CivicScience captures millions of survey responses every day to turn real-time consumer insights into high-performing advertising. Learn how we drive impact here.

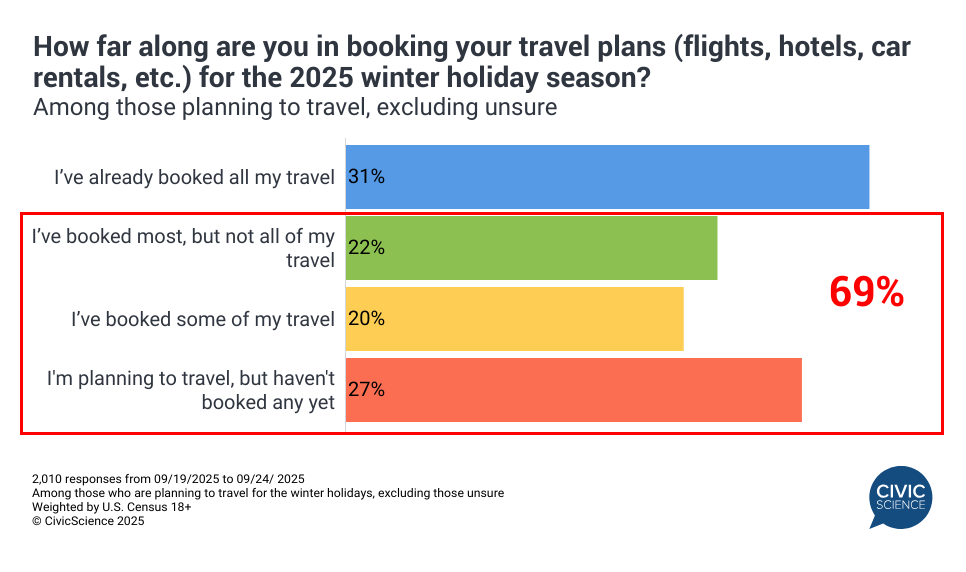

While travel brands wait for peak booking season, 69% of holiday travelers still haven’t finalized their plans—representing a massive opportunity for brands that act now.

Pinpointing High-Intent Holiday Travelers With Data

As winter holiday itineraries take shape, advertisers can catch consumers before their plans are set in stone. CivicScience data shows so far that 36% of U.S. adults intend to travel, and another 14% are undecided. This represents a massive addressable audience: 50% of U.S. adults are still in the market for travel-related purchases.

Among committed travelers, 69% still have bookings to finalize—a timely opening for brands to guide decisions on flights, hotels, dining, and more. Holiday travel decisions accelerate rapidly in November—brands that activate these holiday travel insights now can capture share before competition intensifies.

CivicScience data provides a closer look at the trends shaping how—and where—holiday travelers are spending, and how they can optimize budgets to capture this season’s travel dollars:

Who’s Traveling: Those planning to travel this year are most likely to be between the ages of 18-44, parents, earn $100k+, and male. That said, those still needing to book arrangements are more likely to be women and non-parents.

