The U.S. pet industry is booming, with pet expenditures around $70 billion annually, and only more projected growth ahead. It’s no wonder; around 70% of the U.S. population is a pet owner. That’s a lot of non-human mouths to feed. There is certainly no shortage of ways for someone to buy pet food and supplies. From right at your grocery store and big-box chains, to specialty chain pet food stores and even local ones, and now online retailers, the options are aplenty. But are online retailers like Amazon, and pet-specific Chewy taking over yet?

In January of this year, consumer research firm CivicScience polled Americans about pet-food buying habits.

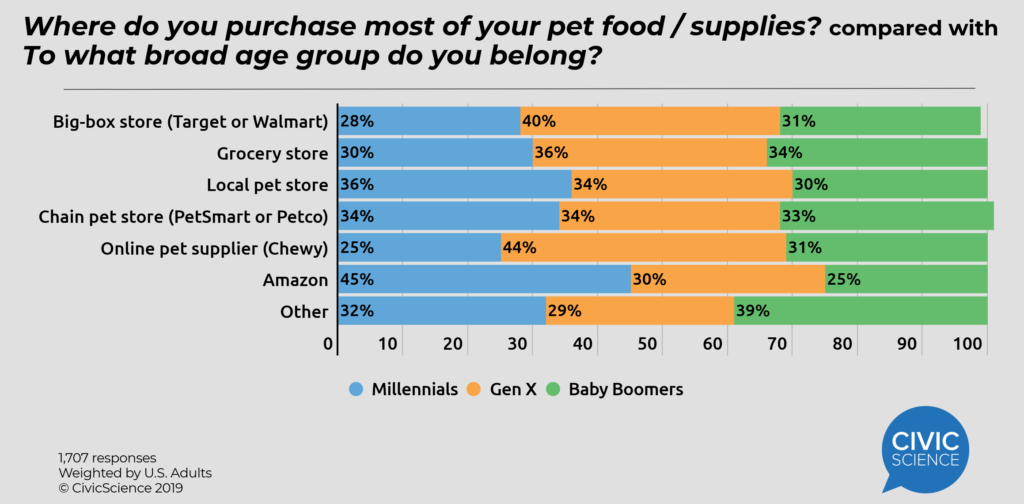

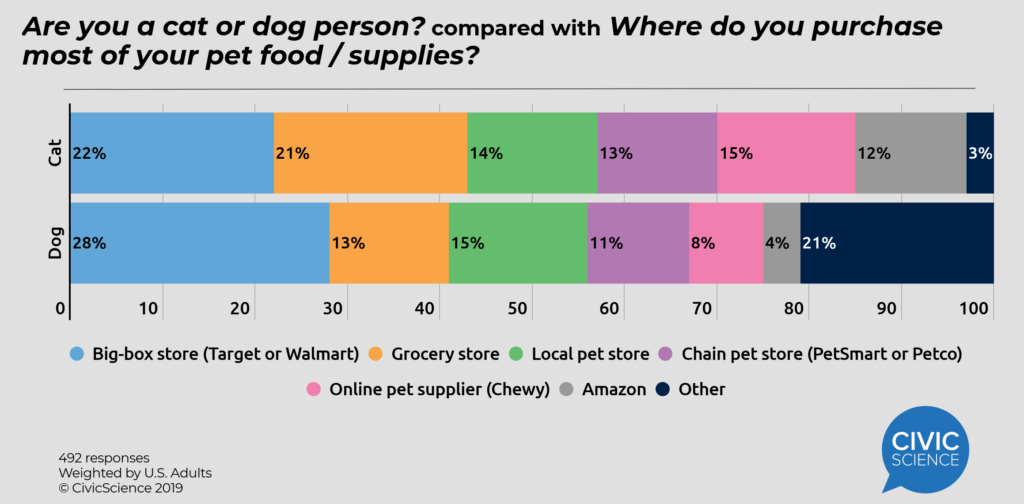

Starting off with the location, the results show where people buy their pet food is all over the map. For the study, the charts are rebased, excluding the ~30% of Americans over the age of 18 who do not own pets.

The results show that Amazon and online pet suppliers like Chewy are taking up about 16% of the pet food retail space among American adults. But the data reveal that big-box stores take the cake, followed up by grocery stores. The data tell us that a large majority of pet owners buy their pet food where they are already shopping for other household or grocery items. But even local pet stores (13%) and chain pet stores (15%) have pet buyers loyal.

There are a few key callouts when comparing where pet owners shop with their generation.

- Millennials have adopted Amazon for their pet food and supply needs. They are the most likely group to be shopping local, too (the exact opposite of Amazon).

- Gen Xers are the more likely age group to have adopted Chewy for pet supplies, but they also shop at big box stores and the grocery store in high volumes.

Quality Matters

When you hear about pet food recalls and grain-free this and that, or even the fact that some dog food is branded as an “entree,” you have to wonder just how many pet owners care about quality when selecting a pet food.

