The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real-time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enables more granular analyses than are currently possible through prevailing measures.

Excerpt From the Latest Reading:

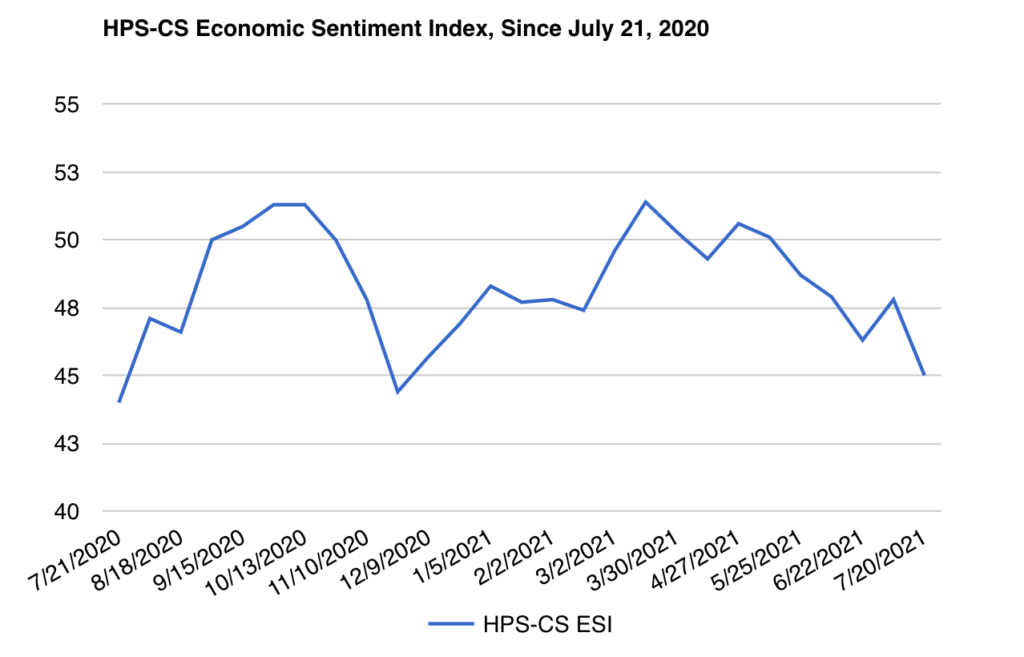

Economic sentiment fell to its lowest point so far in 2021, as the HPS-CivicScience Economic Sentiment Index (ESI) dropped 2.8 points to 45.0. Amidst a surge in inflation worries, confidence in making a major purchase and confidence in the housing market drove a significant decline.

After briefly reversing in the last reading, the months-long divergence between confidence in big-ticket purchase indicators and confidence in finding a new job once again entrenched itself over the past two weeks. Confidence in making a major purchase dropped 6.2 points to 33.0, the biggest single decline since the March 31, 2020 reading, while confidence in the housing market dropped 3.9 points to 29.0. Confidence in finding a job was the only indicator to rise over the past two weeks: It jumped 1.1 points to 59.5. Consumers reported record complaints about inflation on big ticket purchases, while the average home loan reached a new record high of $392,370. The other indicators to fall were:

– Confidence in personal finances dropped 2.6 points to 57.5.

– Confidence in the overall U.S. economy dropped 2.5 points to 45.9