The Gist: Regardless of income, more smartphone owners finance their phones than buy them outright, but buying unlocked phones are still a popular option. iPhone ownership may play a key role in determining phone buying trends.

Smartphones — everyone has one, right?

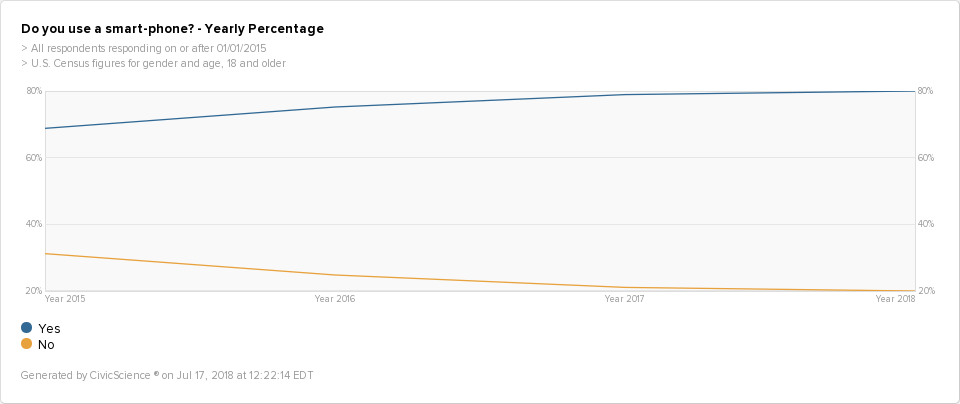

Well, almost everyone. Our data shows that 80% of U.S. adult respondents use a smartphone, and that’s up from 69% in 2015.

To put that into perspective, it’s estimated that 95% of Americans own a cell phone of some kind. While not everyone owns a smartphone, the majority of Americans do, after a decade of incredible growth.

However, the mobile industry is worried that the market has been tapped — people just aren’t buying as many new phones now and revenue is falling. Slowed sales, coupled with more options available to consumers than ever before, raises the stakes for industry players, especially carriers.

How do smartphone buying choices factor in? Are more people buying phones outright instead of signing on to a payment plan, whether that’s with a carrier, manufacturer, or financing company?

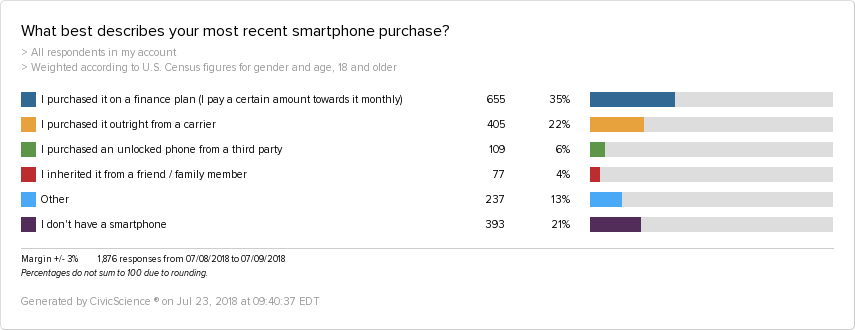

We looked at current smartphone buying trends and found that financing is the most popular option among U.S. adults for purchasing smartphones, but not by much. While 35% of respondents say they financed their most recent smartphone through a payment plan, 28% purchased unlocked phones: nearly one-quarter of Americans (22%) bought an unlocked phone from a carrier and 6% bought one from a third party seller.

