A version of this article originally appeared in ROAR Forward as part of a collaboration with their quarterly ROAR Report. For more consumer insights like this from CivicScience, get in touch.

As Americans move past the holidays into the doldrums of mid to late winter, we find that the 55+ demographic continues to have a more optimistic outlook than other age groups when it comes to their emotional well-being and experiential spending, even as most of the country feels slightly less optimistic in February compared to January.

A look at CivicScience’s Emotional Well-being Index, Consumer Financial Health Index, and Weekly Spending Attitudes paints a picture of a 55+ demographic that seems to feel emotionally better than much of the population, less optimistic than other demos about their financial health, yet generally bullish around spending, especially on travel and restaurants.

Emotional Well-being

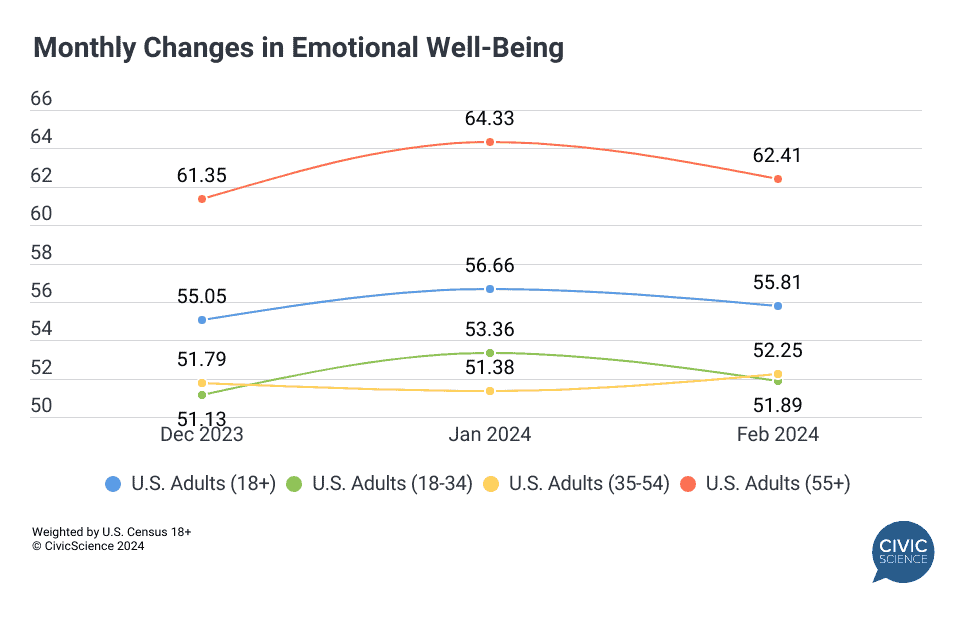

Responses to the Emotional Wellbeing Index (which tracks consumer feelings of stress, happiness, excitement, and fear) show that following a positive start to the new year, the emotional well-being of most of the U.S. population (Gen X being the exception) declined from January through February. Likely contributors to this decline include stress related to paying back holiday debt and student loans coming due. Additionally, political concerns may play a role as we progress into the heart of the primary season.

But Americans 55+ rank more than six percentage points higher than the general population – and consistently ranked higher for the two months in 2024 – in terms of their overall well-being. Factors such as children moving out of the house, nearing retirement, and being less likely to be burdened with debt (or specifically concerned about paying student loans) are all likely contributors to this trend.

Take Our Poll: Would you say the time you spend online is beneficial or damaging to your emotional well-being?

