The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real-time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures.

Excerpt From the Latest Reading:

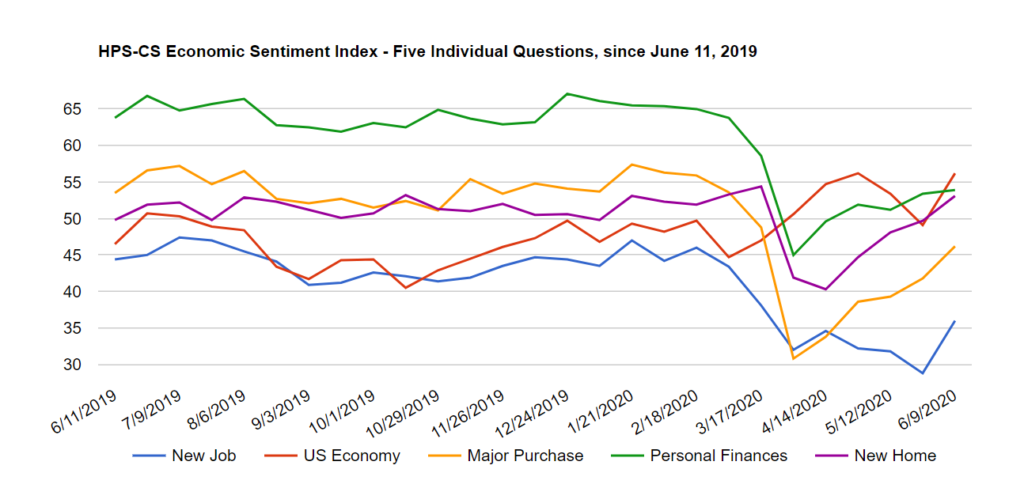

Economic sentiment rocketed up over the past two weeks, ending its month-and-a-half long plateau. The HPS-CivicScience Economic Sentiment Index (ESI) increased 4.5 points to 49.1, setting a new record for largest ever reading-to-reading increase in the ESI’s history and reaching its highest level since March 17. The reading was driven by record-setting surges in confidence toward the job market and the economy following a surprisingly positive jobs report last week and emerging signs of an economic recovery.

All five of the ESI indicators increased over the past two weeks as consumer confidence across economic indicators returned to levels not seen since the beginning of the COVID-19 pandemic. Confidence in the job market rose dramatically from its all-time low of 28.8, rising 7.2 points to 36.0. This rebound marks the largest reading-to-reading increase for the indicator in the ESI’s history and comes amidst a surprising May job’s report in which the U.S. economy added 2.5 million jobs, dramatically beating expectations. Confidence in the U.S. economy experienced a similar record-setting surge, rebounding by 7.1 points to 56.2. Consumers also showed increased confidence in their willingness to spend, as confidence toward making a major purchase and the housing market increased by 4.4 and 3.4 points, respectively. These rebounds come amid a 20% increase in mortgage applications compared to last year. Confidence in personal finances also rose, increasing by 0.5 points reaching 53.9, its highest level since March.

The rapid rebound in consumer confidence comes amid a ray of positive economic news. Outside of May’s job report there are some other signs of economic recovery as home mortgage applications, hotel reservations, restaurant bookings, air travel, and driving have all substantially increased. The sustained rise in economic metrics has given some optimists hope that the worst of the COVID-induced recession is over, and a quick economic recovery is to follow. This optimism has helped carry the Nasdaq to a record high, and helped the S&P 500 erase all its losses for 2020. Despite positive signs of recovery, the National Bureau of Economic Research has officially noted that the U.S. economy is in a recession and new research shows that more businesses have shut their doors for good in the last three months than during all of the Great Recession. Future readings will provide a better sense for the impact these developments have on consumer confidence.