Because Home Depot and Lowe’s were deemed essential businesses, their customers are still venturing out for the nuts and bolts necessary to kickstart home projects. And CivicScience data shows 35% of U.S. adults plan on doing a home project within the next 6 months. This number is only down from 39% two years ago, suggesting that the pandemic hasn’t deterred many handy men and women from pursuing upgrades and fixes around the house.

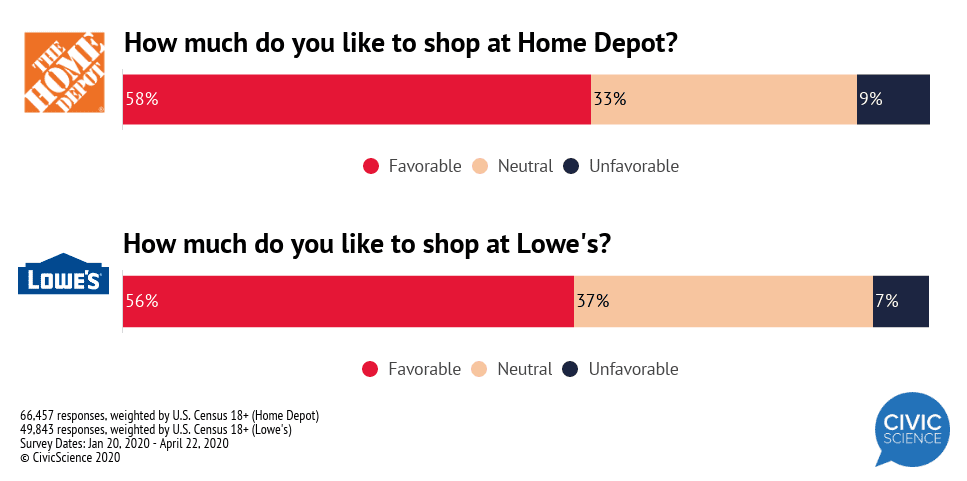

Home Depot and Lowe’s share very similar popularity among their customers. They also share similar offerings of products and services. In theory, either one could provide the essentials for painting, building, installations, and the like. Yet, as we know, consumers have their sworn allegiances to either the orange or the blue which have built two loyal customer bases that differ in their beliefs and spending habits.

CivicScience looked at the sentiment and preferences of each brand’s fan base in order to understand how their respective customers are going about home projects amid the uncertainty of lockdowns and and the economy.

In the event of a notice from the government to return to daily activities to prevent economic collapse, 46% of Home Depot favorables said they would stay quarantined. Maybe they are ordering odds and ends online, but they certainly aren’t headed to their nearest store to get their timber measured and cut.

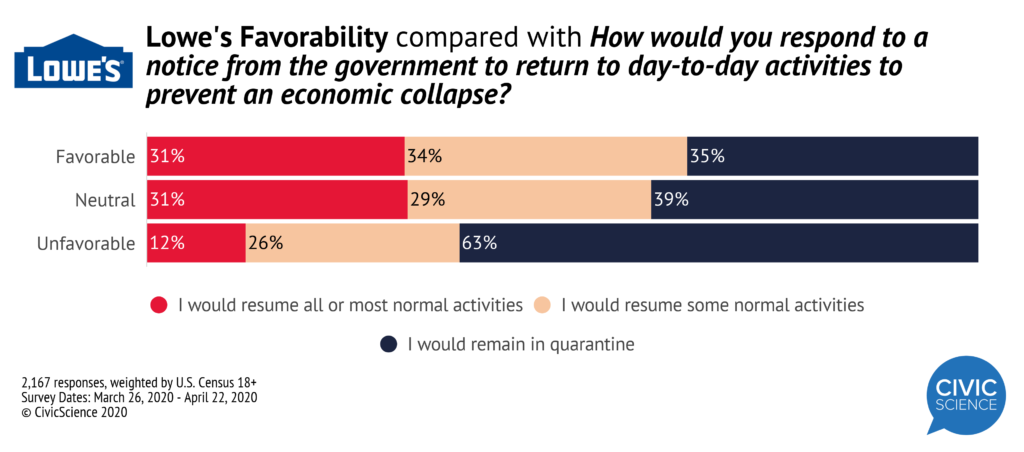

Lowe’s favorables were different. Lowe’s fans were more likely to say they would return to normal if government officials gave the all-clear. Only 35% of them would remain quarantined, which is 27% less than people who favor Home Depot.

Both fan bases are still planning home improvement projects in the next 6 months and at the same rate. CivicScience tracking shows younger generations (Gen Z and Millennials) favor Home Depot over Lowe’s. Given what we know about the political leanings of younger generations, it’s possible that this year’s spring sales will bloom later for Home Depot than for Lowe’s.