GUEST POST BY: – Director and BTIG Media Analyst

Originally posted on BTIG Research: Eight Key Takeaways from Fortnite’s Success

Almost overnight, Fortnite Battle Royale has become deeply ingrained in the American zeitgeist. It is impossible to scroll through social media without encountering a Fortnite reference or to spend a day at the office without hearing coworkers complain about the time and money their children are spending in the game. Fortnite has even found its way into professional sports, playing on the scoreboard during a recent Indians rain delay (link), inspiring celebratory dance moves for the Boston Red Sox (link) and keeping NBA players busy until the wee hours of the morning (link, with screenshot embedded to the right). Meanwhile, investors, publishers, and even other industries are wondering what to make of Fortnite.

Investors are clearly nervous about the impact of the game – not just because Fortnite’s popularity is likely cannibalizing time spent in other games, but also as the “sudden” emergence and success of a free-to-play game throws into question the barriers to entry for AAA publishers and the sustainability of their existing business models.

We have agonized over Fortnite’s impact over the past several weeks. With the help of survey work from CivicScience, we have come to eight key takeaways for investors and publishers.

Video game publishers are certainly facing near-term competition from Fortnite. However, Fortnite’s success reminds us of, and even epitomizes the enormous opportunities for publishers brought by connectivity, especially as they continue to transition to the games as a service (GaaS) model. And, the learnings from Fortnite’s success may actually help the major publishers in the GaaS transition and to unlock new growth opportunities.

Eight Key Takeaways from Fortnite’s Success

1) Video Games Taking Share of Time and Attention

All entertainment companies, whether linear or interactive, are competing for one thing: consumers’ time. Video games have increasingly taken more and more share of consumers’ time globally at the expense of numerous other activities, whether it is linear television (#goodlucktv) or participation in stick and ball sports. Fortnite is just an extreme example of a trend that is lifting all publishers. The success of each individual game is not zero sum for the industry.

2) Fortnite Luring Non-Gamers

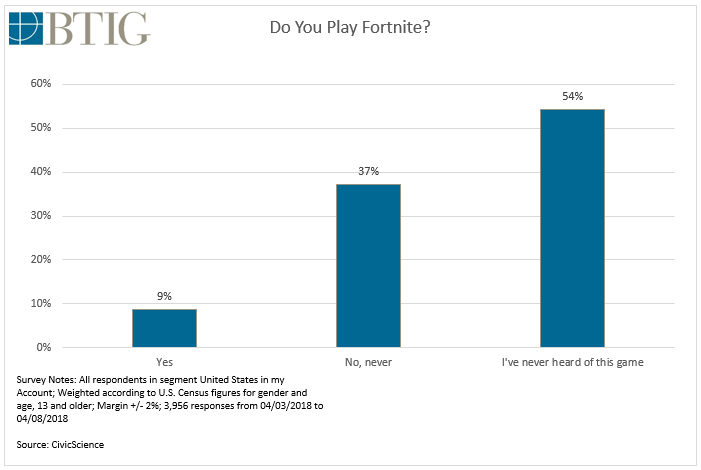

CivicScience conducted a survey for BTIG of 3,955 persons aged 13+ (margin +/-2%) to determine who is playing Fortnite. The survey indicated a very high awareness and a large active player base. In total, 9% of respondents said they are playing the game and 46% were aware of the game.

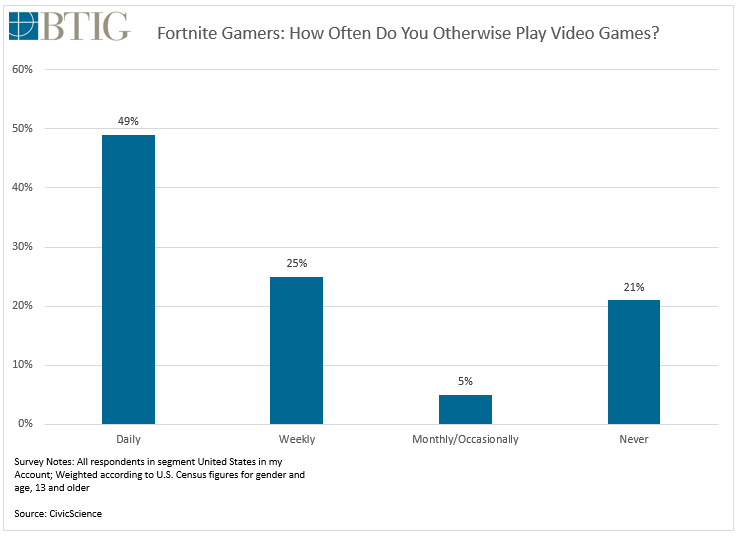

But what was much more interesting is that 21% of respondents playing Fortnite were previously non-gamers. Another 5% played games only monthly or occasionally.

