CivicScience coverage of the informal Dry January or abstaining from alcohol for the entire month of January aligns with overall trends that suggest younger Americans may not be as open to alcohol as generations prior. While health concerns are likely playing a role, it’s far from the only motivator for drinking-age Americans, young and old, to refrain from cracking open a cold one as often as they once did. Regardless of their reasoning for passing on alcohol, its clear impacts will extend well beyond a singular Dry January. Here’s a look at the latest consumer insights around alcohol as we head deeper into spring and prepare for summer:

Just How Often Are Americans Drinking Today?

Fresh CivicScience data show that 69% of U.S. adults 21+ drink alcoholic beverages at some point during the year. That percentage jumps to 74% among 21- to 34-year-olds. This age group drinks more frequently than the Gen Pop: 38% of drinking-age Americans say they drink at least weekly, compared to 45% of 21- to 34-year-olds.

Most Americans Drinking Less Than a Year Ago, Younger Adults Hold Distinct Motivations for Cutting Back

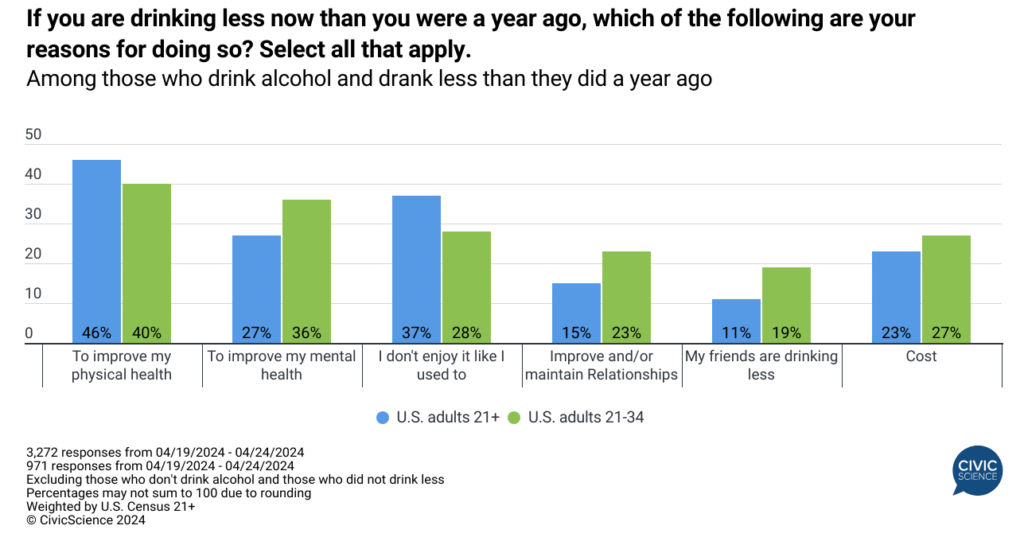

Still, additional CivicScience polling finds that as many as 64% of those 21+ – and 72% of Americans aged 21-34 – who drink alcohol say they’re drinking less now than they did a year ago. Their motivations for doing so differ quite a bit, with wanting to improve physical health and lack of enjoyment being the most common reasons. Cost is a prohibitive factor for close to 1-in-4 people who have cut back on drinking, as the price of beer in the U.S. rose considerably in 2023 alone.

Younger drinking-age Americans (under 35) are more likely than the Gen Pop to cite improving their mental health (+9pp), improving their relationships (+8pp), that their friends are drinking less (+8pp), and cost (+4pp).

Join the Conversation: Have you been drinking alcohol more, the same amount, or less in the past few weeks?

