When it’s time to buy that new couch, do you hit the stores or pick up your phone and start browsing?

In a survey of 1,986 respondents, CivicScience found that while the majority of U.S. adults prefer to buy furniture in stores, nearly 20% have bought furniture online and say they would do so again.

All signs point to a growing trend in online furniture buying. In 2015, the U.S. Department of Commerce estimated that online shoppers purchased $28.9 billion of furniture and home furnishings, making up 10% of total e-commerce sales. Today, estimates are hovering around $38.5 billion in online furniture sales, with expectations for continued growth. Consider that 14% of survey respondents say while they haven’t bought furniture online before, they are interested in doing so in the future.

What’s fueling this growth? There are some obvious answers — online-exclusive retailers, like Wayfair and Amazon, have gained traction in the furniture market (although Wayfair is now branching out to brick-and-mortar). Traditional retailers, like IKEA and Ethan Allen, have ramped up their online experiences, offering augmented reality (AR) apps that let customers see how a piece of furniture would look in their living rooms.

That said, buying furniture online still has its setbacks, such as shipping costs. While Amazon and Wayfair offer free shipping, for the most part, not all retailers do. Also, buyers aren’t able to get a physical feel for their item before it arrives, among other concerns.

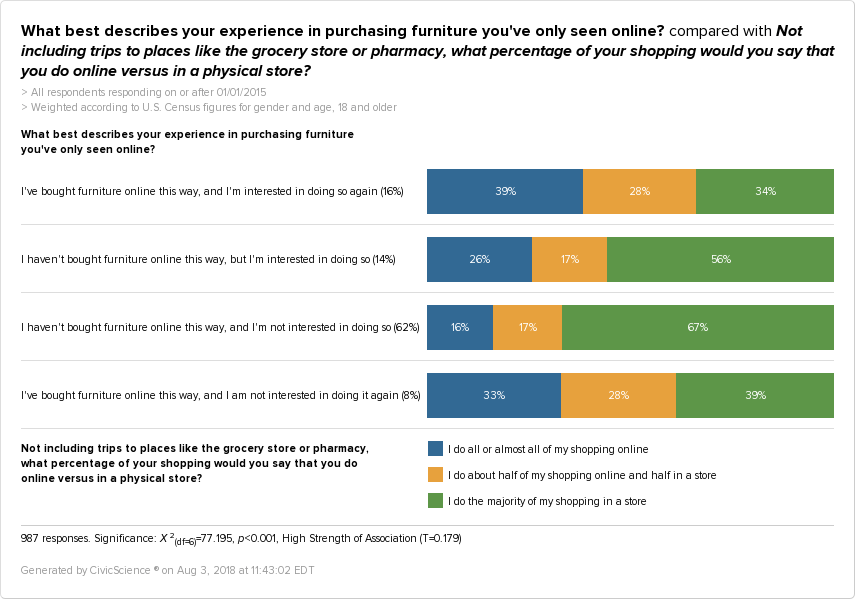

Still, the potential cons aren’t enough to keep some from making that online purchase. For one, online furniture buyers are far more likely to be accustomed to making other retail purchases online than in-store furniture buyers.

CivicScience found that online furniture buyers are already avid online shoppers, with close to 40% reporting they shop more online than in stores. That’s compared to 16% of those who have never bought furniture online and don’t plan to.

Demographics play into buying preferences, as well. Gen Xers are the biggest online furniture purchasers, followed by Millennials — 21% of Gen X and 18% of Millennial survey respondents reported buying furniture online with intent to do so again, compared to only 14% of Baby Boomers.

The survey also found that women and city dwellers showed a stronger preference for buying furniture online. Considering the difficulty of transporting and moving large bulky items in urban areas, delivery is a major advantage for those in cities.

How much do augmented reality apps factor into someone’s choice to buy online or in store? While it’s hard to say exactly, survey results do show that online furniture buyers exhibit the strongest preference for mobile apps out of everyone surveyed, with 35% saying they are “important.”

Given that Millennials value apps the most out of U.S. adults, retailers who are using apps to propel furniture buying are likely headed in the right direction.

Expectations for growth shouldn’t neglect that 8% of survey respondents said they bought furniture online but wouldn’t again. While 8% appears low, it represents nearly one-third of all adults who said they bought furniture online and isn’t connected to age-related differences. Buying furniture online may appear to have a promising future, but it certainly has some kinks to work out.

Speaking of online shopping, tomorrow’s webinar on the Amazon ecosystem is almost full. Save your seat here.