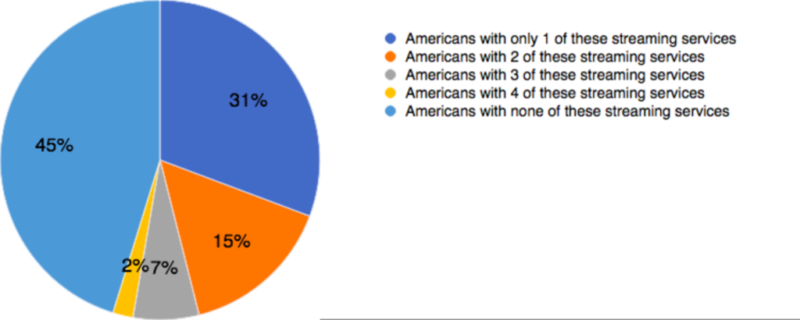

The Gist: 55% of the general population subscribes to a streaming service, and of that group, 85% are Netflix subscribers. In the streaming service game, it’s a battle for second place as Netflix holds a strong first.

If we’re calling the battle for the dominant streaming service a race, then Netflix is laps ahead of the competition. As we talk about the trend towards cable cutting, the streaming service Netflix has a clear lead, with 47% of the general population subscribed to it.

Let’s break this down. For the sake of simplicity, we’re looking at the big 4: Netflix, Amazon Prime Video, Hulu and HBO Now. Each service provides original content, as well as a library of content from outside studios.

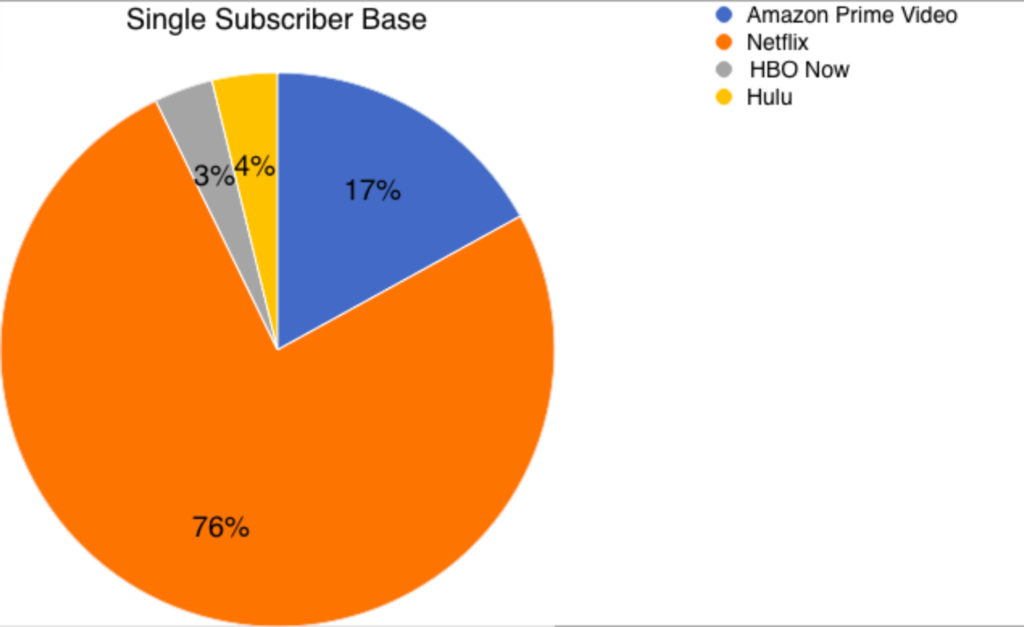

Solo Subscribers

It’s most common for streaming subscribers to use just one service. 23% of the general population subscribes to just Netflix. Amazon Prime Video trails behind at 5% subscription rate. Once again halved is Hulu’s subscriber base–just 1% of the general population. Finally, 1% subscribe just to HBO Now.

A clearer picture emerges among subscribers to just one service. Of them, here’s the breakdown:

Dual Subscribers

Incidence rates drop when subscribing to more than one service. 15% of the US general population subscribes to only two online streaming services. From this point forward, we’ll be looking at percentages among people who subscribe to streaming services, not the general population.

The most common combination past a single subscription? 18% of subscribers have both Amazon and Netflix. So if you use more than one streaming service, it’s most likely to be those two. 35-44 years olds are more likely to subscribe to these two. Netflix and Hulu combination trails behind at 6%.

We tend to talk about these services as if they were a level playing field, but it’s clear Netflix has a hold on the market, at least for primary subscription service.

Hulu and Amazon have been pumping money into original series production and acquiring content–which seems to be paying off in critical circles at least. However, awards tied to Hulu’s The Handmaid’s Tale didn’t budge the subscription dial much, the service only saw a 2% increase in past year.

It’s clear as things stand now that it’s not about the dominant streaming service, that’s Netflix, but a race to second place.

Two or More

The incidence rate of having more than two streaming services is low among the general population. 12% of subscribers have three services, and it’s no surprise the most popular combination of the three is Hulu, Amazon, and Netflix (7%).

Having it All

When we talk about the future of cord cutting, there seems to be this idea we can pick and choose for less than the cost of a monthly cable bill. Depending on where you live, subscribing to all four services can be heftier than cable.

Only 4% of subscribers have all four services, which makes sense. Amazon Prime Video users have access to HBO’s backlog of content, and a Hulu Live TV subscriber can add HBO to the monthly package. Given the overlap in services and video libraries, it’d be silly to opt in on all four.

What Does This Mean for Everyone Except Netflix

If you look at our numbers, not all four streaming platforms are on the same, for lack of a better word, platform. Perhaps it’s just the length of its existence, or the sheer catalog of original “prestige” content it’s produced, but Netflix is far beyond the rest regarding subscribers.

Netflix competitors have to understand their market is more likely to be Netflix users than people subscribed to no platform at all. Netflix seems to be the gateway service, and Amazon and Hulu are almost add-ons. Much of this has likely has to do with the way we talk about the services–as if they’re all the same. Amazon and Hulu will be better off focusing on differentiators from other platforms.

This would benefit competitors because not all of these services are built alike. Amazon Prime Video can be accessed with an Amazon Prime membership or purchased a la carte. Hulu has a monthly service that looks similar to Amazon and Netflix, but for around $40 a month, customers can access live TV programming–making Hulu a more realistic competitor to cable cutting than the others.

We are still in the early days of the streaming wars, and who is to say if we can crown a winner now. As media and viewing habits develop, so too will the subscriber bases of each platform.

As it stands now, there’s a larger fight brewing for the number two spot than one. Amazon Prime Video has a leg up over Hulu and HBO Now, but given Hulu’s recent award-winning television, as well as its goal to directly address cable unbundling, it’s still anyone’s guess who will be number two.