The Gist: In the midst of an evolving job market, U.S. adults who work more than one job or have additional sources of revenue are more likely to be middle class, Millennials, and Gen Xers, to have greater student debt, and to be happier in their jobs.

Today, the unemployment rate is the lowest it’s been in 17 years, and at the same time, the number of Americans who are moonlighting–working a second or multiple jobs–is on the rise.

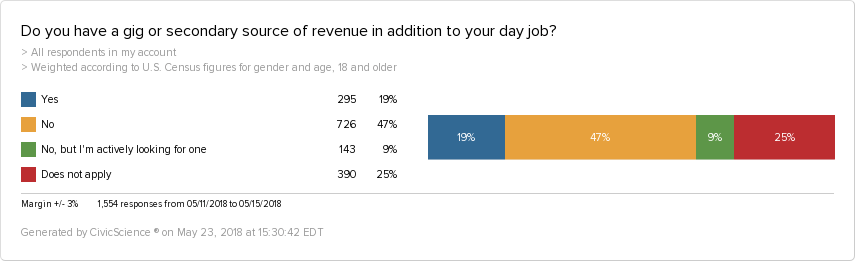

Taking a look for ourselves, we learned that 19% of U.S. adult respondents say they have a gig or secondary source of revenue in addition to their day job, and an additional 9% are actively looking for one.

That’s much higher than the Bureau of Labor Statistics’ estimate of moonlighters (5% of the total employed population in 2018). However, the BLS identifies a secondary job as ‘part-time’ and excludes those who are self-employed.

When we consider the growth of the ‘gig economy’ and more traditional self-employed workers, whether that’s driving for Uber or Amazon Flex, freelancing on websites like Fiverr and Upwork, or working as an independent contractor, 19% could indicate that a much larger percentage of people are working secondary self-employed jobs as opposed to traditional part-time jobs.

In fact, it’s estimated that 34% of U.S. workers are self-employed, and that number is only expected to grow in anticipation that more Millennials will turn away from traditional 9-to-5 jobs in search of self-employment.

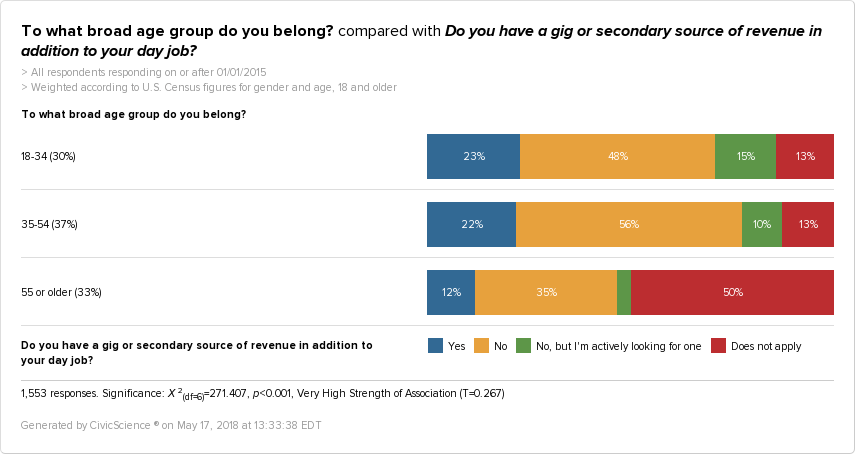

We see that secondary jobs are highest among both Millennials and Gen Xers — nearly one-quarter of both age groups say they have a secondary source of income in addition to their day jobs. However, more Millennials (15%) are actively looking for a second job compared to Gen Xers (10%).

Interestingly, our data shows that younger Gen Xers, 35-44-year-olds, are the most likely out of all age groups to have a second job, followed by 18-29-year-olds.

Stagnating Wages and Debt

What’s driving Millennials and Gen Xers towards secondary jobs and self-employment? Perhaps greater job availability — galvanized by the low unemployment rate, more people can get a secondary income stream going, and some may welcome the chance to do it on their own terms as gig workers and independent contractors (setting their own hours, being their own boss, working as much or as little as they want).

However, the unemployment rate is low, but the underemployment rate is not. Some argue that the growth of the side hustle is the result of stagnating wages and shouldn’t be taken as a sign of a healthy labor market. Stagnating wages combined with debt may be major contributors to a growing number of Americans juggling more than one job just to get by, especially Millennials.

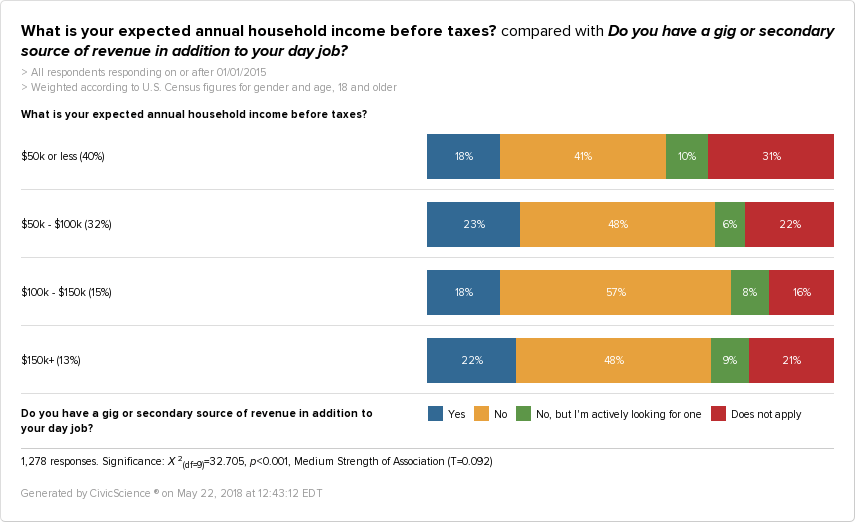

We found that solidly middle-class earners ($50-100k annually) are the most likely to have a secondary source of income, but all classes follow fairly similar trends. Those who make $50k or less are the most likely to be searching for a second job.

