Last week, Pandora came out with a new service called Pandora Premium. With a $10 monthly payment, users will be able to skip ads, curate playlists, and receive top-notch music recommendations.

The company boasts that Pandora Premium is unlike any other streaming service, though the initiative has been met with a fair degree of skepticism. In such a saturated musical market, how can Pandora compete?

Well, we found out.

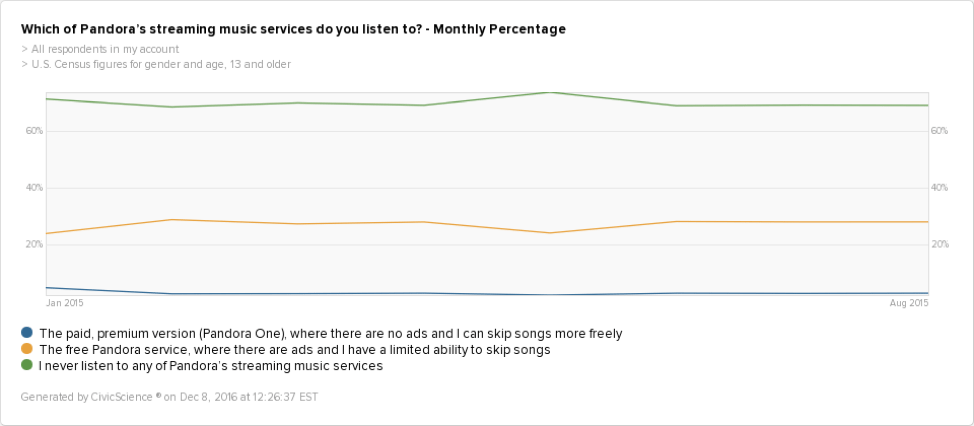

We’ve been tracking free and paid Pandora use for years:

As you can see, more people are using Pandora now, but most of them are using its free service. Those who pay have remained at a steady 3-4%.

However, we considered the traits of those who currently use its free service (beyond simple age and gender demographics) to reveal some insights that may help Pandora sway current free-service users.

As a starting point, we found that 26% of them would be willing to pay for ad-free video streaming, so why not ad-free music streaming as well?

As Pandora surely knows, these folks are much more likely to air on the younger side, from 18-34. All the corresponding social media traits naturally follow. They’re more likely to use Snapchat, Pinterest, Facebook and Instagram. They are also more likely to go to the movies at least once a month and use Netflix.

Although these folks, akin to others of their age demographic, are more likely to be influenced by social media, and have their music taste influenced by social media, they are also able to stand out. What do we mean?

They are more likely to try new products before other people do, and to tell others about new brands and technology. With Pandora’s personalized music recommendations, which the company claims to outperform other similar technology, these folks may be convinced to pay in order to get a close look at cool music that they can share.

Interestingly, they like alcohol…a lot. They are more likely to drink pretty much every alcohol, from brown spirits and clear spirits to beer and wine. This love of alcohol presents several opportunities. Pandora Premium may want to sponsor certain liquor advertisements, and associate its service with the warm buzz that these folks appreciate.

They also enjoy a good sports game! They’re more likely to attend sporting events regularly, and to follow both the NBA and NFL. So, sports partnerships and endorsements may present several opportunities as well.

One of the strongest brand correlations we found among these folks is with Beats by Dre, owned by Apple. This group is more likely to favor the celebrity-saturated headphone brand.

Lastly, they’re more likely to exercise regularly. Because of this, Pandora may want to advertise the new service’s offline and ad-free capabilities that could accompany this group in their frequent workouts.

Although Pandora will have a huge battle ahead if it hopes to compete with other paid music streaming giants, it’s not impossible. Capitalizing on the traits of current free users to convert them into premium paying customers may help the new service become much more successful.