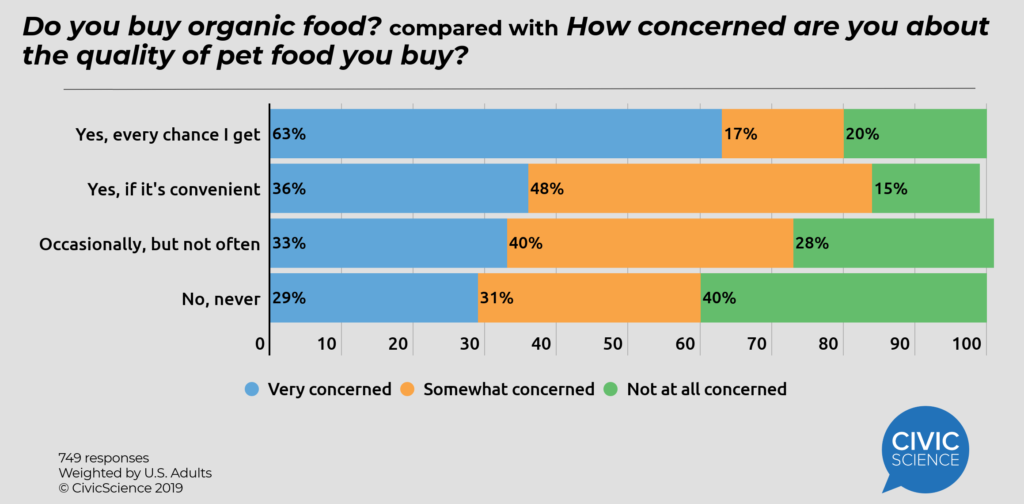

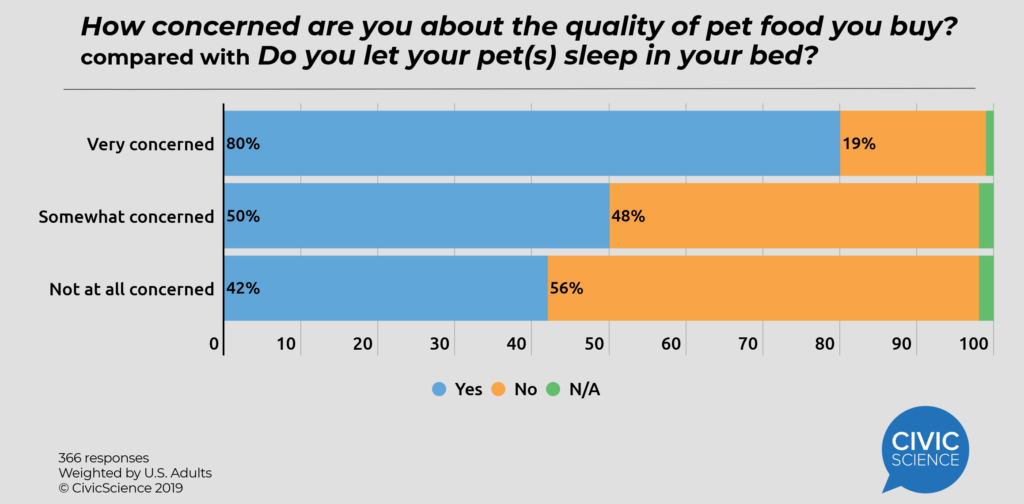

Based on a poll of 1,774 pet owners, over 75% have some level of concern about the quality of the pet food they buy.

When comparing pet store preference and quality concern, we see that over half of those who shop for pet supplies on Amazon, as well as Chewy, deem themselves very concerned about pet food quality. This group is also likely to go to a local pet food store or chain pet food store to purchase their food, showing that this group is willing to make a specific trip just for a bag of food for their pet.

Barking up the (Same) Tree

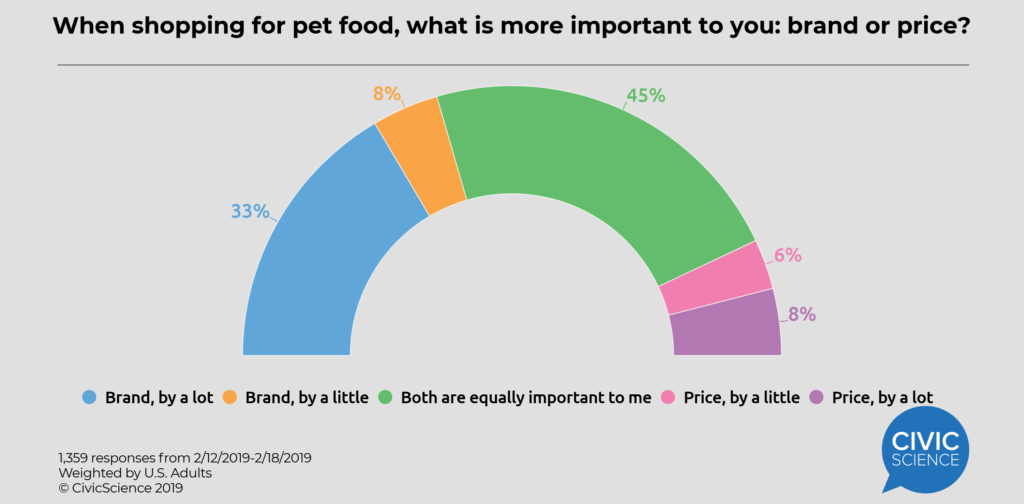

33% of those polled consider the brand of their pet’s food to be more important to them when doing their pet food shopping. One thing of note, while 45% of respondents consider both brand and price equally important, price alone is not a big factor.

