The Gist: Retail mobile apps are finding favor among early tech adopters in all generations, specifically Gen Xers. But they face a significant challenge — app adopters are more likely to be online than in-store shoppers.

Even though a majority of U.S. adults still shop more in stores than online for retail goods (and largely for the sake of quick convenience), forward-thinking brick-and-mortar retailers are redefining the shopping experience. Mobile apps are emerging as strategic players to keep shoppers from straying.

Leading brands, such as Sephora and Macy’s, now offer mobile apps that can be used as ‘shopping companions’ while in stores. The apps offer things like on-the-spot scanning, discounts, event notices, product recommendations and other personalized features that make use of latest technologies. For example, Macy’s app lets you place a piece of furniture into an image of your living room to see what it might look like.

How many people are actually using mobile apps or have used them while they’re shopping in retail stores?

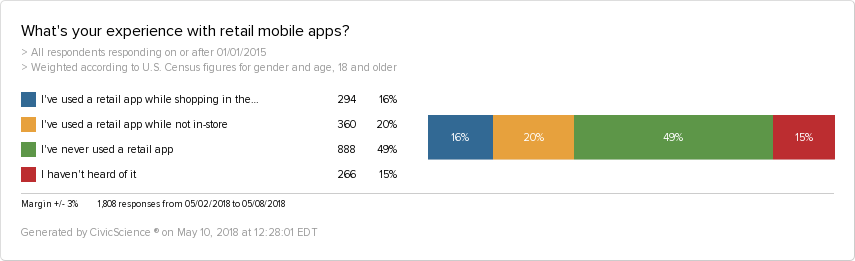

We found that 16% of U.S. adult respondents say they have used retail apps while shopping in stores, while on the opposite end, 15% have never heard of retail mobile apps.

Not a bad adoption rate, considering that a lot of these apps are still relatively new; and even better when we compare to mobile payment apps in the U.S. (a tiny 1%). While it’s not exactly apples and oranges — mobile payment apps have unique factors, such as low vendor adoption rates and security concerns — it shows that there is indeed a market in the U.S. for engaging with smartphones and apps during the physical shopping experience.

Right now, it appears that the market (of in-store retail mobile app users) is also more likely to be early tech adopters of other products, including:

- Streaming music services

- Social media websites

- Smartwatches

- Smart home automation products

- Augmented and virtual reality products

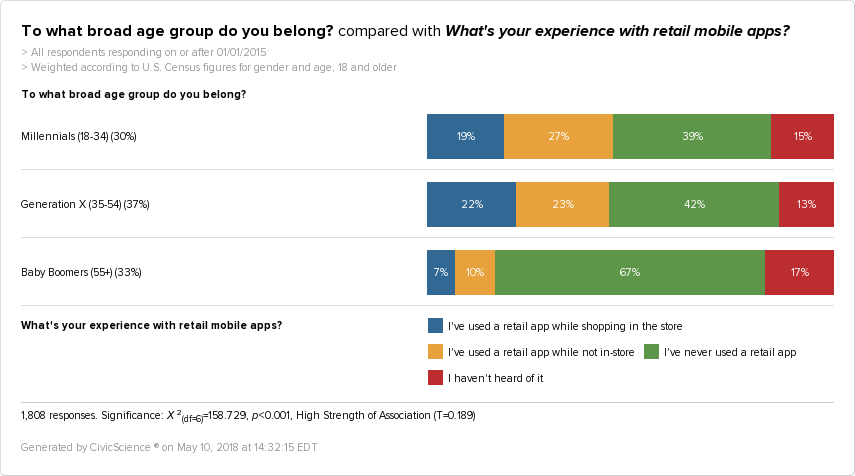

Not surprising. However, contrary to expectations that Millennials would be leading the way with adoption, we’re actually seeing Gen Xers to be bigger in-store retail app users, with 22% having used an app while shopping.

That should come as good news for retailers, considering that our research shows Gen Xers do slightly more shopping in stores than Millennials. Still, both younger generations do less shopping in stores and more shopping online than Baby Boomers, so being able to capture 19% of Millennials and 22% of Gen Xers may be promising for future adoption.

Of course, an important question for retailers revolves around the likelihood that the mobile app usage translates to sales.