There are several possible explanations for the game’s popularity with non-gamers including it being free-to-play, fun to play, having an easy learning curve, available across all devices including mobile and having shorter play sessions.

Regardless, the sheer size of non-players in the base indicates Fortnite cannibalization is likely less than many fear. Even more importantly, this illustrates a meaningful opportunity for publishers to not only serve their core players but to unlock brand new players that the industry is not currently serving.

While the survey did not focus on men/women, we also sense Fortnite has a far greater percentage of female players than we would normally expect to see from a first-person shooter game; yet another potential opportunity for publishers.

3) Fortnite Skews Young

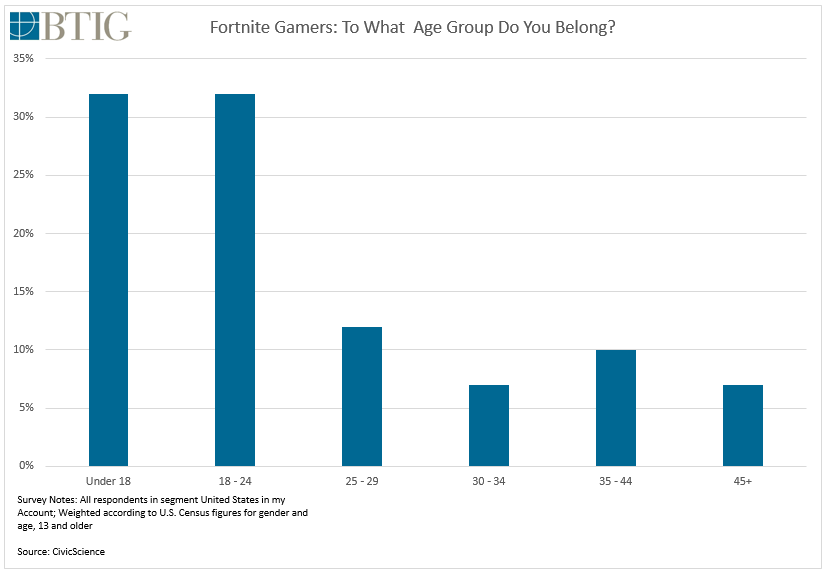

The audience playing Fortnite is young. The survey found 64% of players to be 24 years old or younger, including 32% under 18. Note, the average age of a U.S. video game player in 35, according to the Entertainment Software Association, with the average age actually climbing throughout this decade.

This puts younger skewing games more at risk for cannibalization. For instance, at ATVI, we are more concerned about its impact on Overwatch than Call of Duty.

4) Fortnite Did NOT Happen Overnight

In our view, the biggest investor misunderstanding about Fortnite Battle Royale is the idea that the game came out of nowhere from a random publisher, and in turn, AAA publishers’ barriers to entry are weaker than previously thought.

If investors want to say that about PUBG, which came from the less known Korean publisher Bluehole (which has actually been around over 10 years), we would understand. But Epic has been around since 1991. It also owns a successful game engine, Unreal Engine, on which numerous developers have built hundreds of games (in fact both PUBG and Fortnite run on the latest version – Unreal Engine 4). And it has had some success with its own titles, including the Gears of War series that it sold to Microsoft.

The main reason Epic was able to create Fortnite Battle Royale so quickly on the back of PUBG’s success was that Fortnite had actually been six years in the making. Epic had been developing a PvE game, now known as Fortnite Save the World, on which it was continually iterating. It simply leveraged that development to create a battle royale mode. In addition, Epic was advantaged with the resources of money and talent to make that transition.

It should also be noted that Tencent is a 40% owner of Epic. So, Epic was able to leverage Tencent’s expertise in the games as a service model and especially free-to-play, in putting Fortnite Battle Royale together.

If anything, the history of Fortnite reinforces our view that making games is hard, and EA, ATVI and TTWO have a significant moat, especially on console.

5) Fortnite’s Cross-Platform Success Reveals Mobile Opportunity for AAA Publishers

One of the major innovations of Fortnite Battle Royale is that it is truly cross-platform (thanks to the flexibility of Unreal Engine 4). The same exact game, with the same map, is available on PS4, Xbox, PC, Mac and iOS (and soon Android). If players like, they can play with friends or other players using different hardware.

Fortnite has been successful across each platform. But what is most intriguing has been its success on mobile, which in some ways is unprecedented. In the East, “core” games, especially based on PC IP, have become big business on mobile (Tencent has multiple games based on PUBG in the market), so much so that they represent many of the highest grossing mobile games in the world. Yet, in the West, very few core games, especially with high twitch factors, have succeeded on mobile. None had come close to being a top grossing app, prior to Fortnite.

Thus far, outside of acquisitions, the major U.S. AAA publishers have had very limited success on mobile. However, being able to leverage their PC and console IP more effectively on mobile could help change their fortunes and become a tremendous source of incremental profits. While we thought near-term this opportunity was only available to these publishers in the East, Fortnite may have opened the door in their home market.

