This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

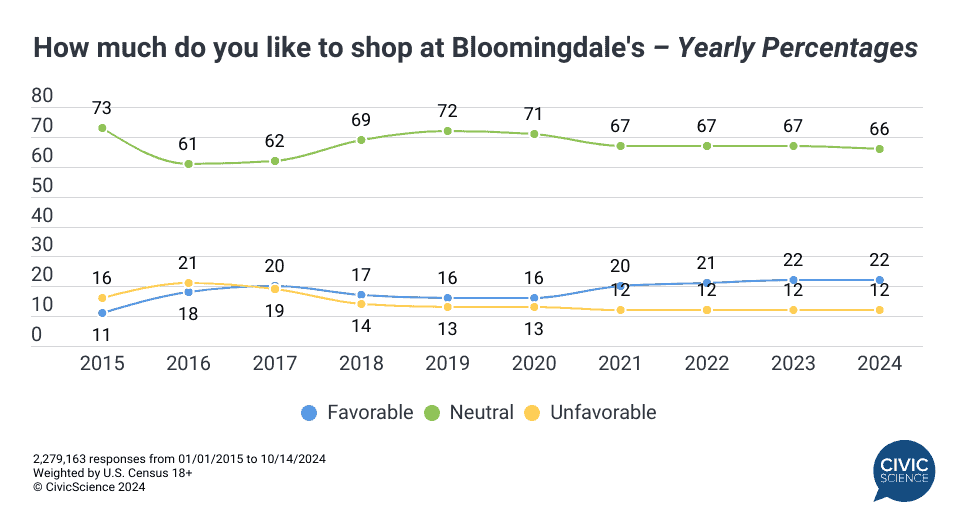

Even with the advent of direct-to-consumer brands, big-box stores, membership clubs, and dozens of shopping opportunities across the internet, the ingenuity of the department store still provides today’s consumers with high-end, one-stop-shopping. Bloomingdale’s is a dynastic and influential name among American consumers. And their popularity has continued to grow: Bloomingdale’s current favorability rating is at its highest point (22% of the Gen Pop) since CivicScience first began tracking its brand sentiment more than a decade ago. The last four years appear to be the most transformative for the retailer, rising several percentage points since 2020.

What can we learn about this growing segment of Bloomingdale’s shoppers? As we enter the busy holiday shopping season, what can we expect to see for Bloomingdale’s, as well as department store shopping in general?

Take Our Poll: How would you rank Bloomingdale’s among all department stores?

The Bloomingdale’s Shopper

Pulling from CivicScience’s vast database of 10K always-on consumer attributes yields key correlations among Bloomingdale’s customers. Bloomingdale’s fans are usually identifiable by the following characteristics:

- Clothing and accessories purchases are influenced by social media.

- Greater likelihood to use a smartphone rather than a tablet to make purchases.

- Use of augmented reality shopping apps and high intent to try them.

- Traveling for pleasure is a passion of theirs.

- High utilization of eBay (53% claim to be users).

- Greater likelihood to buy organic food when possible.

In general, Bloomingdale’s fans prefer department stores and luxury retailers to specialty brands like J. Crew, GAP, or Banana Republic. Digging deeper, data show that Bloomingdale’s fanbase is highly correlated with the Nordstrom fanbase, which stands out as a primary competitor: 86% of Bloomingdale’s fans are also big fans of Nordstrom.

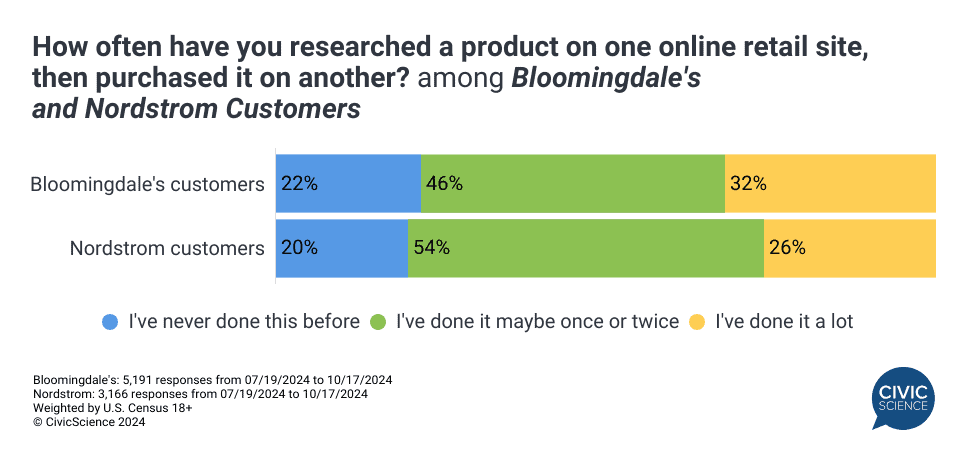

It’s possible to interpret a love of Nordstrom among Bloomingdale’s customers as having a connection to price or inventory. One-third of Bloomingdale’s fans say they often use one website to research a product but another site to purchase that product. This type of purchasing behavior is occurring less frequent among Nordstrom customers.

