The HPS-CivicScience Economic Sentiment Index (“ESI”) is a “living” index that measures U.S. adults’ expectations for the economy going forward, as well as their feelings about current conditions for major purchases. The primary goal of the Index is to accurately measure movements in overall national economic sentiment and to provide a more sophisticated alternative to existing economic sentiment indices. Unlike other prominent indices that release consumer sentiment estimates infrequently, the HPS-CivicScience Index is updated in real-time as responses are collected continuously every hour, every day. Large-scale cross-tabulation of survey responses and consumer attributes enable more granular analyses than are currently possible through prevailing measures.

Excerpt From the Latest Reading:

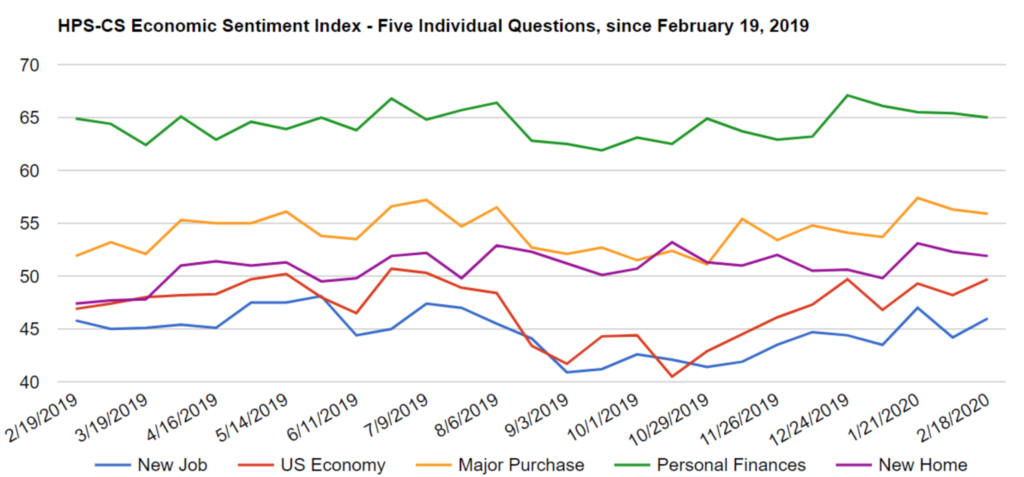

Consumer confidence increased slightly over the past two weeks, according to the HPS-CivicScience Economic Sentiment Index (ESI), rebounding from a plunge in confidence in the last reading. The ESI rose by 0.4 points to 53.7 over the past two weeks. The modest rise was driven by significant improvements in sentiment towards labor markets and the broader U.S. economy, which were largely offset by continued drops in the Major Purchases, Personal Finances and New Home indicators.

Two of the ESI’s five indicators increased over the past two weeks. Consumer confidence in labor markets experienced the largest improvement, rising by 1.8 points to 46.0, while confidence in the broader U.S. economy rose 1.5 points to 49.7. These increases were largely balanced out by drops in other indicators. Confidence towards making a major purchase and housing markets both dropped by 0.4 points to 55.9 and 51.9, respectively. Consumer confidence in personal finances dropped 0.4 points to 65.0.

The moderate increase comes after the release of a better-than-expected jobs report for January, with unemployment remaining near 50-year lows and the labor force participation rate reaching a seven-year high. Weighing on the economy, however, is the continued threat posed by Covid-19 and its creeping impact on earnings.

Check out the full reading.