The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real-time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures.

Excerpt From the Latest Reading:

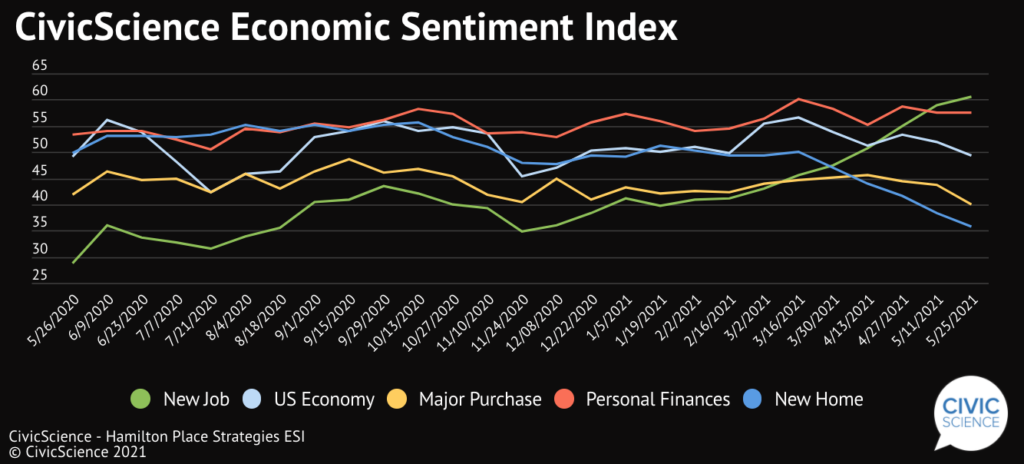

Overall economic sentiment fell again over the last two weeks, according to the HPS-CivicScience Economic Sentiment Index (ESI), dropping 1.4 points to 48.7. While job market confidence increased another 1.5 points to 60.5, an all-time high for the third reading in a row, housing market confidence tumbled 2.6 points to 35.8, a record low for the second consecutive reading.

As COVID-19 restrictions dissipate, jobs are plentiful, but workers are not. Especially in lower-wage industries like hospitality, positions are widely available—but employers are struggling to fill them. On the other hand, intense demand and short supply are driving home prices to grow at the fastest pace in 15 years. These forces in the job and housing markets are tugging overall economic sentiment in polar opposite directions; the remaining three ESI indicators also display a mixed consumer confidence:

– Confidence in the U.S. economy dropped 2.6 points to 49.4.

– Consumer confidence in making a major purchase fell 3.6 points to 40.0, the lowest reading in 2021.

– Confidence in personal finances ticked up 0.2 points to 57.6.