Those who care about the brand of their pet food, care about the brand of their own food, too.

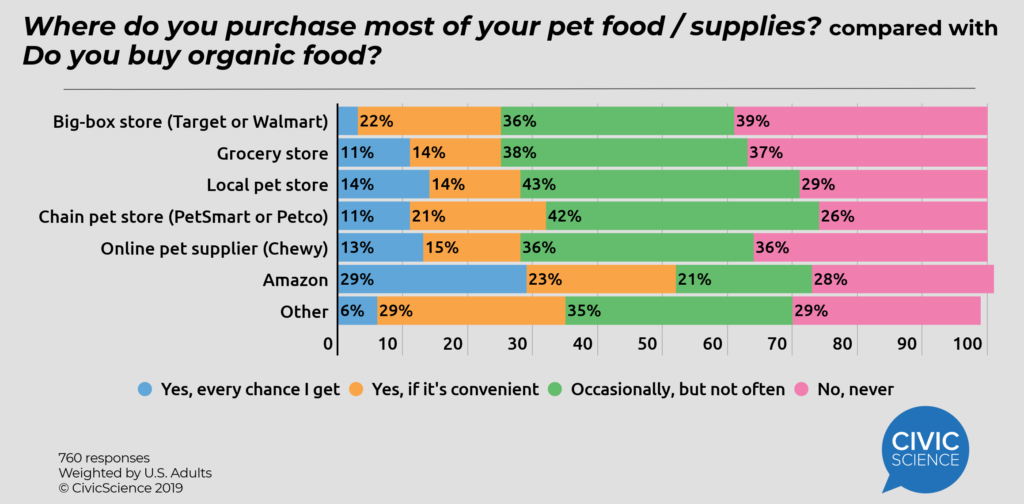

Same goes for organic food buyers and high-quality pet food buyers.

Those who shop at Amazon for pet food are the most likely to buy organic when grocery shopping for themselves.

And those who are concerned about the quality of their pet’s food are more likely to have tried pet food themselves. Yes, you read that right.

Dog vs. Cats

There are some distinct pet-food shopping differences between cat people and dog people.

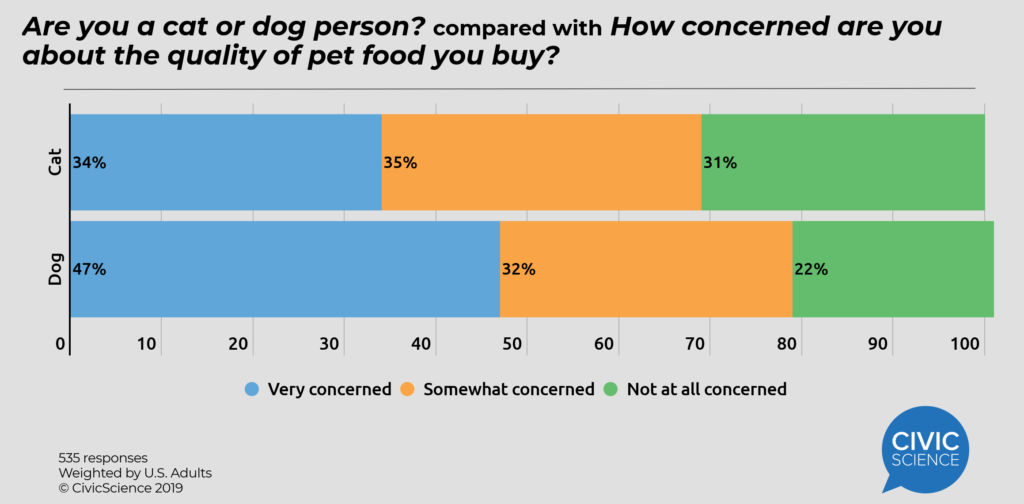

Dog people are more concerned with food quality than cat people are.

Dog people are more likely to go to a big box store, while cat people are more likely to shop at a grocery store.

Cat people are twice as likely to shop for pet supplies on Chewy or Amazon than dog people are.

Notable: dog people are more likely to say “other”. This could be people who prepare their own pet food or purchase it directly from a company who does.

It appears this should be the next topic of the CivicScience Trend Watch series.

Lastly, those who are very concerned about the quality of their pet food are twice as likely to let their pet sleep in bed with them than those who aren’t concerned about quality.

Two things are clear after analyzing the results of this CivicScience study: The majority of pet owners put quality first, and the pet supply market is huge. Will Amazon and Chewy be able to move in on traditional pet retailers? We’ll track that.