The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real-time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures.

Excerpt From the Latest Reading:

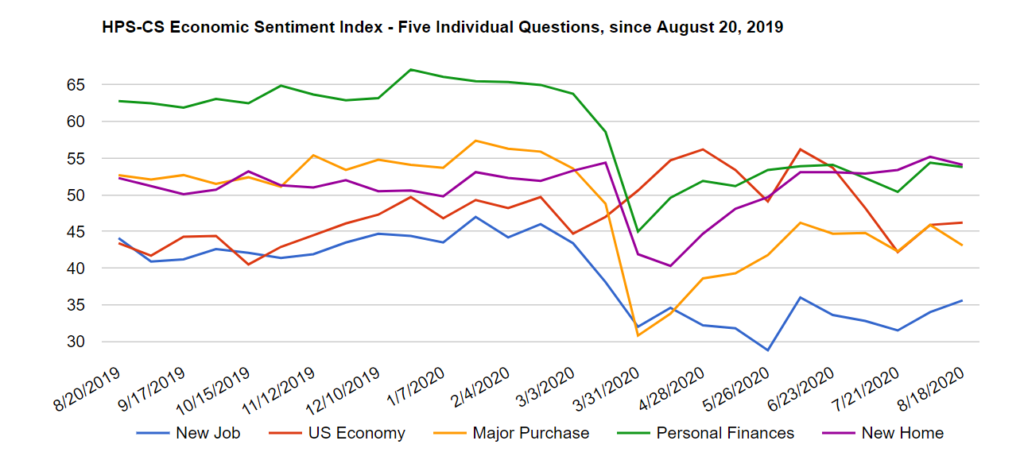

Economic sentiment trended downward over the past two weeks, reversing course from last reading’s surprising increase. The HPS-CivicScience Economic Sentiment Index (ESI) fell modestly, dropping 0.5 points to 46.6. Despite increases in confidence in the job market and the overall economy, economic sentiment fell on the whole, led by a significant decline in confidence in making a major purchase.

Three of the ESI’s five indicators fell over the past two weeks. Confidence in making a major purchase dropped the most, falling by 2.8 points to 43.1 and erasing most of last reading’s gains. Close behind was a 1.1-point decline in confidence towards the housing market, which fell to 54.1. Despite the decline, confidence in the housing market remains the ESI’s highest indicator as housing data continues to beat expectations and homebuilder confidence reaches a record high even while the delinquency rate for residential mortgages has risen. Confidence in personal finances also fell by 0.6 points to 53.8, hovering around its early summer levels. Meanwhile, confidence in the job market and the U.S. economy both rose, increasing by 1.6 and 0.3 points to 35.6 and 46.2, respectively. Despite its rise over the past month, confidence in the U.S. economy remains 10.0 points below its June numbers, while confidence in the job market has largely returned to early summer levels.

The downturn in sentiment follows the July jobs report which showed the economy added 1.8 million jobs, as well as the first time weekly jobless claims fell below 1 million since March. While the top-line numbers were positive in the July jobs report, some experts are concerned the data signals a slowdown in economic momentum and recovery. Despite these concerns, markets continue to tick upwards, with the S&P 500 hitting a new record high yesterday. There still remains a high level of uncertainty surrounding a new COVID-19 relief package, with no clear legislative path forward at the moment. The President did, however, sign a number of executive orders aiming to boost unemployment payments, provide a payroll tax holiday, defer student loan payments, and extend protections from evictions.