It’s no secret that the COVID-19 pandemic has taken its toll on the stock market, especially given the passage of the government stimulus package late Wednesday night.

CivicScience is constantly tracking Americans’ habits and feelings on investing, and its latest survey data show that U.S. adults ages 18 and up are feeling the pinch of the stock market downturn.

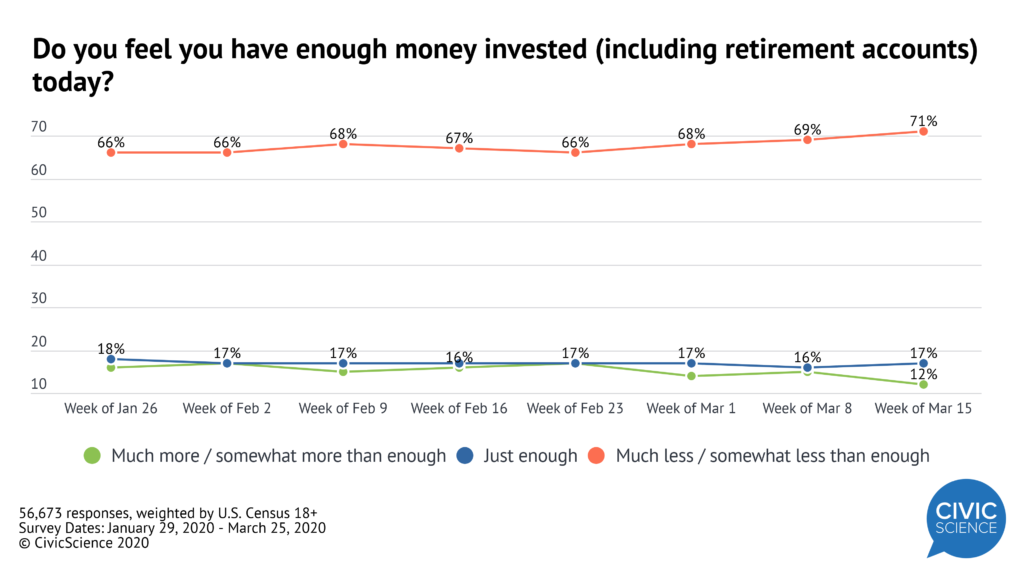

Since late February, the percentage of American adults who say they don’t have enough invested right now, including money in retirement accounts, has risen from 66% to 71%. In the same time frame, the proportion of adults who said they have “somewhat more” or “much more than enough” invested fell from 17% to 12% — a 29% drop in a matter of weeks.

Possibly even worse news? U.S. adults aren’t feeling at all hopeful about the future prospects of the economy, either.

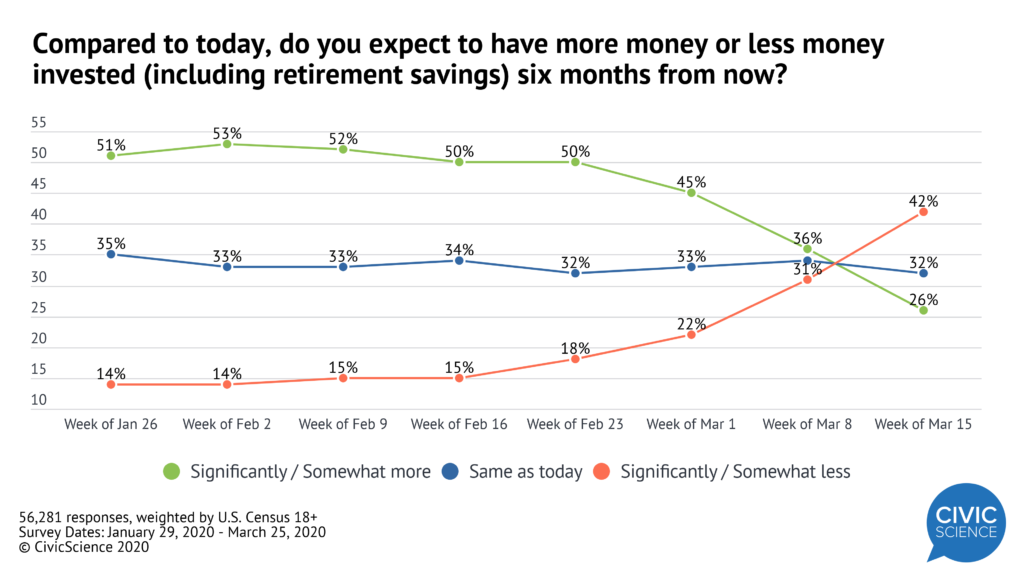

Since late January, the percentage of adults who said they expected to have more money invested in six months had been floating above the 50% mark, and fewer than 20% of respondents were saying that they thought they’d have less money invested in six months. Things began to change drastically in late February:

By mid-March, the number of Americans who thought they’d have less money invested six months from the survey date had eclipsed the number who said they expected to have more money invested.

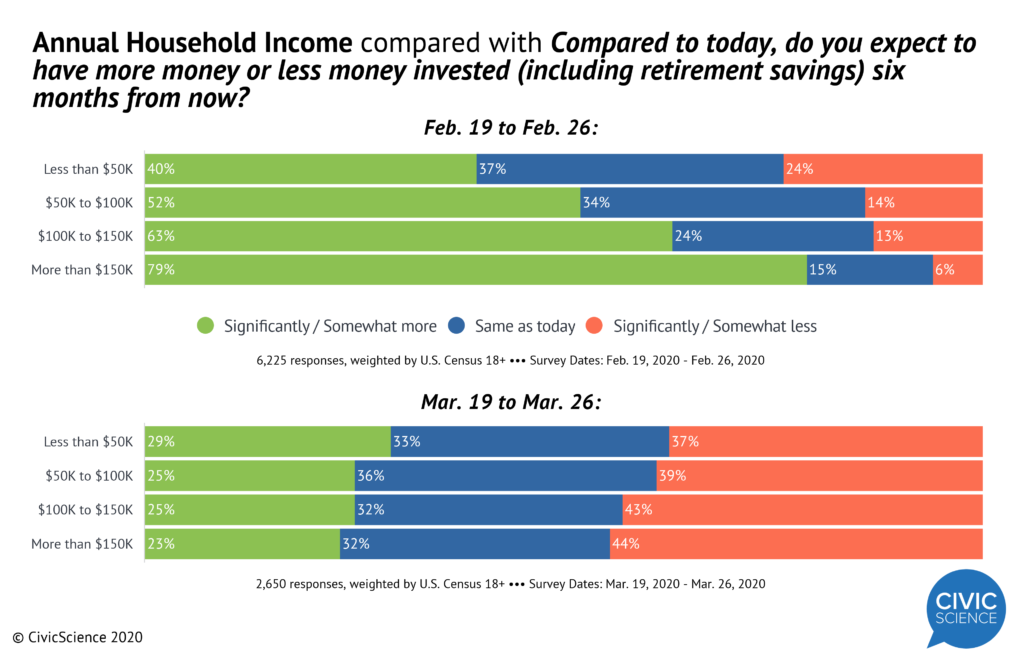

This pessimism about investments has surged wildly among the highest income earners — a 633% increase in investment pessimism among those earning more than $150,000 per year, from 6% to 44% in the past month — while lower earners have been more modestly affected overall.

Only time will tell the full extent to which the coronavirus stock market downturn will impact Americans — but CivicScience will continue to track the issue throughout the COVID-19 pandemic and beyond.