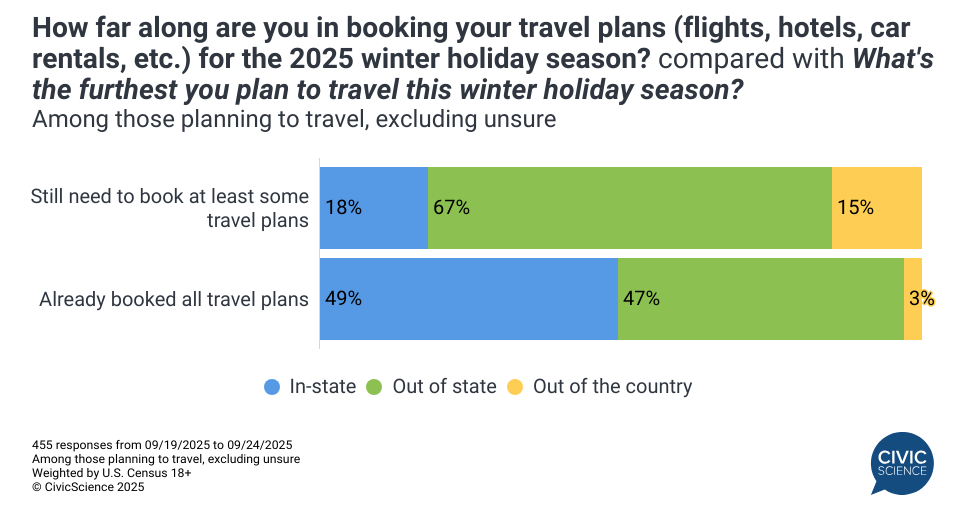

Out-of-State Holiday Travel: Eighteen percent of those still booking their holiday travel plan to stay in-state (vs. 49% of those already fully booked). The substantial majority (69%) say their furthest holiday travel will be out of state, 20 points higher than those who have already booked. Thirteen percent, meanwhile, are eyeing international destinations, 5x higher than those with solidified plans.

Accommodations: Planners are split nearly evenly between staying at hotels, bed and breakfasts, or motels (36%) and staying with family and friends (35%). Fewer (20%) plan to stay at a rental property.

Value Beats Comfort: Seventy-eight percent of holiday travel planners say they are likely to consider less convenient or comfortable travel options to stay on budget when they travel.

Using AI to Plan: They’re also more than twice as likely as the Gen Pop (34% vs.14%) to have used generative AI for trip planning (e.g., finding destinations, itinerary planning) in the past month.

The Holiday Travel Revenue Opportunity

The data reveals multiple high-value revenue streams:

- Out-of-state travelers (69% of uncommitted bookings) represent higher spending per trip

- International destination interest (13% vs 2.6% of booked travelers) signals premium pricing acceptance

- Budget-conscious mindset (78%) creates opportunities for value-positioning brands

- AI-assisted planning (34% usage) indicates tech-savvy, efficiency-seeking travelers

Targeting Travelers With Planning Left to Do

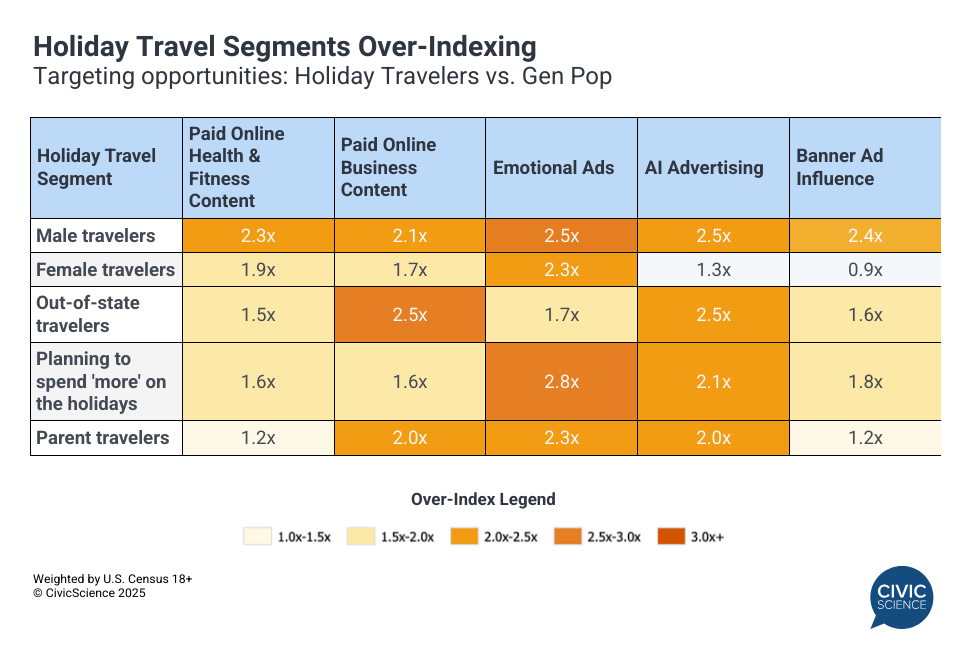

Here’s a glimpse of how CivicScience uses millions of daily self-reported consumer intent data points to build high-performing ad campaigns. (Note: The following compares segments among those planning holiday travel and have at least some booking left to do compared to U.S. adults 18+.)