Financial Mixed Feelings for 55+

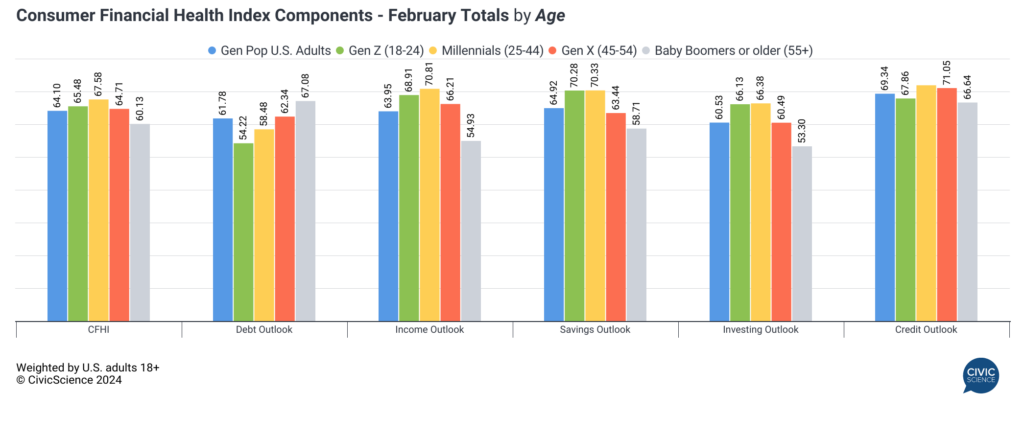

Despite scoring highest in terms of well-being, Americans 55+ firmly rank at the bottom among all age groups on the CivicScience Consumer Financial Health Index. What gives? If their well-being ranks high (and they are bullish on spending), what factors led to the 55+ crowd’s low rank on the CFHI?

Cumulative data from February reveal that adults 55+ hold a more pessimistic view regarding income, savings, investing and credit than other age groups. The lone component where they outrank other age groups is their debt outlook – where they rank 5.8 points higher than the general population. High scores around debt can most likely be attributed to their more advanced life stage – where they have little, or no student debt and mortgages are less of a concern. Lower scores around investing, savings and income may very well be outcomes of concern about inflation, later life employment, their political positions, and the constant news drumbeat about a possible recession.

Bullish on Spending

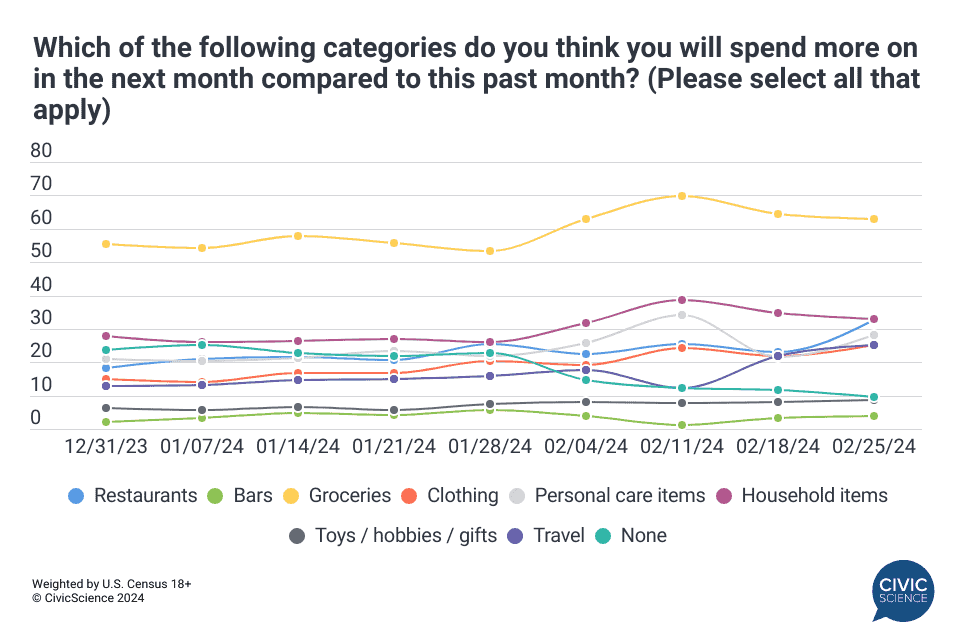

Surprisingly, additional data suggest that, in the short term, Americans aged 55+ are more likely to increase spending in several areas. They seem to be displaying some bullishness around spending despite some bearish attitudes around economic well-being. Despite financial concerns possibly intensifying as their potential earnings years prior to retirement shrink (or they are already living on a fixed income), their spending behavior appears to align with their emotional well-being. They are much more likely to increase spending on restaurants, travel, and clothing, for example.

This continuation of prioritizing experiences (after staying home and focusing on purchasing goods for themselves and their homes during the pandemic) possibly contributes to the overall enjoyment of their lives and, therefore, their higher ranking in the well-being index. They have prioritized spending on services over goods since 2021 and may now view enjoying life through experiences as a non-negotiable.

Weigh-In: How confident are you in the current state of your finances?

At the moment, Gen Z adults and Millennials are attracting considerable attention due to their debt (student loans and consumer debt). At the same time, Americans 55+, who have little debt and higher wealth, seem to have a mixed outlook – feeling emotionally better than their counterparts and potentially increasing spending on experiences – but they are the least optimistic about their finances. It will be important to watch whether 55+ well-being attitudes continue to worsen or if spending attitudes turn negative. This group is one of the key drivers of the consumer economy, and their spending is currently one of the bulwarks of this economy, and erosion of the outlook or their spending will have important future implications.