6) The Importance of Putting Fun Before $$$$

It is easy to forget that the games as a service model is still in its infancy. Studios are still learning how to create games that maximize engagement, and especially how to best monetize that engagement. They will improve by learning from their own experiments and from the successes and failures of others.

The industry would be wise to learn from Epic’s success. Last month, Gamasutra interviewed Fortnite Battle Royale Design Lead, Eric Williamson and Producer Zack Estep (link). One thing that stood out from the interview is that the number one priority of the team creating the game mode was to make it a fun experience for the player. One quote that stood out by Williamson: “It’s a silly thing to say, but we were so focused on fun and making the experience enjoyable above all else that those are kind of happy accidents along the way. It’s great we have that exposure on Twitch and that people are picking up the game as they are, but the core for us was focusing on the fun, and making sure it puts a smile on your face.”

Fortnite’s success reinforces our view that in the GaaS world, if game designers focus first on “delighting” gamers, they will build engagement, and players will be happy to spend. In contrast, games such as Battlefront 2, which focus on the business model first, will raise the ire of the gaming community and have less success.

The best monetization techniques actually enhance the player experience and help grow engagement on their own. Fortnite’s Battle Pass subscription has actually been additive to the experience, with weekly challenges becoming an integral part of the game experience for many subscribers, while its emotes have become part of Fortnite’s universal charm. And dividing the game into seasons was also a smart innovation, adding recurring revenue but also giving players something to look forward to and debate.

Fortnite has monetized its player base. In February, Fortnite was already the third highest grossing game on console, according to SuperData (link). The mobile launch has gone similarly well. Sensor Tower estimates the game earned $25mm in its first month on iOS and is run-rating over $1mm per day now (link). Beyond Battle Pass, Fortnite’s expensive in-game items have sold. When Fortnite put its $20 Raven skin on sale, it crashed Epic’s store.

7) Streaming and Social Can Accelerate a Game’s Success

Social media has clearly had a profound effect on the growth of Fortnite. The game’s constant presence on social media, whether in celebrity accounts or the likes of Barstool, is likely largely responsible for its insertion into the American zeitgeist and its popularity among non-gamers. We have never seen a game lifted by non-gamer social media like this before.

What is not new is the impact of streaming video on the success of a game. Games that build audience on Twitch and also YouTube benefit from an additional virtuous circle, with time spent viewing deepening players’ relationship with a game and leading to more time spent within those games etc. The battle royale genre has had massive success on streaming video; PUBG was the most watched game on Twitch at times in 2017 and Fortnite is seeing engagement that no game has ever seen on Twitch. Last week, 173k viewers were watching Fortnite on Twitch during the average minute, representing nearly a third of viewers on the platform. One streamer, Ninja, now has over 6mm followers on Twitch. He amassed a peak audience of 680k viewers last weekend for one event, breaking the record he set playing Fortnite with Drake.

8) Free-to-Play Creates New Growth Opportunity for Publishers

Fortnite’s success will undoubtedly encourage more FTP offerings from more Western publishers – even on console. This has been a source of understandable investor anxiety. Besides offering more competition to publisher’s traditional business model games, investors fear it could change consumer expectations and jeopardize AAA publishers’ legacy business model.

We hope to learn more about how AAA publishers feel about expanding FTP offerings in the wake of Fortnite’s success. Take-Two’s Strauss Zelnick has already spoken out on the topic, in response to our question on TTWO’s fiscal Q3 2018 earnings call:

“If your question is whether the business model moves in that direction, I would say it probably can’t because in a free-to-play true — free-to-play environment, 10-ish percent of your consumers maximum are paying you and that’s not going to support the very significant investment that an AAA title requires here and in our competitors’ shops. And we think consumers understand that and I think to the extent people want to continue to have big AAA experiences and they do, and they are prepared to pay what ultimately is a very low price given the massive number of hours that one can spend enjoying the titles.”

We agree with Zelnick that shifting expensive, high profile games such as Grand Theft Auto to free-to-play does not make financial sense at this time. The increased risk and incremental revenue from increasing the player base is highly unlikely to offset the lost game sales revenue. A more likely scenario from these publishers is wider adoption of subscriptions that incorporate AAA first run games, as Xbox is now offering as part of Game Pass, and we believe will eventually happen on EA Access.

But Fortnite’s success illustrates there is an opportunity to have success in FTP games, especially as these companies improve at in-game monetization. And FTP can help unlock new players (age/demos) and expand the market for gaming. Publishers should likely take more risk in building FTP games or offering free modes of paid games. Even if there is some cannibalization of the publishers’ bigger paid titles, the overall market opportunity in terms of players and dollars spent is growing and it will likely take multiple business models to maximize longer-term success.

As the fate of other entertainment businesses such as television and music have taught us, if incumbents only focus on protecting their legacy business models and do not innovate, despite the inherent risk of disruption, they are likely to be left behind.