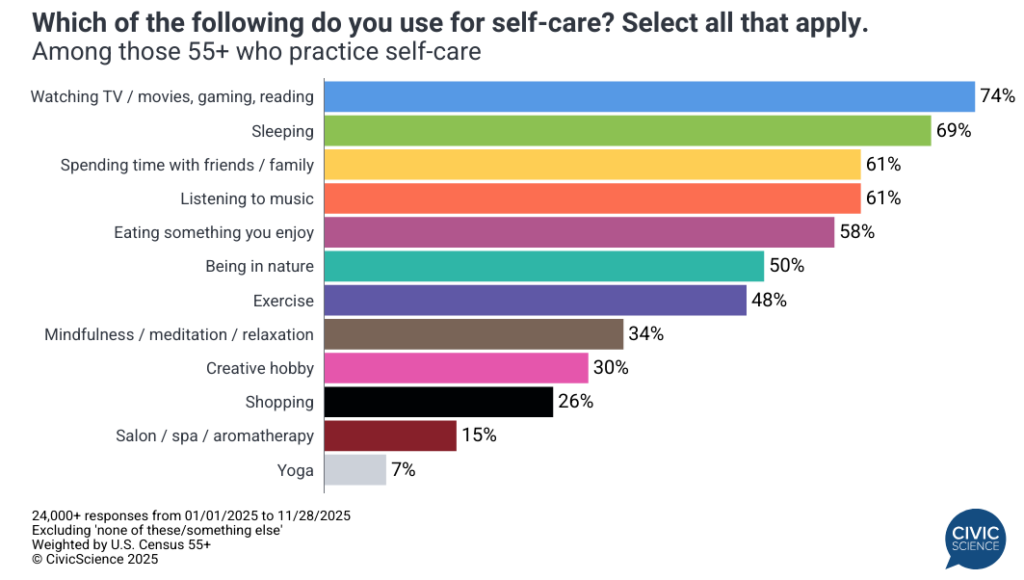

Self-care comes in a wide variety of forms for the 55+ consumer, but there appears to be several tiers in terms of popularity. At least 6 in 10 respondents cite either media, sleeping, or time with loved ones as their methods of self-care. At the other end of the spectrum, salons and spas and yoga are by far the least common means of self-care. Although it’s also less common, more than one-quarter of people use shopping as a form of self-care.

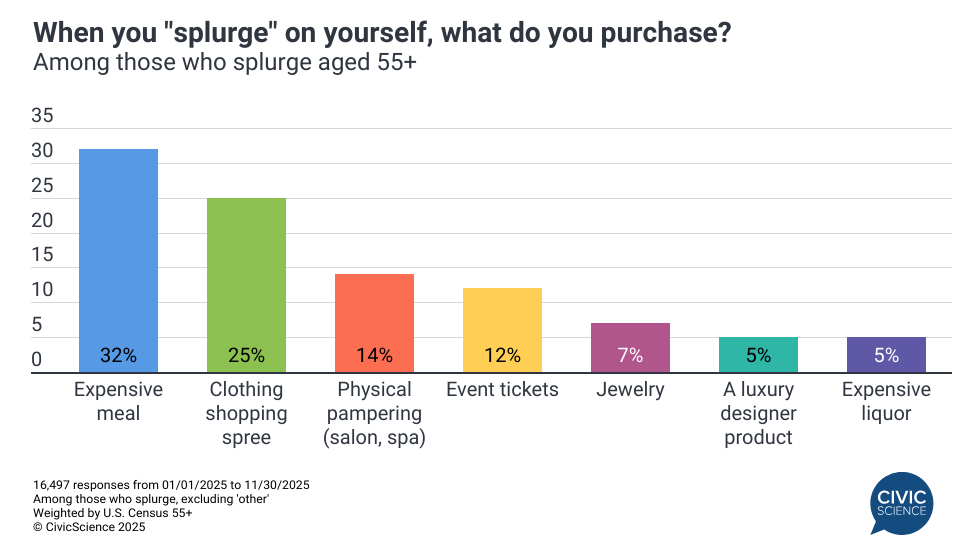

Splurging specifically on oneself is another form of self-care and is something 62% of Americans in the 55+ age bucket say they do. And when they do, they are most likely to treat themselves to an expensive meal or a shopping spree.

Despite economic uncertainty weighing heavily on expectations for 2026, Americans 55+ are maintaining a firm grip on their desired quality of life. Their choice to largely maintain holiday spending and to actively invest in well-being and personal luxuries suggests this demographic is strategically adapting to financial volatility, rather than pulling back completely. For the retail and brand landscape, this highlights the necessity of delivering offerings that meet dual demands: tangible value and a strong emotional return on investment, especially as broader financial conditions remain complex.