When it comes to shopping, most people love getting a deal. CivicScience asked more than 4,500 U.S. adults about their experience with shopping off-price retailers such as T.J. Maxx, Marshalls, and other discount companies. As the data show, more than half of respondents (64%) shop at this type of store.

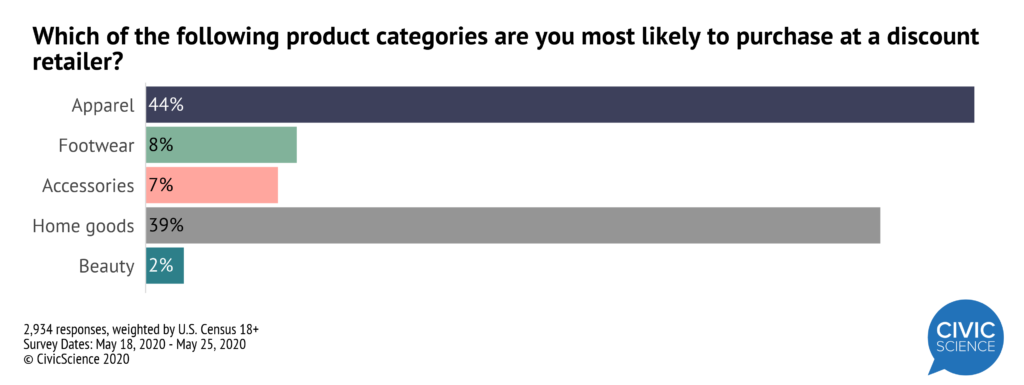

When shopping at a discount retailer, consumers most often look for apparel and home goods before footwear and accessories. Generally speaking, beauty is the least popular item for consumers who choose to shop at these kinds of stores.

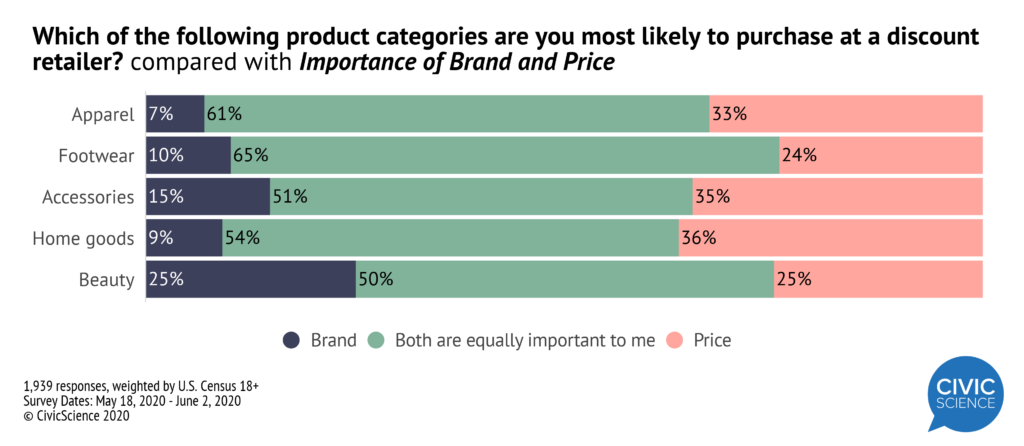

Does Brand Matter?

Even for those looking to get a deal, the question of brand versus price remains relevant. While beauty products were the least popular category overall for consumers shopping at discount retailers, beauty product shoppers appear to be the most interested in brand name. In fact, beauty was the only retail category where brand name won out over price.

T.J. Maxx on Top

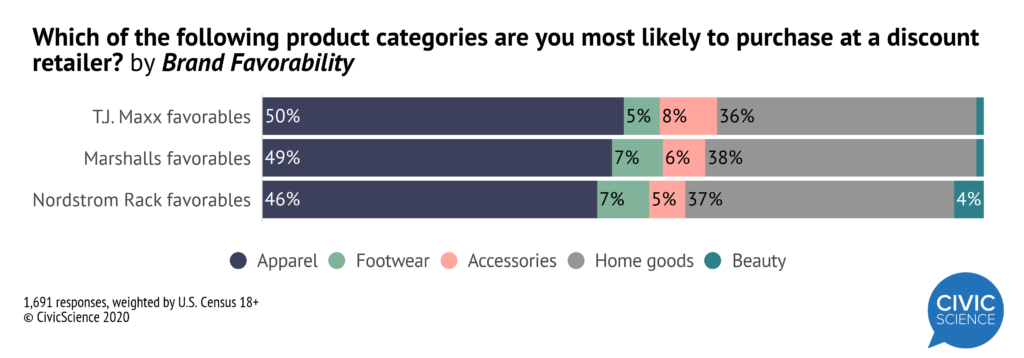

Even in light of recent frustrations with online marketplaces, T.J. Maxx has the highest favorability, with 37% of U.S. adults approving of the company. In a very close second is Marshalls, with 34% favorability. Both of these retailers surpass Nordstrom Rack’s favorability, which has just 26% of U.S. adults.  Across all three stores, apparel and home goods are the most sought after items.