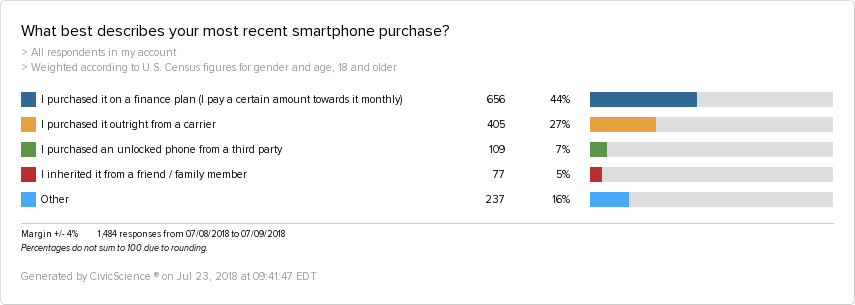

When we exclude the 21% of adults who don’t own smartphones, that works out to be 44% of all smartphone owners who financed their phones, versus 34% who bought a phone unlocked.

Financing has an edge. But that said, buying a smartphone outright is still a popular option.

What makes someone buy outright versus finance their phone?

Looking at income among smartphone owners, we can group purchasing habits into two groups: middle-income earners and low/ high-income earners.

Middle-class earners, who earn between $50-150K per year, are the most likely to finance their phones, while those making under $50K per year are the least likely:

Middle-class earners are the least likely to buy phones outright, while lower income earners are the most likely. What’s interesting is that lower income earners and high-income earners ($150+) mirror each others’ buying behaviors. Among smartphone owners, 34% of $150K+ earners bought their phones outright, compared to 36% of the lowest earners — not much of a discrepancy.

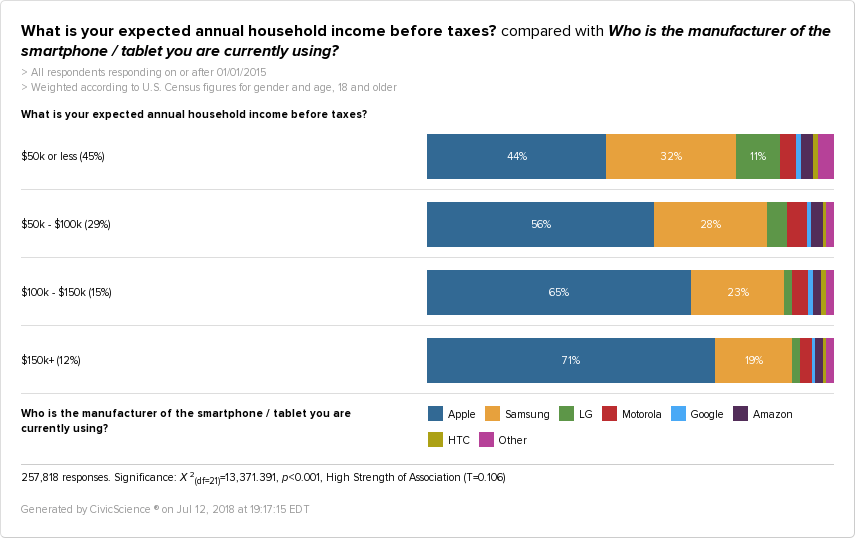

What could account for these nuances? Data suggests it’s all relative to the phone itself. If iPhone ownership is any indicator of purchasing power (and some researchers say it is), what we can assume is that fewer lower income earners are financing high-end phones than middle or high-income earners.

Here we can see that the more you make, the more you’re likely to own an Apple device and the less likely you are to own any other device brand, even Samsung.

It’s plausible that the iPhone accounts for the bulk of financing among middle-income earners — between 56-65% use an iPhone and between 50-52% finance their phones.

While we do see some fluctuation in phone buying across income levels, we largely still witness similar trends: all smartphone owners are most likely to finance their phones, while a healthy amount buy phones unlocked. At the end of the day, income can provide an idea of how someone might purchase a phone, but alone it isn’t a great predictor.

The phone itself also likely plays an important role — what drives someone to purchase an iPhone versus a cheaper alternative? We’ll be exploring that in a later post.

Furthermore, shifts in buying trends will undoubtedly continue to impact sellers. When it comes to buying unlocked smartphones, most purchase them from carriers. But with the wealth of buying options and deals available, like Amazon Prime Day’s unlocked phone sale, we’ll be watching to see if third-party sellers gain traction going forward.