This is just a sneak peek at the thousands of consumer insights available to CivicScience clients. Discover more data.

The holiday season is a time for spreading cheer, joy, and gifts. However, in the effort to make the season special, some gift-givers needed to take on debt to cover the costs of doing so. According to CivicScience data collected through December 24, 16% of American holiday shoppers planned to take on debt for holiday gifts this year – a three-point increase from 2022. Now that the holidays have passed, how confident are these shoppers in their ability to repay the debt, and what it might mean for consumer spending in 2025?

What to Know – Concerns Increase About Repaying Holiday Debt

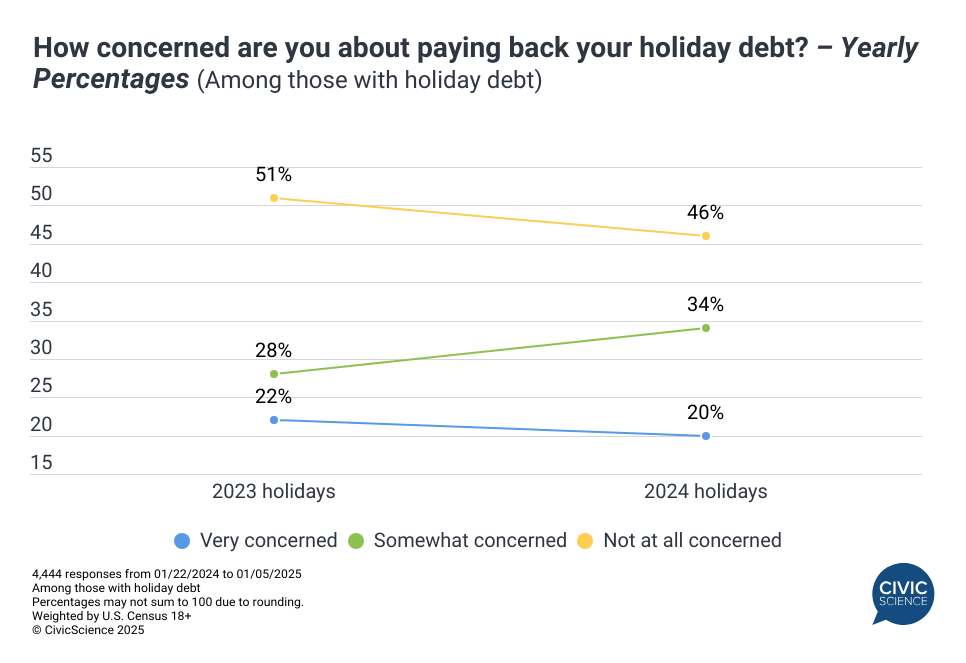

It’s unsurprising that taking on debt can be a stressful proposition. CivicScience polling finds more than half (54%) of respondents who took on debt to pay for holiday gifts are at least ‘somewhat’ concerned about paying that debt back. That percentage, however, has gone up by four points from last year’s holiday season (50%) and includes 20% who are ‘very’ concerned.

Additional data highlight the key demographics most concerned about repayment, with women, individuals under 45 – particularly Gen Z – Democrats, and residents of the West and South showing the highest levels of concern.

Answer Our Poll: How concerned are you with the amount of debt you accumulated this holiday season?

Buy Now, Pay Later Debt Mounts

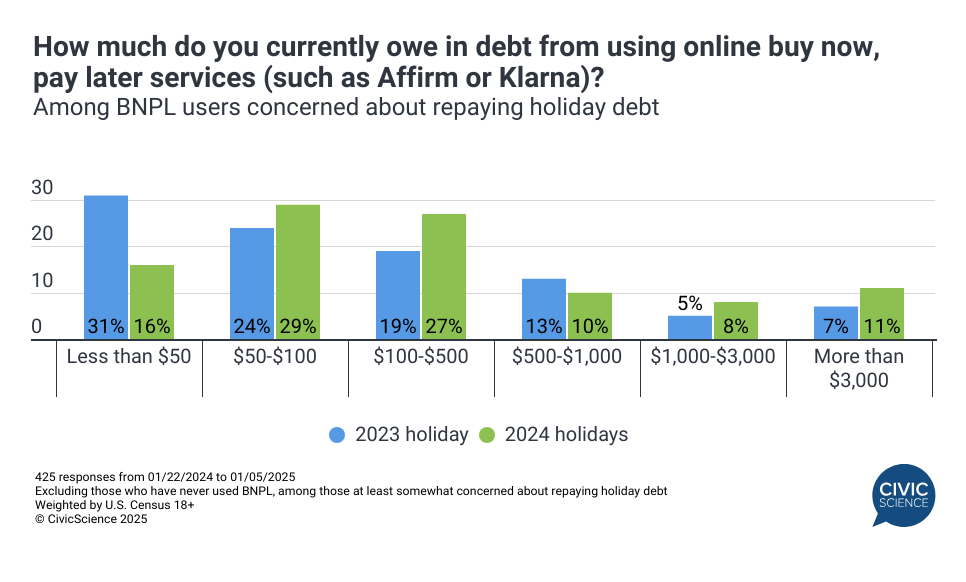

Earlier CivicScience data showed that 2024 holiday shoppers were less likely to use Buy Now, Pay Later (BNPL) services. However, new polling reveals that those who did are carrying higher balances this year. Among BNPL users concerned about repaying their holiday debt, 29% report owing $500 or more, up from 25% following the 2023 holiday season.

Why it Matters for 2025

As holiday debt repayment looms, new CivicScience data sheds light on the actions being taken by those who are at least ‘somewhat’ concerned about repaying their holiday debt to improve their overall financial situation. Key strategies include cutting back on spending at bars and restaurants, reducing purchases of non-essential grocery items, and opting for generic or private-label products over brand names.

A close look at just a few brands shows that impacts span different industries. For example, CivicScience data show that roughly three in four customers of GNC, L’Oréal, and Jersey Mike’s Subs report carrying at least some holiday debt this year. While not all of those with debt are concerned about paying it off, GNC customers, in particular, hold the highest levels of concern about repayment.

This is just the tip of the iceberg of the data available, want to see the full picture or the actions that your customers plan to take? Let’s talk.

Cast Your Vote: Which debt should be paid off first?

It’s clear that holiday debt is weighing heavily on consumers’ minds as the new year begins. Some have already shifted spending priorities or plan to do so soon, while others are increasingly reliant on gift cards to get by on essentials. Whatever action they’re eyeing, it’s essential for brands to monitor the impacts of holiday debt on their customers in the weeks and months ahead.