The Gist: Amazon may be slaying, but the majority of American shoppers still prefer a real shopping cart.

Recently, we posted about Walmart shutting down several of its Sam’s Club stores and converting them into e-commerce distribution centers. The company hopes to gain traction in its online shopping front.

With Amazon and newcomers like Boxed transforming the retail landscape, it seems only natural for traditional discount retail stores to heed the call of the great and mighty internet and step up their online presence — a motion that is seconded by others, such as Business Insider.

But, to what extent should they?

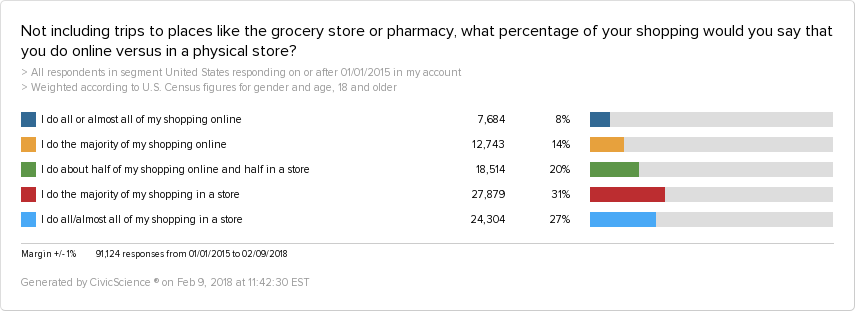

We asked whether people prefer to do more shopping in stores or online.

It turns out that 22% of respondents do more shopping online, while 58% do more shopping in stores.

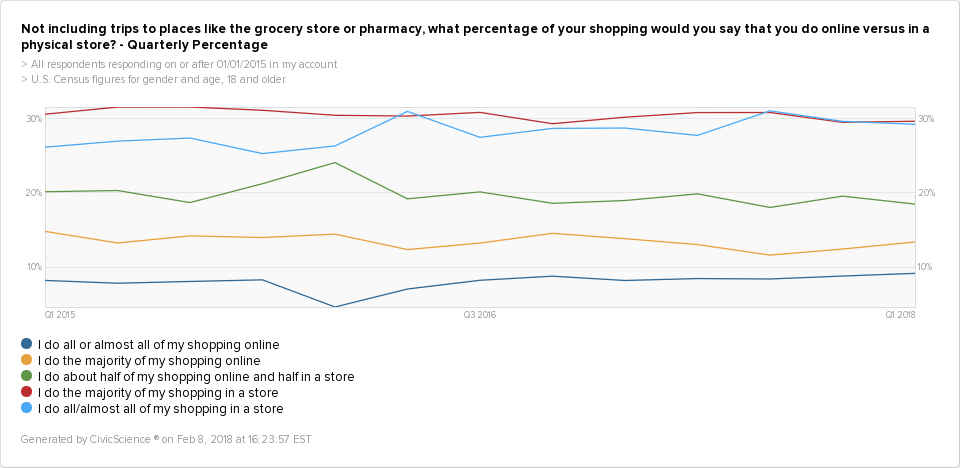

What’s odd is that since 2015, the number of folks who claim to do more online shopping has not increased nearly as dramatically as you might have expected.

In the past year we’re seeing a slight increase in online shopping, but only by 1-2%.

Even though more people are favorable to Amazon than to Walmart (58% to 48%), Amazon and online competitors are still in second place when it comes to where Americans are buying the bulk of their retail goods.

Walmart / Sam’s Club vs. Amazon

We looked at the shopping habits of those who “like” or “love” to shop at Walmart and Sam’s Club. We found that 64% of those favorable to shopping at Walmart (and 60% of Sam’s Club shoppers) do more shopping in stores than online.

Those numbers have fluctuated a mere 1-2% since 2015.

As for Amazon, you would think that a much higher percentage of those who like or love shopping at Amazon would do more online shopping, but not necessarily. An average of 30% of those favorable to Amazon are doing more shopping online. Even in Amazon territory, we’re still seeing Americans preferring to shop more in stores.

But – Millennials!

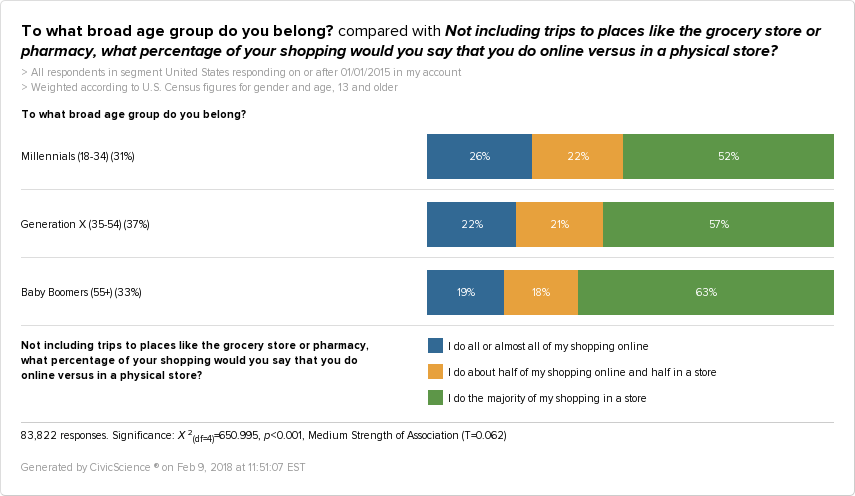

Some argue that Millennials are more likely to buy online and so it’s prudent for Walmart to begin moving in that direction. They may be right.

We’re seeing that 26% of Millennial respondents do more of their shopping online – that’s above the average – in comparison to 19% of Baby Boomers.

So it makes sense for companies like Walmart to continue pushing forward in the online retail direction. In fact, research cited in Forbes positioned Walmart as the third largest online seller in the U.S. by the end of 2017, behind only Amazon and eBay.

But if their customer base has anything to say about it, Walmart stores shouldn’t go the way of the dinosaur anytime soon. We can speculate as to why, but it’s likely convenience has something to do with it – it’s estimated that there is one Walmart store within 10 miles of 90% of the U.S. population.

Online retail certainly offers its own brand of convenience, but how does it compare? We’ll be taking a closer look at what convenience means in today’s economy in an upcoming post.