As an example, when purchasing beauty products, Bloomingdale’s fans are more likely to favor brand over price than Nordstrom fans, who show more price sensitivity in this category. A similar dynamic is observed in the apparel category with Bloomingdale’s fans being more brand-conscious than Nordstrom fans, although price sensitivity is comparable.

Loyalty to brands is stronger among Bloomingdale’s favorables than it is among Nordstrom favorables which means its customers are more inclined to shop around for the logos and labels they love. If a retailer’s selection, prices, or inventory doesn’t satisfy, they will take their business to one that does. The long-term goal for Bloomingdale’s will be to tailor their customer experiences in such a way that increases trust in and devotion for its own name.

Holiday Shopping – How Can Bloomingdale’s Win This Year?

As the holiday shopping season picks up speed, Bloomingdale’s can boast a much greater percentage of shoppers who anticipate spending more this year than Nordstrom or Macy’s customers. Both Bloomingdale’s customers and Nordstrom customers over-index in likelihood to shop in physical stores this year, and both customer groups are significantly more likely than the average holiday shopper to visit department stores, malls, and mall events to complete their shopping.

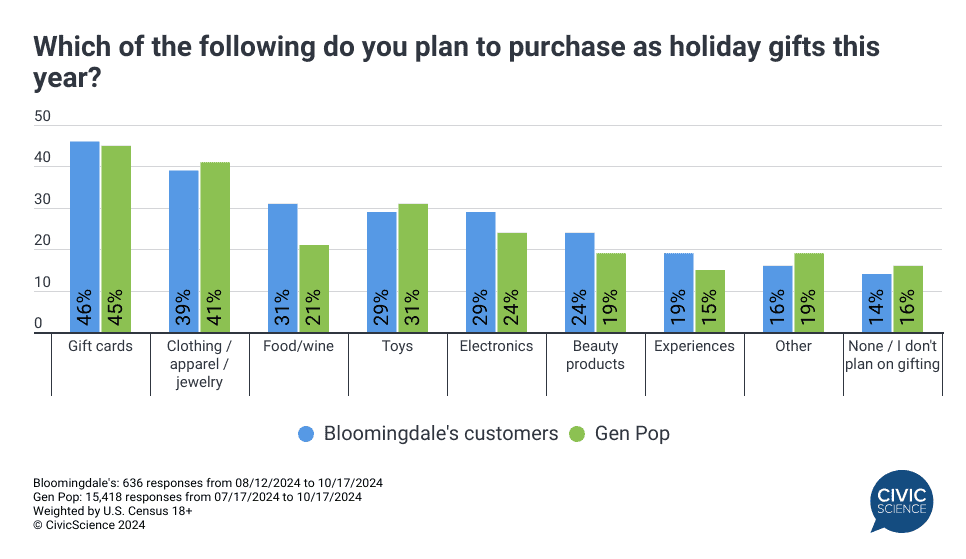

Like most holiday shoppers, Bloomingdale’s and Nordstrom fans will predominantly purchase gift cards and clothing. Where the Gen Pop chooses to forgo holiday shopping, Bloomingdale’s customers will purchase items in the beauty and food/wine categories.

Compared to the average holiday shopper, Bloomingdale’s and Nordstrom customers are much less influenced by a store’s deals and promotions. When deciding where to make purchases, Bloomingdale’s and Nordstrom shoppers consider shipping and financing options. Despite drastically under-indexing the Gen Pop’s rates of online shopping this holiday, Bloomingdale’s fans are more than twice as likely to select a retailer based on its ability to provide expedited shipping.

Ongoing CivicScience polling holds hundreds of insights about lovers of Bloomingdale’s. Using tracking data on competitor strategies and its own favorability ratings, Bloomingdale’s will be able to maximize its effectiveness and have its most successful holiday season yet. Key points from these findings include solidifying the Bloomingdale’s brand so shoppers don’t have to think twice about where to take their business, leaning into specific gifting categories, and bolstering the in-store experience so it stands out from its competitors.

Join the Conversation: Do you shop at department stores frequently?