A walk down the dairy aisle these days reveals a growing number of alternative milks gracing the shelves. In the past several years, non-dairy milk has escalated in popularity, gaining attention across social media platforms and the internet at large, as a solution for those seeking a cow-free dairy-style beverage. CivicScience asked 4,254 U.S. adults about their milk preferences.

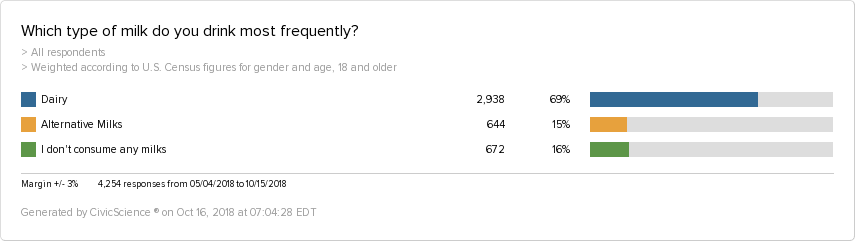

According to the data, 69% of U.S. adults drink dairy milk most frequently. 15% drink alternative kinds of milk, which is just slightly less than the 16% who do not drink any milk at all. Although seemingly small in comparison to dairy milk drinkers, these statistics hold their own, revealing the subtle, yet potentially impactful divide amongst consumers.

Does Gender Play a Role?

As it turns out, alternative milk is more popular amongst women, they make up 66% of the alternative milk drinkers. As for non-milk drinkers, women are also in the majority making up 52%.

The fact that more women are drinking alternative milk or no milk at all raises the question of whether or not calcium or future bone strength is of any concern? Alternative milk may be fortified with calcium, but how well they compare, from a long-term nutritional standpoint, is yet to be fully understood. And for those opting to skip out on milk entirely, could other food or supplement choices be filling in the gaps?

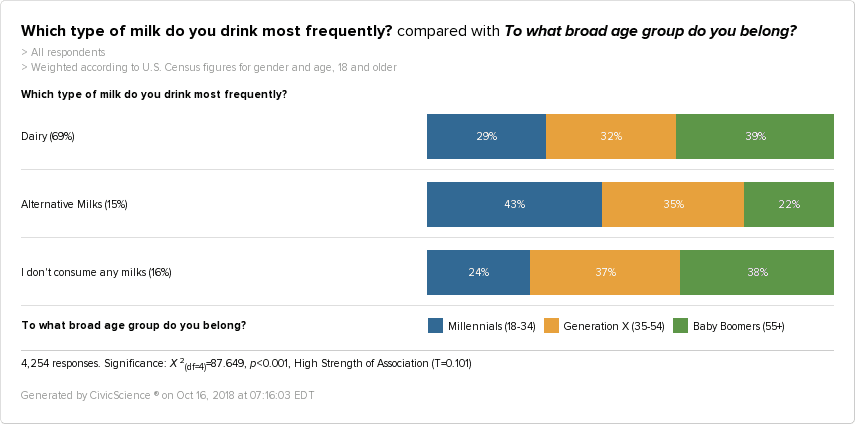

Milk, Age, and Income

Age certainly plays a role in who drinks alternative milk–which are most popular amongst Millennials. However, when it comes to those who do not drink any types of milk, Baby Boomers make up 38%–the largest percentage in this category. That said, they also make up 39%–the largest percentage–of those who prefer dairy milk. So while they may still be staunch supporters of traditional dairy, they are also contributing to the growing percentage of individuals not drinking any milk at all.

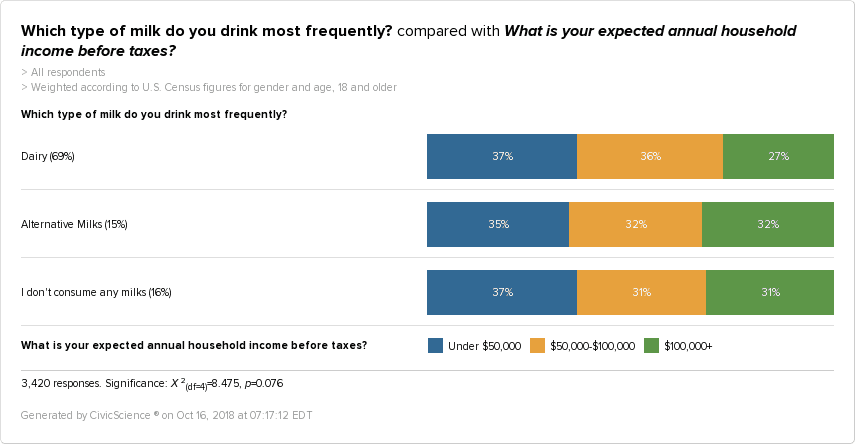

One factor that does not seem to inhibit milk selection is income. Across the board, low-income earners are more likely than their middle and high-income earning counterparts to purchase milk. This is especially interesting in the case of alternative milk. While dairy milk is heavily subsidized, non-dairy milk is not, often carrying a much higher price tag.

Is Alternative Milk to Blame?

In light of the growth of this alternative milk industry, many dairy producers have worried over these milk alternatives taking away from their business, particularly protesting plant-based alternatives labeled as milk. But, the truth is that alternative milk on its own is not necessarily the biggest cause for concern for dairy farmers. The alternative milk adoption rate is still slow enough that, for the time being, this is not the sole factor impacting the dairy industry.

The larger and perhaps more relevant conversation lies in the distinction between those who drink dairy milk versus those who have turned away from traditional dairy, in favor of alternative milk or no milk at all. These two latter groups make up 31% of consumers, a sizeable amount of the population, who are less interested in dairy milk as a regular option.

So while alternative milk may be taking some consumers away from dairy, it seems that milk, in any form, simply may not be as in demand as it has been in the past.