Across all three stores, apparel and home goods are the most sought after items.

While all the retailers drew in shoppers for apparel and home goods, Nordstrom Rack favorables showed the highest incident rate of shoppers seeking beauty products. It’s worth noting that income does play a larger role at this off-price retailer than at any other, with 33% of high-income earners shopping here. With fewer low-income consumers shopping at Nordstrom Rack, this could be a major factor in why this particular retailer’s favorability is much lower than others.

A Decline in Interest?

Over the past two years, favorability towards off-price retailers has seen a slight decrease. T.J. Maxx favorability has fared quite well since 2018 while Marshalls favorability has fallen 2 percentage points. Nordstrom Rack, on the other hand, has gained loyalty.

Although these changes are minimal and could simply be related to temporary issues with online orders, it could indicate a downward trend for the long-term.

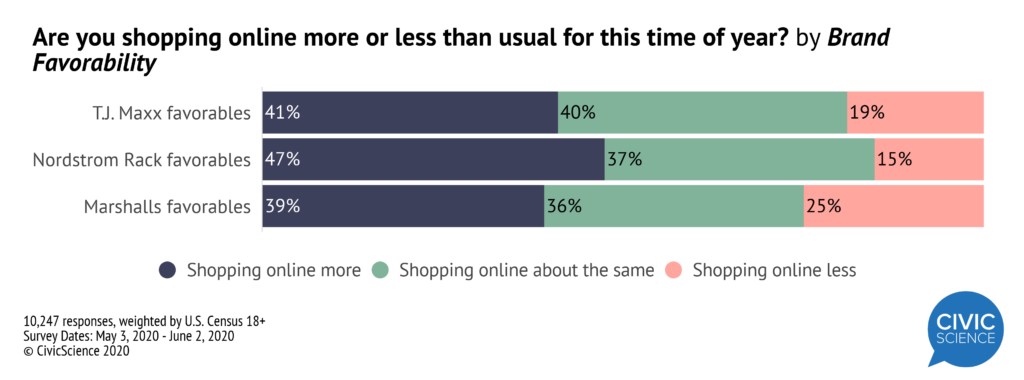

Those who like T.J. Maxx have recently been spending more money online in general, though at a slightly lower rate than their Nordstrom Rack-loving peers.

Marshalls favorables, on the other hand, have not demonstrated a substantial uptick in online shopping.

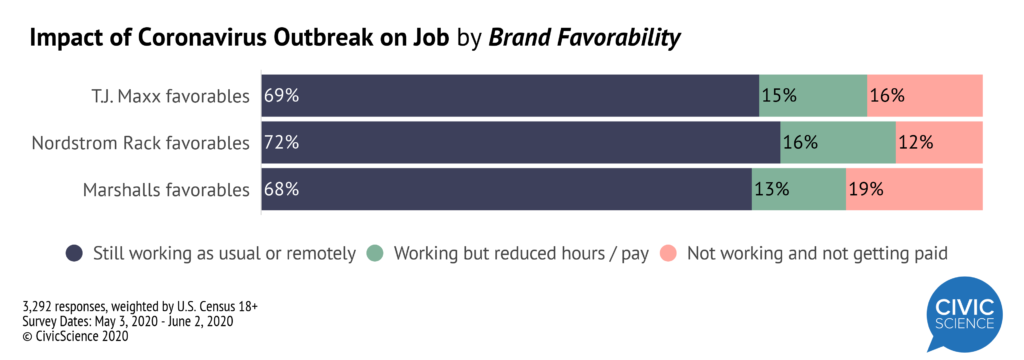

Working Through the Pandemic

One of the reasons that Nordstrom Rack favorables may be shopping online more could be due to the fact that they are working remotely more than those who favor T.J. Maxx or Marshalls. Job stability, combined with a higher general income, could be the perfect combination of factors to prompt an online, off-price shopping spree for Nordstrom Rack lovers.

By contrast, those who like T.J. Maxx and Marshalls are still largely working as usual–with fewer indicating a work from home option.

When it comes to discount retailers, income and current work environment play a much larger role in brand favorability than one might expect–especially with regards to getting a discount. While T.J. Maxx may be the general fan favorite, Nordstrom Rack attracts a more exclusive crowd, whose higher income and work from home privileges may drive greater traffic to the company’s online presence–ultimately bolstering sales in an otherwise uncertain time.

Want to know how fans of your brand feel about shopping online versus in stores? Our clients have access to consumer sentiment and behavioral trends that we don’t publish on our blog. Sign up for a demo to unlock consumer insights you can’t find anywhere else!