The Gist: Potential car buyers are continuing to favor used cars over new or leased vehicles. In fact, the percentage of likely car buyers who would prefer to buy a new car as their next purchase dropped 4% this past quarter. If the trend continues, as many speculate it will, other industries may face the fallout.

Tensions remain high, and eyes glued, as the value of used vehicles continues to plummet. Though it may seem this phenomenon is isolated to the automotive industry, used car sales could have a nasty spillover effect on the economy overall. For those who appreciate a more detailed synopsis, here’s what Zerohedge has to say:

“Lower used vehicle values mean lower trade-in value which means lower vehicle affordability. Maybe the consumer is underwater (especially if bought on longer term loans). New volumes could decline if the consumer holds off (or looks to the secondary market). Mix worsens as the consumer affordability is lower. ATPs decline as OEMs incentivized to keep volume and/or mix going. Captive finance companies may write down lease portfolios. In general, monthly payments go higher which raises the credit risk which in turn means auto loan rates could increase which could then stymie demand/mix.”

The consequences of this fallout may be particularly disastrous for car rental companies such as Hertz, who rely on higher used car values to survive. In fact, the company already lost one-fifth of its value in just one week in 2016. As if that’s not bad enough for Hertz and others, forecasts estimate the trend will continue throughout the end of 2017 – if not longer.

Why? There is a domestic surplus of used cars, which is “driven by 2013 lease returns coming back into the market.” To put a concrete number to it, these returns represent roughly an 800,000 increase in used cars when compared to 2015.

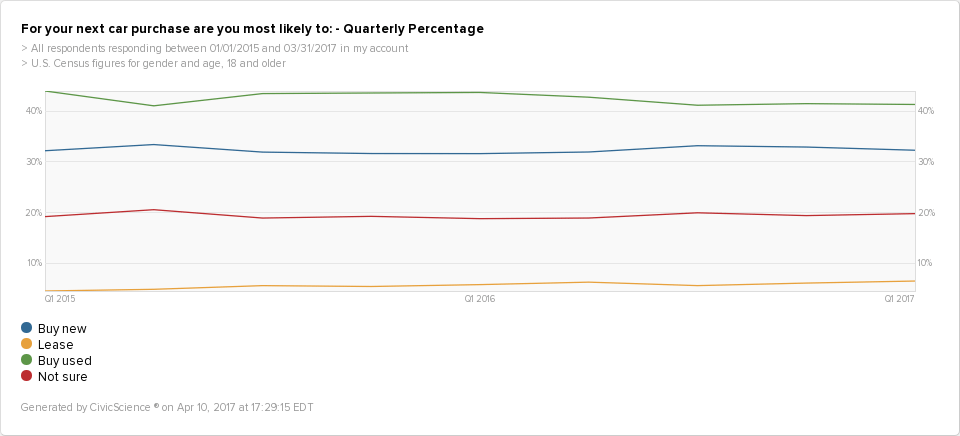

Hoping to lend some good news to the auto industry, we may have turned out empty-handed. Through looking at the following time graph – representing all U.S. Adults 18+ – here’s what we found:

Right off the bat, the numbers don’t surprise us based on industry news (and panic). Out of the 200,000+ adults represented, we can clearly see that adults are much more likely to say they will buy a used car over a new car for their next purchase.

That said, it seems there isn’t much growth among any particular buyer group. In fact, those who would buy a used car for their next purchase dropped by 1% last quarter.

THE REAL CAR BUYERS

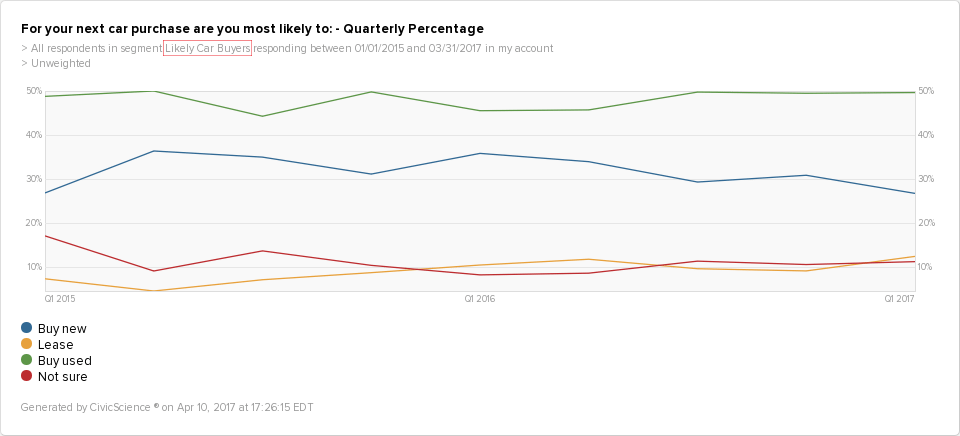

As usual, that doesn’t cover the whole story. To take a deeper look, we segmented the above question to only include those who are “Very likely” or “Somewhat likely” to purchase a new car in the next 90 days. In other words, these are the real buyers who stand to disrupt or rebuild the fraught industry. Here’s what we found:

The percentage of likely car buyers who say they would buy a new car for their next purchase dropped 4% this past quarter. Given the industry’s woes – that’s not good. In addition, those who say they would buy a used car increased 1%, and those who would lease a car increased 3%.

Stretching for relieving news, those who say they are not sure which car they would buy next increased a few percentage points as well. Perhaps there is an opportunity for car manufacturers to snag these persuadables – as small a group as they are.

Our preliminary insights surrounding these persuadable buyers – again, who are at least somewhat likely to buy a car in the next 90 days — show that they are more likely to be women, and are more likely to earn under $50k each year.

THE END OF THE ROAD

As much as we would like to be the deliverers of pleasant news to companies facing the turmoil of falling car prices, our data seem to confirm the fear that’s been spreading across various industries. There is no shortage of top-of-the-line, groundbreaking new vehicles, but there are just not enough people planning to buy them. Instead, these buyers are gearing towards used cars that have re-entered the market, causing a monumental decrease in value.

If the trend continues, it won’t just be Hertz that continues to feel the fallout.

Interested in other insights? Check out our recent findings into the growing fear of self-driving cars, decreasing concern for consumer privacy, and one other industry that may be in trouble – sports.