Throwing debt into the equation adds perspective. We found that $50-150k earners are also the most likely to have some form of debt compared to other income levels, which we discussed in a previous post.

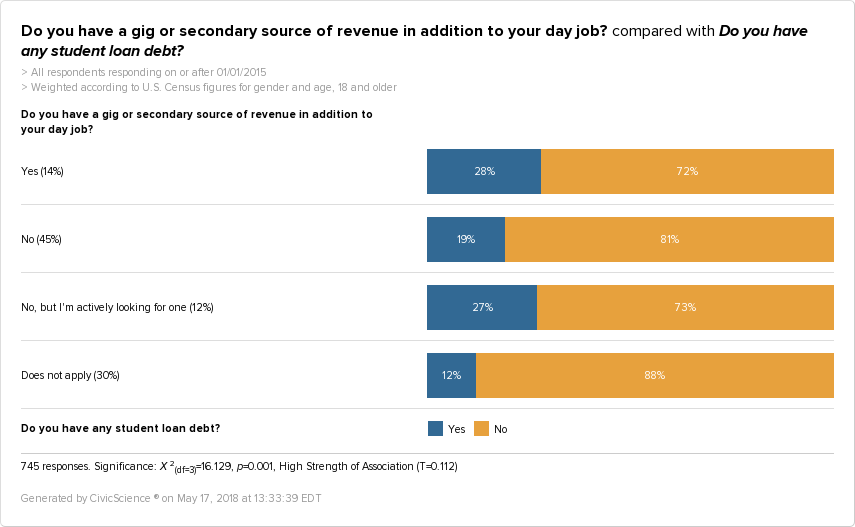

Looking at student loan debt, moonlighters and those actively looking for additional work are nearly 10% more likely to be saddled with student loan debt than non-moonlighters.

This trend is probably fueled largely by Millennials, who are more likely to have student loan debt and to have greater amounts of it than older generations.

When it comes to Gen Xers, our data shows they are overall more in debt than any other generation, which could account for the high rate of Gen Xers with second jobs. But, it’s interesting to note that U.S. adults with second jobs are 10% less likely to have credit card debt than those without them, so moonlighting Gen Xers may be better off than their single-job peers.

Debt may be driving some to take second jobs or gigs, but it certainly doesn’t explain the whole story.

A Brave New Workforce?

Moonlighting appears to be one of those things that historically waxes and wanes with business cycles, although researchers can’t quite pin down cause and effect. But if the traditional 9-to-5 full-time job paradigm is being disrupted at its core, could working multiple jobs become the new normal?

Some caution that while moonlighting doesn’t negatively impact work performance, working greater hours per week may take a toll on family life, leading to greater work-family conflict.

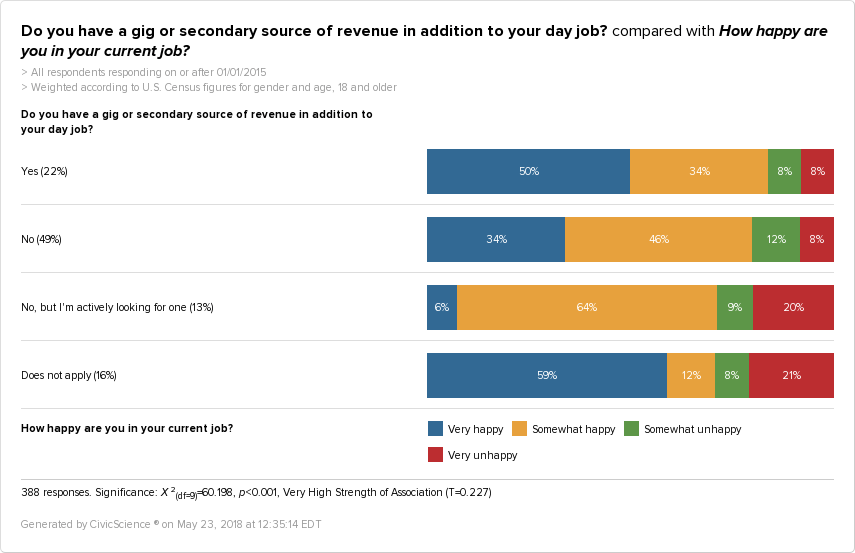

That may be true, but we found that those with second jobs rate themselves to be considerably happier in their current job situation than those without second jobs. Half of the moonlighters say they are “very happy” with their current job, compared to 34% of employed non-moonlighters.

Looking down the road, the trend toward self-employment may very well change the future job market. Some view this as promising, while others argue that it creates a volatile, precarious situation for workers, who will be forced to contend with unpredictable income and lack of employer benefits.

Much is still left to be determined, but what we can take away now is that more than 20% of Millennials and Gen X respondents are working more than one job, and it’s likely that many are engaged in some sort of self-employed work. Even if debt and stagnating wages are motivating forces, at the end of the day, they are still surprisingly happier in their jobs than those working single jobs.