The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real-time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures.

Excerpt From the Latest Reading:

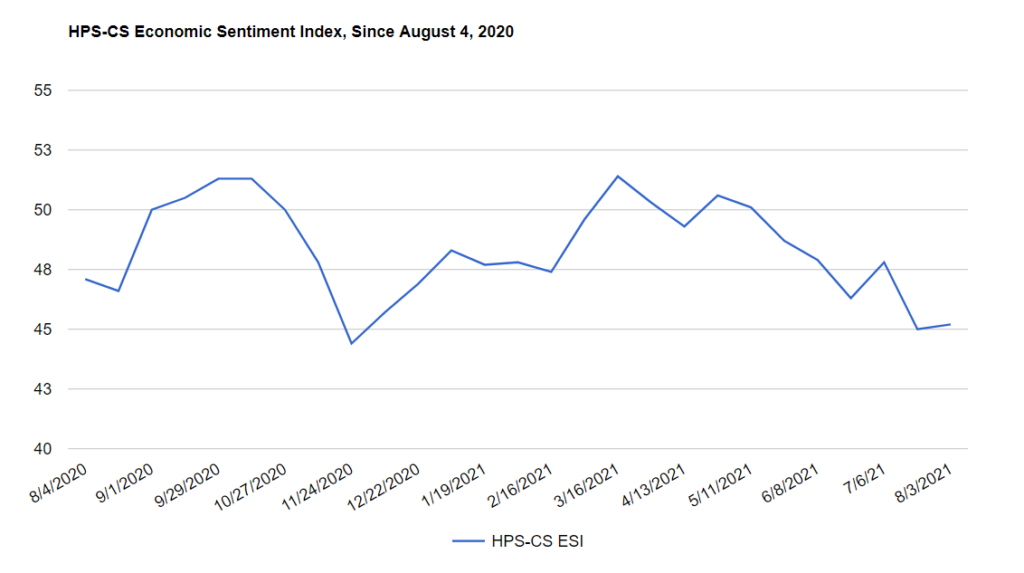

Economic sentiment eked out a positive gain over the past two weeks, amid questions surrounding inflation, vaccination rates, and new mask mandates. The HPS-CivicScience Economic Sentiment Index (ESI) added 0.2 points, driven mostly by a recovery in sentiment towards making a major purchase.

The ESI’s five indicators diverged substantially over the past two weeks. Making the biggest positive jump was confidence in making a major purchase, which rose 3.3 points to 36.3. The biggest decline, meanwhile, came in confidence in personal finances, which dropped 1.9 points to 55.6. American workers are benefitting from higher wages as the job market remains tight, yet the past few weeks raised new questions surrounding the impact of the COVID-19 Delta variant; companies including Apple and Google announced plans to push back return-to-work dates, while cities including Washington, DC reintroduced indoor mask mandates. The ESI’s other indicators made the following moves:

– Confidence in the overall U.S. economy rose 0.7 points to 46.6.

– Confidence in the housing market remained unchanged at 29.0.

– Confidence in finding a new job dropped 0.9 points to 58.6.