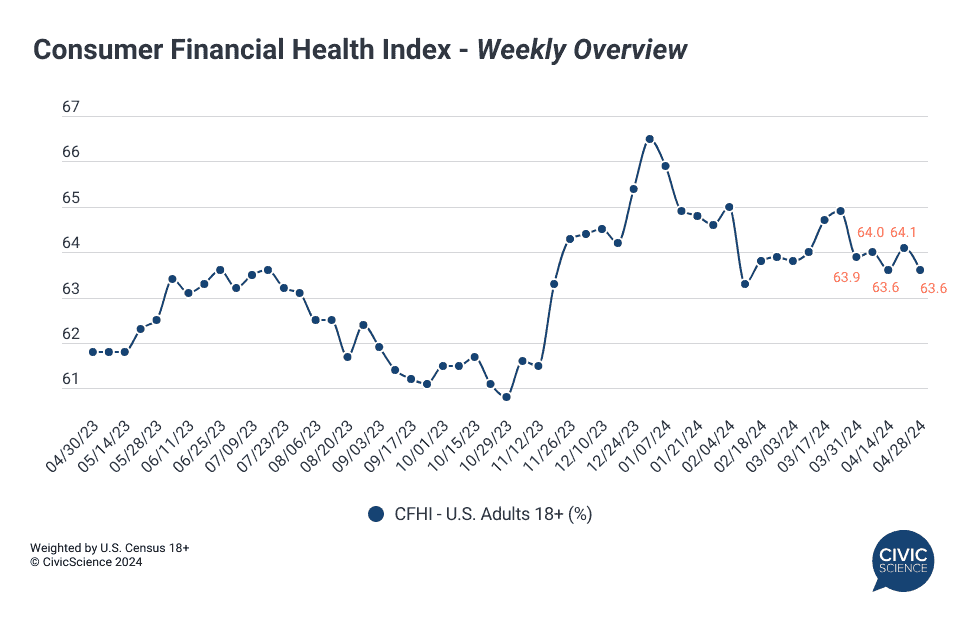

Measuring the financial health of the nation is key to understanding the current state of the consumer and predicting how they will react in the months ahead. The CivicScience Consumer Financial Health Index (CFHI), which measures how consumers expect their financial situation to change in the next six months, saw a good amount of movement in April. After a sharp decline at the start of the month, outlook swung up and down in the last weeks, ending April on a down note at 63.6%.

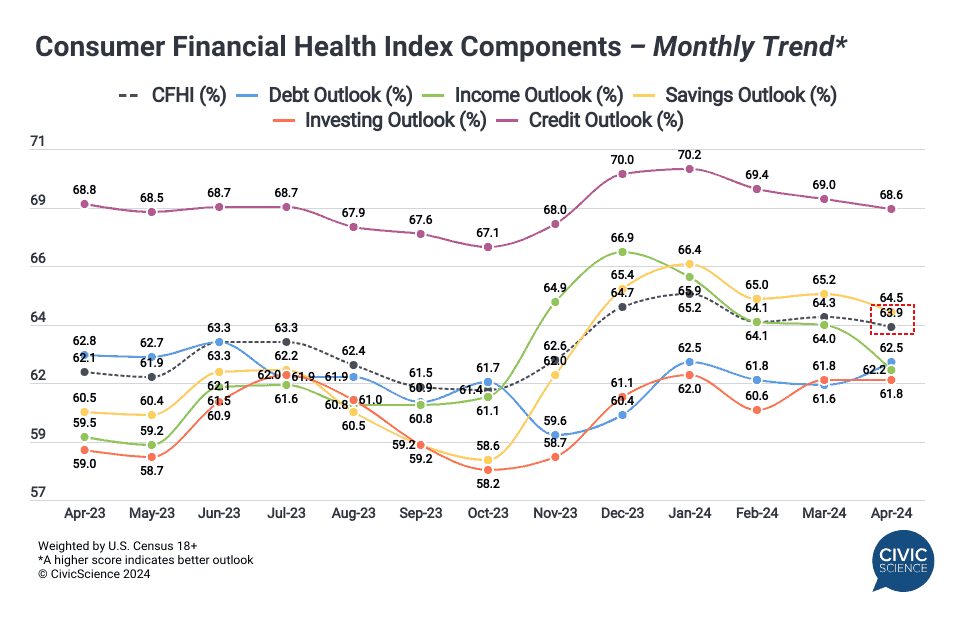

As a monthly average, consumer financial health declined slightly to 63.9% in April from 64.3% in March, which marks the lowest point of the year thus far. A look at the individual markers behind the collective score shows that income outlook took the biggest hit month to month, falling 1.8 points. The decline comes amidst a cooling job market, with lower-than-expected job growth numbers reported in April, as well as declining confidence in finding a new job.

Consumer credit outlook also continued to drop, while debt outlook improved considerably by 0.6 points. Investing outlook held steady, as savings expectations also fell sharply by 0.7 points.

Outlook for income and savings has been on a gradual descent since reaching high points in December. Consumers began the year on a high note, but it’s likely that persistent inflationary pressures and cooling job growth has led to the rapid decline. CivicScience data has shown that older Americans aged 55+ tend to report comparably worse income and savings outlook than younger adults, and lower overall financial health. Data from the latest CivicScience Election Mindset Tracker also show that Republicans reported declining overall financial outlook from March to April, while Democrats and Independents remained relatively stable.

Attitudes change before behaviors do. To stay ahead of how your customers, key consumer segments, and competitor’s customers are feeling about their finances, get in touch. Learn more about the CFHI here.