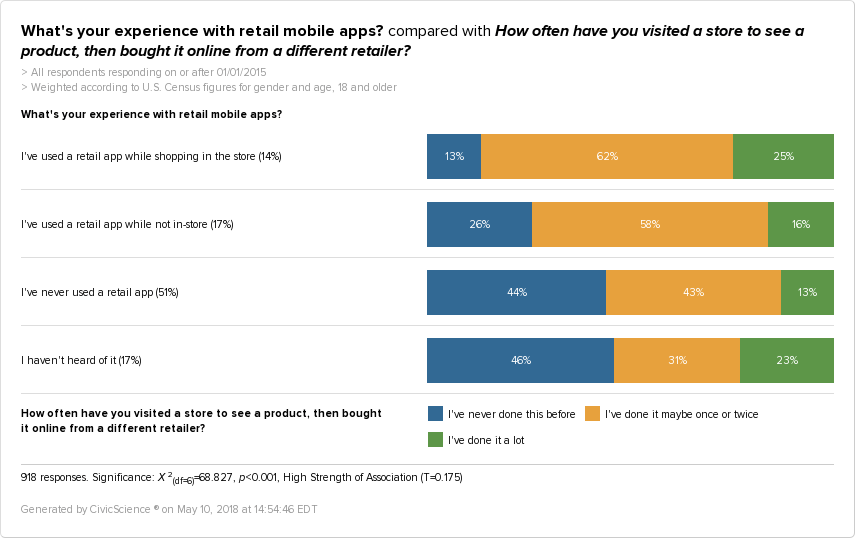

When we compare retail mobile app adopters with those who visit stores to see a product, but then buy that product online, things don’t look as cheery. It turns out that retail app users are the most likely to view a product in-store and then buy it online: 25% say they’ve done it a lot and 62% say they’ve done it once or twice.

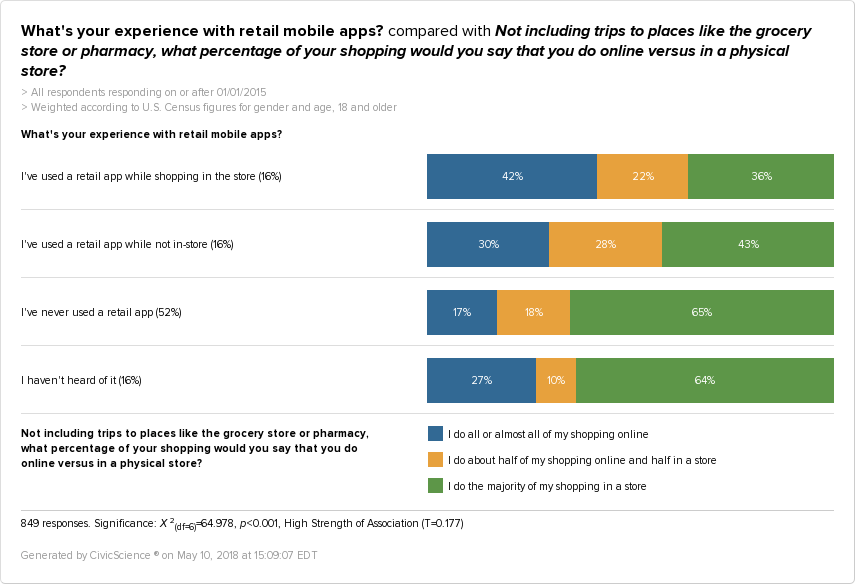

Perhaps that’s the natural consequence of the retail apps drawing in a more tech-savvy crowd; they’re already more likely to be online shoppers. In fact, 42% of those who have used mobile apps while shopping in retail stores do more shopping online than in stores, while only 36% do more shopping in stores.

Even though shoppers may enjoy the experience of using apps, retailers should take note that of the 16% of those who have used mobile apps while shopping, more are regular online shoppers than regular store shoppers, while at the same time, 25% frequently forgo purchasing a product in a store in favor of buying it online from a different retailer.

The challenge for brick-and-mortars then is to encourage greater app adoption among regular online shoppers — whether they are shopping equally between stores and online or shopping more online — and at the same time, discourage straying elsewhere to buy the same product.