Digital Content Subscriptions

Holiday travel planning behaviors reveal sophisticated content consumption patterns that signal premium advertising opportunities. Out-of-state holiday travelers are 2.6x more likely than Gen Pop to pay for business content subscriptions. Low-income travelers (making $50K or less) show the strongest health/fitness content affinity, over-indexing Gen Pop by 2.0x. Out-of-state travelers also dominate news consumption, with 1.9x over-indexing for national news content. In contrast, non-parent travelers are 1.7x more likely to subscribe to local news content.

Streaming Platform Preferences

Ad-supported streaming preferences create precise targeting opportunities within holiday travel segments. Low-income travelers are 1.5x more likely to use Peacock with ads, while parent travelers over-index by 1.4x for HBO Max with ads. Meanwhile, Netflix’s ad-tier draws 1.4x more increased holiday spenders. CivicScience data offers the opportunity to dive deeper into who’s using ads vs. ad-free versions across platforms, allowing advertisers to target with greater precision and impact.

Advertising Receptivity Patterns

High-value travel segments exhibit pronounced advertising engagement patterns that significantly exceed baseline responses. Those planning to spend more on the holidays are 2.8x as likely to say emotional advertising resonates with them, while male travelers match this intensity with 2.5x emotional ad receptivity. Out-of-state travelers showcase the most advanced advertising acceptance, over-indexing 2.5x for AI-powered advertising approaches—positioning them as innovation-embracing consumers ready for cutting-edge marketing technology.

Answer our Poll: Do you typically start your holiday shopping earlier or later than most people?

Industry-Specific Opportunities

- Airlines: Target the 69% out-of-state travelers with route-specific offers and the 13% considering international destinations with premium route marketing.

- Hotels: Reach the 36% preferring accommodations over staying with family, emphasizing value for the 78% budget-conscious segment.

- Travel Tech: Engage the 34% using AI for planning with innovative booking tools and streamlined decision-making platforms.

- Restaurants/Experiences: Connect with budget-conscious travelers seeking value through cost-effective dining and entertainment options.

- Streaming/Entertainment: Leverage the 1.4x-1.5x over-indexing on ad-supported platforms for travel-related content and destination marketing.

The CivicScience Holiday Travel Advantage

While other advertising data is dependent on past behaviors like site visits and purchases that are often old and stale, CivicScience identifies the 69% who haven’t booked yet, the 78% prioritizing budget over comfort, and the 34% using AI for trip planning based on what our scaled community of respondents tell us about their plans. CivicScience captures these nuances by building precise, high-value audience segments. Our platform identifies travelers through authentic, declared response engagement, giving marketers a sharper path to conversion.

Just Some of The Holiday Travel Audience Segments Available for Targeting with CivicScience:

- Male holiday travelers: AI advertising positive, banner advertising responders, health/fitness content subscribers

- Out-of-state holiday travelers: Business content subscribers, AI advertising positive, national news consumers

- Those increasing holiday spend: emotional ad responsive, inspirational ad preference, Netflix ad-tier users

- Non-parent holiday travelers: Local news subscribers, community-focused information seekers, intentional media consumers

- High income ($100k+) holiday travelers: AI advertising positive, informative ad preference, multi-screen TV behavior

Leverage CivicScience to Activate Your Campaigns

Holiday travelers are far from a uniform audience – they break into distinct segments with unique behaviors, preferences, and media habits. Some prioritize sticking to a budget, others are most influenced by emotional or banner ads, and many show a strong openness to AI-driven messaging. CivicScience data highlights that those who haven’t finalized their travel plans are a particularly valuable group, offering a window for timely, relevant advertising.

With CivicScience’s self-reported insights, marketers can identify which holiday travel segments are most likely to engage with their messaging, which platforms they use, and the types of content that resonate. Our always-on survey data enables you to target and measure audiences most likely to book travel, purchase related products, or respond to ads—turning insights into actionable campaigns.

Don’t miss the 69% of holiday travelers still booking. CivicScience’s real-time travel intent data ensures your campaigns reach decision-makers before they commit elsewhere. The holiday season is moving fast—are you reaching high-value audiences when they’re still making decisions?