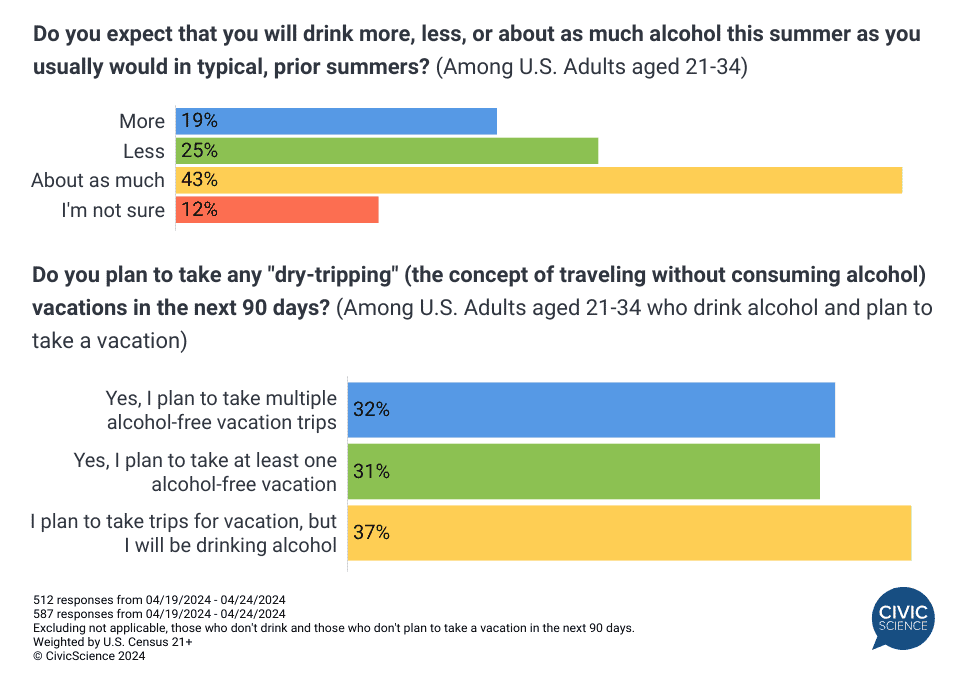

This trend of Americans drinking less does appear like it will carry over into the summer among some of the younger crowd. Roughly one-quarter of Americans of drinking age under 35 who drink alcohol report they’ll likely be drinking less this summer compared to past summers, however 19% expect they’ll be drinking more. That’s compared to just 12% of Gen Pop (21+) say they’ll drink more, while 24% plan to drink less.

Taking things a step further, “dry tripping,” or taking a trip entirely free of alcohol, looks to play a significant role in summer vacations this year among 21- to 34-year-olds in particular. CivicScience data show 75% of this age group who drink alcohol plan to take a vacation in the next 90 days. Among them, a significant majority (63%) plan to take at least one alcohol-free vacation, with 32% planning multiple dry trips.

Alcohol’s Loss Is Non-Alcoholic Beverages, Cannabis’ Gain

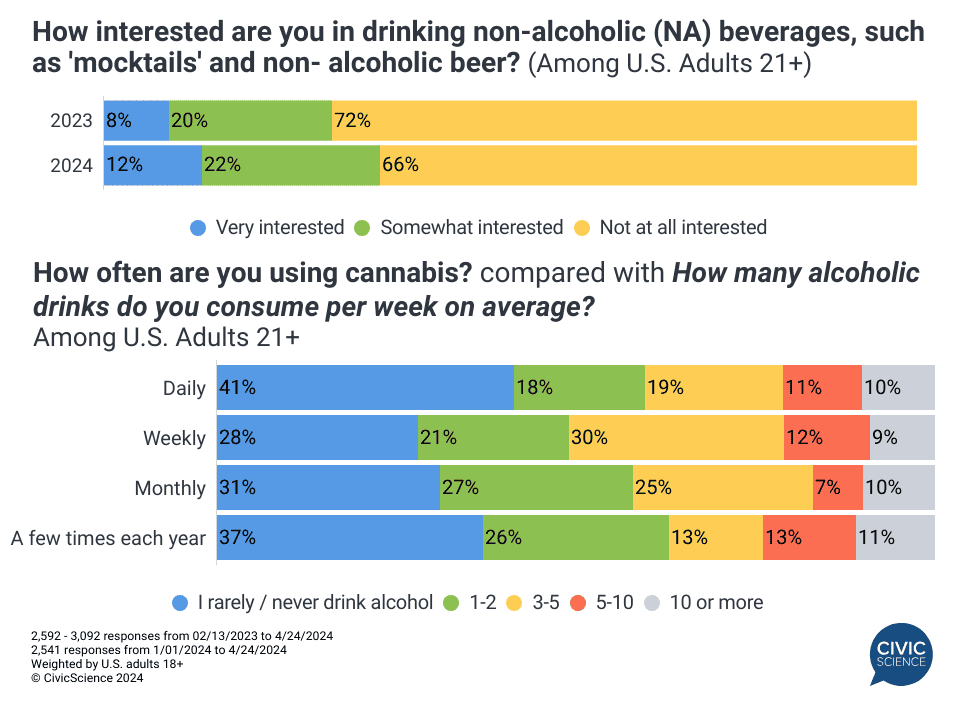

Interest in drinking alcohol may be on the decline, but that is certainly not the case for non-alcoholic beverages like zero-alcohol beers and mocktails. Ongoing CivicScience tracking finds that 34% are interested in drinking non-alcoholic beverages – a percentage that’s increased by six points since February 2023.

Data show there’s also a strong correlation between cannabis use and abstaining from alcohol, coinciding with a steady rise in daily cannabis usage since 2020. Notably, among U.S. adults (21+) who report daily cannabis use, a significant portion (42%) claim they rarely or never partake in alcohol consumption.

Take Our Poll: What is your favorite non-alcoholic drink for the summer?

With many motivations for reducing their alcohol consumption, it’s clear that the idea that younger Americans, in particular, are drinking less is not simply a temporary fad or something that’s confined to Dry January. Summer plans – sans alcohol – are already taking shape that should have restaurants, bars, and the travel industry as a whole on notice and prepared with alcohol-free options on hand.

If you’re interested in staying ahead of the curve or seeing where your customers stand on alcohol, contact us now to learn how you can utilize our InsightStore™ database of over 500K crossable questions.